Banks

HKMA prepares cyber security ‘fortification’

Monetary authority seeks to build a framework for assessing cyber risks as well as providing training and building infrastructure for sharing “threat intelligence”

Research considers use of blockchain in securities settlement

Paper published by SWIFT Institute says full application of technology could lead to, and would require, change in existing business processes in the industry

Regulators can influence but not prescribe culture, Bailey says in last speech at PRA

Incoming FCA chief warns bank regulators cannot write a rule to “settle” culture, but cites the senior managers regime as an example of influence

World Bank report sees risks if Mozambique continues to raise rates

Report praises efforts of central bank so far but says further tightening could harm certain sectors of the economy; exchange rate volatility having adverse effects on debt

IMF staff call for new macro-prudential tools in Denmark

Danish authorities told to consider placing limits on debt to income ratios; macro-prudential measures suggested by IMF staff to complement existing regulation

Cunliffe warns of tough transition to new resolution regime

Going back to world of small, less complex banks is not how to solve ‘too big to fail’ problem, BoE deputy suggests, instead favouring a ‘multi-pronged’ regulatory approach

RBI plans to regulate nascent P2P market

Central bank proposes bringing peer-to-peer lending within its regulatory remit, fearing lack of oversight might lead the rapidly growing sector to develop “unhealthy practices”

Time ‘ripe’ to consolidate public banks – RBI’s Gandhi

Consolidation could help banks spread their risk and compete on a global scale, deputy governor says – though they may need a “nudge” from government to get going

BoE paper explores impact of prudential measures abroad on UK bank lending

No “significant” spillovers to bank lending following prudential measures, authors find, while composition of lending can change when domestic actions are taken

BoE paper seeks unified global approach to NPLs

A multidisciplinary approach to legal, accounting, statistical, economic and strategic elements of loan loss provisioning and NPLs

Cross-border banking contraction broadens – BIS statistics

Latest cross-border banking statistics show drop in cross-border claims spread in Q4 2015 from emerging markets to broader regions; China sees particularly large drops in lending

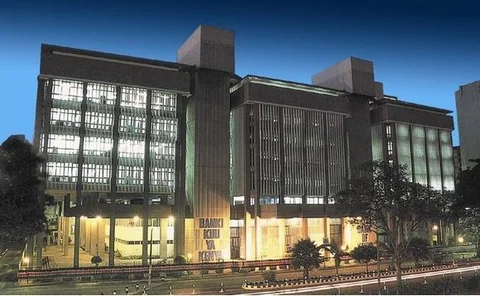

Troubled Kenyan bank to reopen under new management

Chase Bank will be managed by Kenya Commercial Bank, which may go on to acquire majority stake; questions raised over pressures on small and mid-sized banks

Basel Committee opts for local discretion on rate risk

Committee abandons attempt to create common global standard for interest rate risk, opting instead to leave discretion with banks and supervisors in final standards

Parliament gains influence in FCA chief appointments

George Osborne says Treasury Select Committee will be able to scrutinise future appointments before they are formalised, with the ability to send them to the House of Commons for a vote

Swedish regulator takes second stab at amortisation rule

Macro-prudential regulator unveils plans for mandatory amortisation similar to those struck down by the Swedish judiciary in 2015

Australian governor Stevens sees more viable options than helicopter money

Reserve Bank of Australia governor identifies a host of practical issues to helicopter money, and says there is more governments can be doing before then

Carney stresses bank resilience in face of large shocks

UK banks display resilience when threatened with Brexit-like shock, stress tests show; London "unlikely" to retain global financial centre status if Britain leaves EU, Carney says

Medium-sized banks are main contributors to systemic risk in Brazilian interbank market, paper says

Emergence of bank communities may act as triggers for systemic risk, stress test scenario shows; medium-sized banks carry non-negligible default probabilities

Viñals supports negative interest rates in current climate

Financial counsellor believes negative rates are helpful, but there are limits regarding how low they can go and how long they can stay there

IMF working paper sees regulation as key driver of decline in foreign lending

Research contends regulatory tightening is behind much of the ‘sluggishness’ in international banking since the crisis; exploits survey data compiled in preparation for GFSR

Central Bank of Kenya creates lending facility in wake of banking troubles

Emergency liquidity offered to any bank under pressure “from no fault of its own”, as fears mount over the resilience of Kenya's banking sector

Rohde laments Denmark’s lack of banking reform clout

National Bank of Denmark governor says Danish system of mortgage credit does not necessarily fit well with Basel framework, but the country has limited options to influence reform process

Central Bank of Kenya places third bank in receivership

Chase Bank under new management after resignation of chairman and managing director; Imperial Bank progress “postponed” while audit continues

BIS’s Shin argues bank capital underpins both monetary policy and financial stability

Research sheds light on tension between bank shareholders and wider society, as high levels of capital support lending and therefore affect the real economy as well as the financial sector