Bonds

The ECB, the lockdown and the monetary financing lock

The eurozone’s central bank may need to break its prohibition on monetary financing to fight the pandemic

German court leaves Bundesbank caught between two legal decisions

Ruling may hamper ECB’s new PEPP programme as it is not constrained by PSPP limits

Hong Kong’s Exchange Fund reports record loss in first quarter

State fund’s assets lose $11 billion and investment chief warns of further losses

UK statisticians turn to online prices to cope with Covid-19 lockdown

Around 80% of prices are usually collected in person, forcing rethink of data gathering approach

German court rules ECB must provide more evidence on PSPP

Judges strongly criticise ECJ’s ruling on QE programme, but stop short of declaring it unlawful

Fed could purchase $750 billion of corporate debt in new facilities

Fed clears staff to purchase investment- and non-investment-grade debt and ETFs

ECB launches new lending facility, but holds rates

Lagarde announces cut for banks’ borrowing rate, but the ECB has not expanded asset purchases

Can growth in developing Asia be made more sustainable?

The structure of the global economy will be reshaped by Covid-19, and what happens in Asia will be crucial, writes Philip Turner

Riksbank open to future rate cut

Swedish central bank keeps stimulus package unchanged in monetary policy meeting

Riksbank unveils details of local bond purchases

Swedish central bank to buy up to Skr5 billion from Kommuninvest i Sverige

Bank of Mexico cuts rates in emergency meeting

Central bank unveils set of measures to boost liquidity amounting to $30.5 billion, 3.3% of GDP

Riksbank will start buying municipal bonds

Central bank includes new assets in 300 billion kronor purchase programme

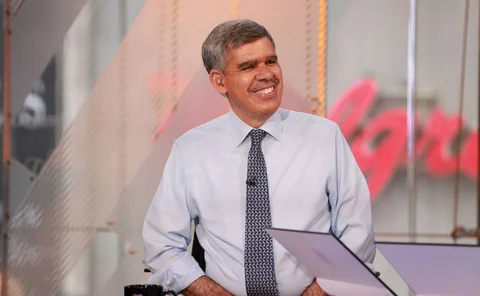

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Indonesia gains ‘second line of defence’ from $60 billion Fed repo

Bank Indonesia secures repo with NY Fed to boost dollar liquidity and shore up rupiah

National Bank of Poland cuts rates to record low of 0.5%

Central bank includes state-guaranteed bonds in its asset purchase programme

Central banks may have to become ‘dealers of last resort’ – BIS economists

EMEs have not overcome “original sin” by deepening local currency bond markets, authors warn

ECB buys Italian bonds well above capital key in March

Central bank bought €11.8 billion in Italian sovereign bonds last month, up from €2.2 billion in February

Bank of Israel launches targeted lending operations

Central bank offers cheap loans to banks as part of Covid-19 response package; research department estimates point to major growth impact from virus

Should the Fed be next to implement yield curve control?

The Reserve Bank of Australia is now the second G20 central bank trying to control longer-term interest rates. Could the Fed be next?

Dutch former governor attacks PM for blocking eurobond

Nout Wellink says Netherlands must prevent further debt crisis in Southern European countries

ECB makes record sovereign bond purchases

Central bank ramped up purchases under the PSPP programme in the week to March 27

Concentrated firepower: central banks must expand their arsenal

Philip Turner argues central banks should be prepared to go further to avoid economic and financial collapse

ECB drops bond-holding limits for crisis response

€750bn stimulus programme will not be subject to previous limits on holding countries’ bonds

Sarb to buy government bonds

South African central bank also broadens refinancing operations to boost liquidity