Asset prices

Football stadiums to airlines: BoE reveals commercial paper holdings

Central bank has taken on exposures to a wide range of businesses – including polluters

Covid-19 forcing reserve managers to rethink asset allocations

Adjusting asset allocations and dealing with reduced market liquidity are key challenges for reserve managers, survey reveals

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

What would yield curve control mean for Fed’s asset purchases?

Policy may imply shift in rationale from crisis to recovery, and potentially more volatility in purchases

Rising to the challenge – Reserve management in an uncertain world

Amid unprecedented measures being taken by central banks and governments to combat the global Covid‑19 pandemic, BlackRock‘s Stephan Meschenmoser, Laszlo Tisler and Crystal Wan compare and contrast BlackRock’s model portfolio against its high-grade…

Banks are ‘inherently unstable’, BIS paper finds

Researchers study the many roles banks play and find all of them tend towards instability

BIS paper: twin financial cycles can ‘turbocharge’ crashes

Policy-makers should differentiate between domestic and global cycles, authors say

Global carbon taxes are coming: central banks must prepare

The next financial crisis could be a green one. Are central banks doing enough to prepare?

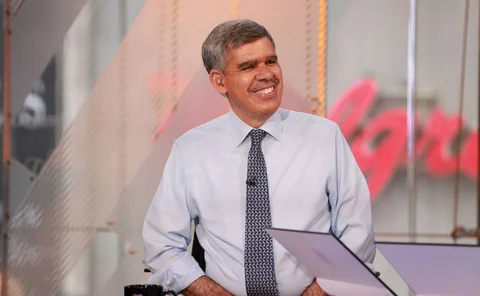

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

World Bank says sub-Saharan Africa destined for first recession in 25 years

Growth could fall as low as -5.1% as largest economies struggle with Covid-19 repercussions

ECB paper presents new model for ‘fire sale’ contagion

Agent-based model shows asset managers spreading contagion during larger liquidity shocks

FOMC discusses communication ‘escape clauses’

Fed might need “leeway” to deal with financial instability, some FOMC members say

Eurozone banks increase illiquid assets after solvency shocks – DNB paper

Shift in asset holdings could create asset price distortions after banking crises, researchers say

Bank of Canada holds rates but cuts growth forecast

Central bank cuts expected growth by 0.75 percentage points lower for both Q4 2019 and Q1 2020

Regional Fed presidents warn asset purchases are creating risks

Robert Kaplan expresses concern over Fed’s response to market funding pressures

Bank of Guyana to manage new sovereign wealth fund

New fund, operationally managed by central bank, will invest profits from new oil revenue

Ghana launches push to turn banking sector green

New sustainable principles address seven areas of social and environmental issues in a growing banking sector

Weak data on sustainable assets threatens financial stability – Sarb

Industries vulnerability to climate-related risk is unknown, South African central bank says

Norway’s SWF chief to step down after 12 years

Yngve Slyngstad presided over international diversification and the adoption of real estate, while total assets multiplied by four

Dutch pension funds hit by low interest rates, says DNB

Today, 63% of funding ratios are below the statutory minimum

Large forex dealers are key to asset pricing – Bundesbank paper

Capital ratios of large forex dealers are important in explaining asset price movements, paper says

Big tech: a threat to banks?

The explosive growth of financial services offered by big tech companies in China offers important lessons

Central bankers without clothes and clout

The focus on the latest actions by central banks is disproportional to their impact on the economy. Without normalisation, central bankers may be revealed to have no clout, writes Jesper Berg

30 years of central banking

Central banks face credibility tests on a number of fronts