Amid unprecedented measures being taken by central banks and governments to combat the global Covid‑19 pandemic, BlackRock’s Stephan Meschenmoser, Laszlo Tisler and Crystal Wan compare and contrast BlackRock’s model portfolio against its high-grade government bond reference portfolio, update its portfolio construction methodologies and consider how to incorporate sustainability into the framework, and explore why certain new asset classes deserve a place in central banks’ reserve portfolios.

In many ways, this year’s safety, liquidity and return reserve portfolio exercise is different from previous editions dating back to 2013, when the series began. This analysis was conducted entirely remotely from BlackRock’s core places of operation, in our search for optimal reserve portfolio construction while navigating the global coronavirus (Covid‑19) pandemic.

Indeed, 2019 brought market euphoria following episodes of difficulties in 2018; 2020 looked to have got off to a good start, but nothing prepared the world – or the capital markets – for what ensued. Stress scenarios were exceeded by realities, asset prices breached new highs and lows almost daily, and central banks and governments deployed unprecedented measures.

However, some things remain constant. For reserve managers, consciously and deliberately balancing volatility and liquidity constraints against realistic income objectives remains a reliable mantra. Amid such turbulence, this mantra is providing much-needed guidance on how to construct resilient reserve portfolios.

In this article, we describe the evolution of its model portfolio and reflects on how it has performed against its high-grade government bond reference portfolio. It updates its portfolio construction methodologies and considers how to incorporate sustainability into the framework. The feature then takes a deeper dive into some of the new asset classes added this year, investigating the reasons we believe they deserve a place in central banks’

reserve portfolios.

Portfolio construction

Official reserve managers need to consciously and deliberately balance volatility and liquidity constraints against realistic income objectives.

A BlackRock sponsored feature published in the May 2019 issue of Central Banking introduced an enhanced approach to constructing more resilient reserve portfolios by taking into account uncertainty and levels of conviction. Further key improvements this year aim to incorporate sustainability, more granular views, lower bounds for government bond yields and an increased focus on resilience and currency hedging.

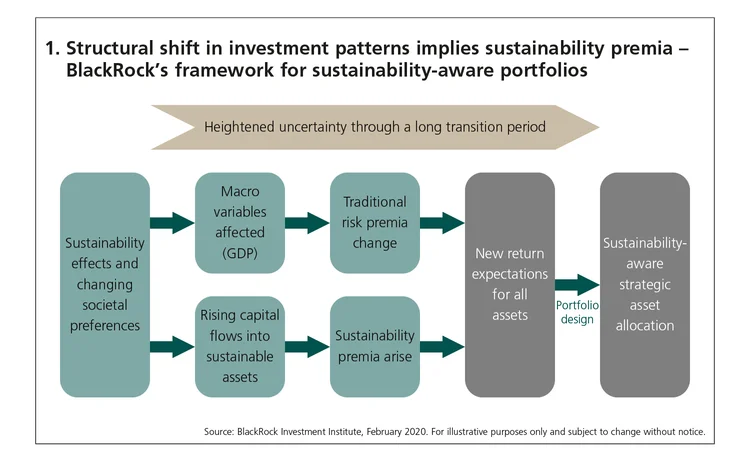

One of the most significant considerations is sustainability. Some argue that, as sustainable assets exhibit a higher degree of resilience, investors should demand less financial return for holding them compared with less sustainable – or riskier – assets, all things being equal. While this could be true in a steady state where risks related to sustainability – or lack thereof – are fairly and fully priced into asset valuation, the world is a long way from it. In fact, we strongly believe we are at the start of a long tectonic shift driven by improving data and disclosure, investor and societal preferences, accelerated by regulation across the world that will reshape all asset prices, creating a ‘sustainability premia’ during this transition.

This has significant implications for long-term expected returns and relative pricing of assets. A robust portfolio construction framework must take into consideration these impacts not only in return forecasts, but also throughout the allocation and implementation process.

