Cash

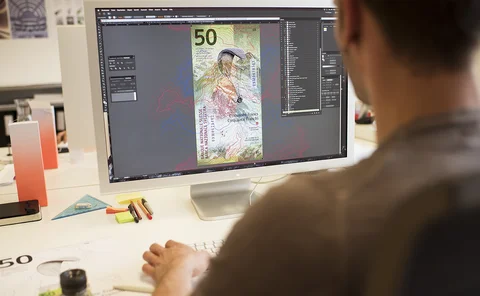

SNB to launch new banknote series

Bank to “pay homage to the country’s unique topography” on new bills

Demand for cash: a global update

Antti Heinonen explores recent data on banknote demand and analyses its impact on cash infrastructure

HQLAs ‘not liquid enough’ for Credit Suisse or SVB

Basel Committee report sheds new light on liquidity risk during 2023 banking turmoil

ECB official open to offering liquidity aid to non-banks

Deputy director doesn’t rule out copying UK plan to extend repo facility to pension funds and life insurers

Central bank digital currencies must be user-friendly – ECB study

To be widely adopted, CBDCs will need to combine best aspects of existing payment methods

Cash use supporting ‘shadow economy’ in Slovakia – study

Central bank research points to “substantial” activity intended to avoid regulatory scrutiny

Interpreting the PBoC’s slew of policy reforms

How are new stimulus measures, bond market tactics, deflationary pressures and monetary policy framework changes affecting central banking in China?

Campos Neto on inflation targeting, independence and the future of financial intermediation

The Brazilian governor speaks with Christopher Jeffery about tackling inflation, the need for financial autonomy, and redefining the financial landscape with open finance, programmable Pix, deposit tokenisation and sound cross-border payments governance

DNB study sounds alarm over youngsters’ payment habits

“Fun” justifications for big purchases storing up trouble for future, says research

Book notes: How a ledger became a central bank: a monetary history of the Bank of Amsterdam, by Stephen Quinn and William Roberds

A masterful piece of monetary history that is relevant to modern-day central bankers

Cash use on the decline in Germany

Card and mobile payments gain ground as cash’s share of payments falls to 51% in 2023

Japan issues first new banknotes in 20 years

New notes are fitted with 3D holograms

BNM’s Rasheed on inflation, growth and currency performance in emerging markets

Bank Negara Malaysia’s governor speaks about balancing inflation and growth, supporting the ringgit, multilateral currency settlement and greening Islamic finance

Lessons from the banking turmoil of 2023

Guardrails on capital, liquidity, deposit insurance, resolution, digitalisation and disintermediation need a rethink

Lkhagvasuren Byadran on geopolitics, gold and 100 years of central banking on the steppe

Bank of Mongolia governor Lkhagvasuren Byadran speaks about monetary and financial reform, embracing AI and fintech, and Mongolia’s new SWF

Cecilia Skingsley on monetary policy tech and a unified ledger

Head of the BIS Innovation Hub speaks about tokenisation, CBDCs and the ‘black box problem’ in AI

PMA launches instant payments amid Gaza cash shortage

Instant payments rolled out as most banks in Gaza have suffered “partial or total destruction”

Bundesbank’s Nagel: central bank business models are changing

Panetta says wholesale CBDC likely to launch sooner than retail; Das gives update on digital rupee

Maximising the impact of banknote communications

Antti Heinonen highlights the ongoing evolution in how central banks talk about their banknotes

Central Banking Awards 2024: fourth round announced

BIS wins Green initiative award; other awards go for currency, CBDC and AML systems

Thailand forges ahead with virtual banking

BoT to accept applications to open virtual banks from March 20

Central banks, FMIs and the ‘green’ agenda

Collective efforts are needed to transform the environmental footprint of payment networks, writes Biagio Bossone

CBDC is inevitable

Central bank digital currency should be thought of as a platform rather than a product, writes Dave Birch

Cash transfers cause persistent jobs boost in Brazil, research finds

San Fran Fed paper argues previous research neglected effects on informal employment