Bonds

Bank of Israel to buy $13bn in government bonds

Central bank also supplying $15bn to banking sector to meet “very high” demand

Riksbank to buy covered bonds; Iceland enters secondary market

Central banks unveil new forms of unconventional purchases

Fed commits to unlimited bond purchases in massive new programme

FOMC announces radical new measures and calls on other policy-makers to act aggressively

RBNZ launches $30bn government bond-buying programme

MPC asked to vote on package via email to ensure social distancing

Riksbank resumes QE by buying government debt

Swedish central bank buys $245 million in sovereign debt and will buy covered bonds on March 25

Croatian central bank starts bond-buying programme

HNB also holds repo auction and may relax banks’ capital buffers in response to coronavirus

Bank of Israel unveils actions to boost market function

Repo operations and asset purchases designed to tackle high volatility

South Korean central bank tests blockchain for bond markets

Bank of Korea is the latest to test DLT-based system for transactions

Did the Riksbank abandon negative rates too soon?

In January, a key inflation measure dropped sharply. Policy-makers face difficult choices if inflation does not recover

Do low rates spur investment?

Many believe low interest rates spur investment, but there appears to be little hard evidence to support such claims, writes former IMF head Jacques de Larosière

Why Bulgaria needs to deepen its currency board

The BNB’s currency board rules should be extended to transaction deposits at commercial banks, which could in turn issue digital currencies, even in the event of euro adoption

IMF staff say Argentina’s debt is unsustainable

Report calls for haircut for private creditors as Argentine government demands IMF debt forgiveness

Interview: Luiz Awazu Pereira da Silva

BIS deputy general manager talks about the obstacles central banks face with regard to climate change and why the status quo needs to evolve

BIS’s Pereira says green QE could distort market

Central banks should focus on financial stability mandate not green QE, says deputy general manager

Bulgaria: long live the currency board

Bulgaria should reject the euro and extend its currency board to cover bank deposits

Yield curve models overstate chances of US recession – ECB research

Models need to account for effects of QE asset purchases on bond premia, authors say

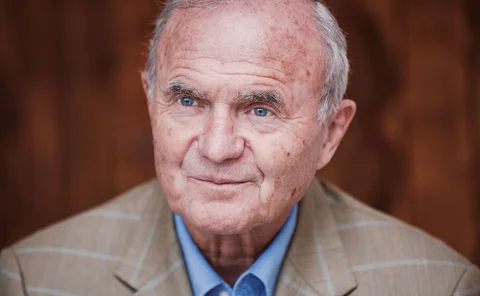

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Global markets award: HSBC

The UK-headquartered bank is a leader in green finance and helped its clients navigate the low-rate environment over the past year

Eurozone banks increase illiquid assets after solvency shocks – DNB paper

Shift in asset holdings could create asset price distortions after banking crises, researchers say

Economics in central banking: Matteo Maggiori, Brent Neiman and Jesse Schreger

The Global Capital Allocation Project has helped pick apart the tangled network of cross-border capital flows. The work may prove essential to those looking to shore up the international monetary system

Governor of the year: Mark Carney

Carney has played a vital role in managing Brexit risks while driving efforts towards climate, payments and dollar funding reform

Asset manager of the year: Amundi Asset Management

The French asset manager helped reserve managers meet ESG criteria while also boosting central bank assets under management

Bank of Canada paper looks at risk in securities dealing

More complex dealer networks can increase probability of settlement failure, researchers find

US mutual funds' liquidity risk on the rise – Boston Fed paper

Ratio of illiquid assets to net assets increased from 2009 to 2019, researchers find