While the strategic asset allocation of our model portfolio only considers allocations to broad asset classes and macro factors, implementing these allocations through vehicles that incorporate environmental, social and governance considerations can be beneficial in volatile market environments – something already observed during recent episodes.

Another important update is the introduction of effective lower bounds for interest rates, which reflects the state of the world today. Indeed, with traditional reserve assets yielding lower for longer, it is important to consider the long-term implications if these assets can no longer serve as portfolio ballast against risk assets as effectively as before. In fact, taking lower bounds on interest rates into account during the portfolio construction process, we find that allocation to government bonds decreases by 3%.

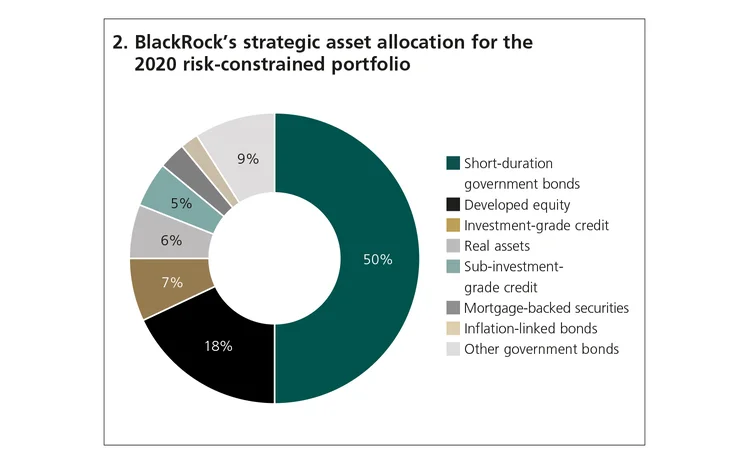

We have also introduced several new asset classes, including real estate and infrastructure assets – together referred to here as ‘real assets’. We make an allocation to Chinese bonds in the portfolio, highlighting that these bonds are further away from their perceived lower bound but still offer attractive yield. Real assets are also present at 6% of the portfolio, reflecting the relatively beneficial risk/return trade off and diversification advantages.

Investment-grade and high-yield credit continue to feature. While cognisant of reserve managers’ aversion to credit risk – and reputational risk related to it – an appropriately sized modest allocation could bring diversification benefits. We explicitly acknowledge the impact of the current market environment on high-yield returns; over the next year, we model defaults and downgrades similar to those that occurred during stress periods and return to our ‘standard’ default assumptions further out in the timeline. While not a common asset class for reserve portfolios, investors that can tolerate fallen angles in their portfolios until the market normalises could potentially help limit adverse return implications.

Some reserve managers are also starting to worry about rising inflation risks – a new concern for many in this decade, as the seemingly bottomless fiscal and monetary policy response continue to enrich the economy with cash. We acknowledge this by increasing our premium for inflation risk in our capital markets assumptions, and suggest those concerned about inflation rising more than market expectation to overweight inflation-linked bonds within their allocation to Treasury bonds.

2020 model portfolio

Consistent with our exercises undertaken since 2013, this year we continue to model two portfolios with 50% liquidity floor – one targets 2.5% return while minimising risk (return targeting portfolio), the other looks to maximise return in adverse scenarios with a volatility ceiling of 4.6% (risk-constraint portfolio).

While in 2019 the 2.5% return target could have been achieved by holding short-dated US Treasury bonds entirely, 2020 required more deliberation and trade-off between risk and liquidity. The 2.5% target return portfolio now includes 15% allocation to equity, 5% Chinese bonds, 15% credit and 2% emerging markets debt. The volatility of this year’s 2.5% portfolio hits 2.7%, compared with last year’s 2.3%.

The portfolio set out in figure 2 represents our strategic asset allocation for the 2020 risk-constrained portfolio. This portfolio has been created with an explicit focus on building resilience – with a one-year maximum drawdown of 1.7%, compared with 1.6% for the Group of 7 reference benchmark.

