Banks

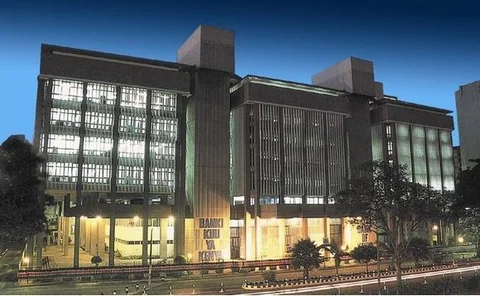

Lenders should reward low-risk customers – Kenyan governor

Banks should praise those performing well regarding credit management, and offer low-risk customers better terms as a result, governor says

Kenya sees a reduction in use of bank services

Mobile payments preferred, with 47.8% of the population using mobile services on a daily basis; banks now mainly used for salary payments

Book notes: Stabilising capitalism: a greater role for central banks, by Pierluigi Ciocca

Pierluigi Ciocca offers an excellent, brief and crisp account of the main issues facing central banks today

End of sanctions offers chance to fix Iran’s banking sector

Iranian banks struggling with high levels of non-performing loans may see their situation improve, but deep reforms are needed and the political situation remains complex

Book notes: Between debt and the devil, by Adair Turner

Adair Turner offers a lively and well-structured account of his proposals to radically overhaul the financial sector

EBA publishes guidelines for co-operation agreements between deposit guarantee schemes

European Banking Authority lays out guidelines for agreements between EU deposit guarantee schemes; clear principles should lessen conflict and make mediation easier, authority says

BoE’s Furse sees benefits to UK as a global finance hub

External FPC member sees plenty of reasons why policy-makers in the UK should seek to make the economy attractive to global financial firms; says robust institutions are important

BIS paper models self-generating financial crises

Authors set out DSGE model where financial crises can be triggered either by an external shock or the endogenous generation of credit booms and busts

BoE and Vickers clash on capital rules

Both central bank and ring-fencing committee chair claim to have recommended higher capital requirements than the other – but a look at the proposals suggests the differences are slim

Austria should ‘stand ready’ to tighten capital requirements, IMF staff say

The country has made ‘significant progress’ in restructuring the regulatory and supervisory framework, the report says, but the banking sector's resilience could be strengthened

BoE sketches proposals for sharia-compliant facilities

Options for deposit facilities include wakalah or commodity murabahah, with the possibility of liquidity insurance to follow

Rajan tells banks to prepare for ‘deep surgery’

RBI governor says banks will have until March 2017 to clean up their balance sheets; banking sector represents weak spot of otherwise vibrant economy

No room for mediocrity, Kenya governor warns banks

Patrick Njoroge tells bankers there is ‘only the thinnest of margins’ for error; each customer should be treated as if they were ‘the only customer in the world’

Danish economists test measure of systemic risk

National Bank of Denmark paper uses ‘SRISK’ measure to assess systemic risk in the Danish financial sector, finding it was a good predictor of banks that needed bailing out

RBI report lays ground for trading new derivatives

Working group proposes allowing new interest rate options in India to improve financial institutions' ability to hedge interest rate risk

RBI’s Gandhi: are regulators ‘barking up the right trees’?

Deputy governor stresses effective regulation is not about ever more detailed rules but rather taking a broad view and spotting emerging risks early on

Weaker shareholder liability need not mean more risk-taking, Riksbank paper finds

Study of abolition of double liability in Canada finds bank riskiness did not increase; authors suggest weaker incentives for shareholders were offset by closer scrutiny by depositors

BoE reveals final element of ring-fencing framework

Systemic risk buffer will apply to ring-fenced assets, with the aim of preventing banks amplifying stress; BoE also hopes it will give smaller banks a competitive boost

BoE’s Bailey sets sights on balance sheet clarity

Clear disclosure of creditor hierarchies will be ‘critical’ moving forward, says Andrew Bailey; clarity in bank balance sheets is a ‘good thing’

Policy interactions may drive global banking contraction, BoE economists find

The combination of unconventional monetary policy and regulation may cause ‘substantial’ spillovers as banks cut cross-border lending, economists including Kristin Forbes find

BIS stats show further retreat in global banking flows

Falling claims on China drive bulk of overall reduction in cross-border claims, but pace of decline slows compared with previous quarter

FCA officials grilled on second comms backlash

MPs accuse FCA of failing to recognise perceived importance of dropped bank culture review, leading to strong public backlash; chief executive says approach to communication will be reassessed

Basel Committee completes trading book review

Much-anticipated redesign of market risk framework seeks to capture risks the Basel accord failed to guard against in 2008; impact study implies median 27% increase in capital charges

BoE moves to close bonus clawback loophole

Under new proposals, banks will no longer be able to circumvent malus and clawback rules by buying out new employees’ bonuses