Basel III

FSB Regional Consultative Group meetings continue

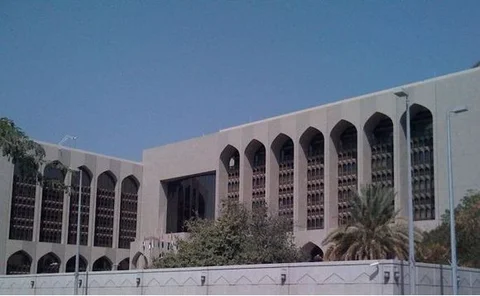

Middle East and North Africa consultative group is latest regional FSB body to meet; discussed financial vulnerabilities of the region

IMF models new liquidity stress test framework

International Monetary Fund study creates new template to conduct balance sheet-based liquidity stress tests

Basel implementation monitoring strategy approved

Basel Committee governing body agrees plans to monitor member countries' efforts to implement new rules; also discusses liquidity coverage ratio

Basel statement on risk transfer could halt legitimate trades, bankers warn

Basel Committee’s focus on cost of credit protection in attempt to stamp out capital arbitrage could also hurt sound trade trades, investment banks claim

FSB consultative group for the Americas gathers in Mexico

Central bank governors Agustín Carstens and José De Gregorio co-chair first regional group meeting to exchange views on key financial stability issues

FSA’s Bailey calls on banks to plan for eurozone break-up

Banks must prepare for the "disorderly departure of some countries from the eurozone", says Andrew Bailey

Sweden sets higher capital buffers for big banks

Swedish authorities say capital buffers of country’s largest banks will be raised to 10% of risk-weighted assets by 2013, swelling to 12% in 2015

RBA’s Debelle discusses eligibility criteria for new liquidity scheme

Reserve Bank of Australia assistant governor Guy Debelle says inclusion of self-securitised mortgage-backed securities as eligible collateral in committed liquidity facility will reduce systemic risks

Austria pushes ahead with Basel III

National Bank of Austria announces plans to require banking groups to comply immediately with Basel III's higher capital requirements; sets restrictions on loan issuance

Ingves says Basel III’s success depends on global application of rules

Basel Committee on Banking Supervision chairman Stefan Ingves says Basel III will only work if implementation of rules is internationally consistent

Australian regulator releases Basel III liquidity proposals

Australia's prudential regulator publishes discussion paper for liquidity reforms under Basel III; Reserve Bank of Australia announces further details for its committed liquidity facility

Video: New York Fed’s Marc Saidenberg denies US go-slow on Basel II implementation

New York Fed senior vice-president Marc Saidenberg says US is introducing Basel II at a similar pace to international peers and is also committed to timely implementation of Basel III

Sweden will go beyond Basel III capital rules, says Ingves

Riksbank governor Stefan Ingves says Sweden will follow Switzerland and UK in implementing higher capital adequacy requirements than Basel III for largest banks; details to be released soon

New Zealand consults banks on Basel III

Reserve Bank of New Zealand issues consultation paper on implementation of higher Basel III capital requirements; deadline for comments January 2012

The dangerous scramble for liquidity

William Allen of the Cass Business School in London warns there is a danger that capital requirement measures intended to make the financial system safer may do more harm than good

BoE’s Haldane discusses broad reforms

FPC member calls for comprehensive reform of bankers’ remuneration and warns Basel III may not go far enough

FSB sets out framework for monitoring implementation of financial reforms

Financial Stability Board announces co-ordination framework for implementation monitoring of G20/FSB financial reforms; priority areas set for extra scrutiny

Basel Committee assesses progress towards new capital rules

Basel Committee on Banking Supervision monitors progress of member countries in adopting proposals for higher bank capital buffers

Video: Banks can arbitrage central bank liquidity provision

A conflict between new liquidity regulations under Basel III and existing central bank operations leaves a gap that banks may be able to exploit, warns financial stability expert

G-sibs surcharge will have positive macroeconomic impact, says joint Basel, FSB working group

Macroeconomic Assessment Group says growth benefits from capital surcharge on global systemically important banks outweigh costs from higher bank funding costs

IMF modelling work on liquidity risk points to capital hike, says Jobst

Recent analysis by the International Monetary Fund indicates that banks in the US need to raise capital to cover systemic liquidity risk threats

Carney to banks: stop blaming each other

Mark Carney, Bank of Canada governor tells banks to stop accusing others of bad behaviour; discusses Institute of International Finance's concerns about financial reform agenda

Video: BoJ’s Hiromi Yamaoka on the failure of global rulemakers to learn from Japan’s ‘lost decade’

Hiromi Yamaoka speaks about new recovery and resolution plans, the strength of the Japanese banking system and why he’s not worried about spiralling government debt

Non-cash payments growth slows

World Payments Report 2011 finds slower growth in non-cash payments; key regulatory and industry initiatives are combining to gradually transform the payments landscape