Average inflation targeting

Iceland raises rates again as inflation reaches highest level since 2012

MPC accelerates current cycle as experts point to problems in housing market

Pierre Wunsch on inflation, forward guidance and policy tightening

The National Bank of Belgium governor speaks about over-reliance on central bank models and forward guidance, the impact of energy costs and inflation expectations, and the need to unwind unconventional monetary policies

Fed keeps investors guessing on speed and endpoint of tightening

Investors generally agree the Fed will tighten policy, but how much and when are unclear

2021: The year in review

The year has seen central banks switch from recovery mode to battling inflation. Central Banking looks back at the stories that made the biggest impact in 2021

Bank of Canada renews monetary policy framework

Central bank conducts first “systematic” study of other frameworks since it adopted inflation targeting

US inflation reaches new peak

CPI figure hits 6.8%, the highest rate in nearly four decades

Powell: FOMC may accelerate taper

Fed will no longer refer to inflation as “transitory”

Mervyn King attacks central bank theories of inflation

Expectations are “too fragile” to serve as an anchor for inflation, former BoE governor says

US records highest CPI inflation rise since 1990

NY Fed detects slight rise in short-term consumer inflation expectations as real wages fall

Fed warns of China debt risks

Financial Stability Report mainly optimistic about systemic health, including housing market

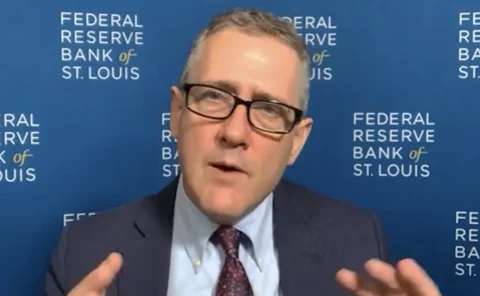

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

Hiking rates before asset sales may constrict credit – paper

Kansas City Fed research says raising the fed funds rate first may cause yield curve inversion

Dallas Fed predicts 2022 core inflation above 2%

Economists expect auto and transportation costs to abate, but spike in housing prices

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight

Clarida: ‘Stagflation is not my baseline case’

Fed vice-chair says inflation situation not akin to 1970s

RBNZ begins monetary tightening with 25bp hike

Central bank is confident inflation will return to target, but says growth will be “volatile”

Larry Summers on stagflation risks, lessons from Delphi and never-ending ‘punch’

The former US Treasury secretary speaks about fiscal ‘overexpansion’, Fed/Treasury debt discord, the pitfalls of ‘unknown unknowns’ and central bankers ‘unable’ to remove the ‘punchbowl’

Monetary Policy Benchmarks 2021 report – executive summary

Insights into the staff that work on monetary policy, decision-making, tools, transparency and market operations

MMT and the challenge of fiscal monetary co-ordination

Sayuri Shirai contrasts modern monetary theory with regimes of monetary or fiscal dominance

Central banks set monetary policy around eight times a year

African central banks reported setting monetary policy less frequently than peers

Too great expectations from the ECB’s strategy review

The review process represents operational best practice, but will fail to unify the Governing Council

Powell says taper test has been met ‘with regard to inflation’

Fed chair tells Jackson Hole conference that slowing QE this year “could be appropriate”

Fed may taper asset purchases this year, say FOMC minutes

Federal Reserve staff warn US financial system has “notable” vulnerabilities

RBA governor dismisses calls for policy review

Opposition politician criticises central bank for frequently missing inflation target