While the maximum drawdown is higher than the benchmark, we believe this is a measured and necessary increase for an opportunity to achieve higher returns. It is worth noting we further reduced the portfolio risk to 3.5%, compared with 4.2% last year – well within the imposed 4.6% ceiling. Looking at risk through drawdown and conditional value-at-risk is better aligned with reserve manager objectives.

The portfolio this year continues to make important allocations beyond traditional reserve portfolio asset classes. Allocating to assets such as equities, emerging markets, real assets and credit offer diversification benefits as well as higher potential returns over the long term. The expected return of the portfolio in average market conditions is +3.1%, with an expected return of +1.9% conditional on being in the bottom half of simulated scenarios, using our Capital Market Assumptions. Comparing these metrics against the expected outcomes for the G7 reference benchmark, one would expect that, in normal market conditions, the volatility-constrained portfolio should outperform the benchmark by +2.2%. Meanwhile, in the bottom half of all outcomes the portfolio is still expected to outperform the benchmark by +2.0%. By being explicitly concerned about the downside in the portfolio construction process we can better manage against the shocks and concerns relevant to reserve managers.

Historic returns

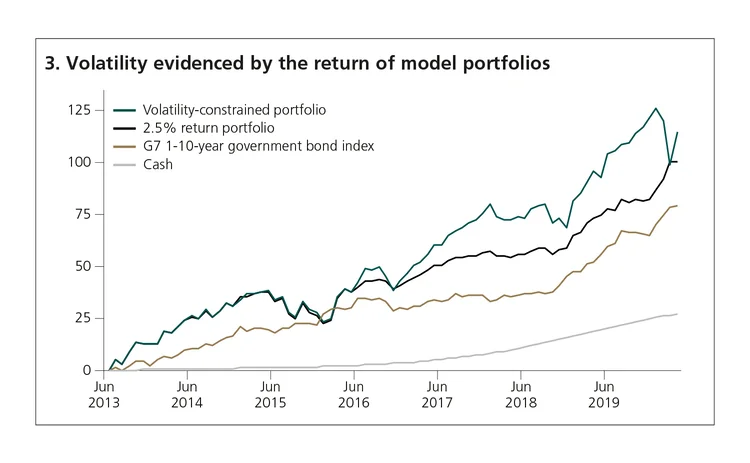

This year has presented many challenges for investors across the investment universe. A global pandemic, and multitudes of unprecedented measures and market moves, all experienced within a short few weeks, have tested resilience of portfolios as well as investors’ bravery. This volatility is evident in the return of the model portfolios.

Zooming in on 2020, in times when markets do not reward risk-taking, cash is king. For this reason, short-duration Treasuries (which the 2.5% target return portfolio consisted of last year) outperform longer duration Treasuries (such as the G7 portfolio) and diversified portfolios (such as the volatility-constrained portfolio), as observed. Our volatility-constrained portfolio underperformed the G7 government bond reference benchmark over the year to the end of April 2020 by -2.1%; the 2.5% target return portfolio slightly underperformed by -0.2%.

However, economic theory argues that, over the long term, including rewarded risks in a diversified fashion will result in better portfolio outcomes. This is also evident in the longer-term returns of the portfolios shown. Over a multiyear horizon – from November 30, 2013 to April 30, 2020 – the volatility-constrained portfolio has beaten the G7 benchmark by 1.1% annualised, and the 2.5% return target portfolio has beaten the G7 benchmark portfolio by 0.7% annualised.

Chinese assets – A role in reserve portfolios

China boasts the world’s second-largest economy, and bond and equity markets, but is extremely underweight in most investment portfolios. We featured China as a consideration for our model reserve portfolios in last year’s paper, recognising the increased adoption of the renminbi as a reserve currency by central banks as well as its growing weight in global indexes. Although near-term risks to China’s economy have prompted a cautious stance among global investors so far, we see a strategic case for holding Chinese assets in portfolios that goes beyond tactical considerations, particularly against the backdrop of ultra-low bond yields elsewhere.

Our return expectations for Chinese assets are based on a cautious outlook for the economy. The way we establish asset assumptions for Chinese assets allows us to think about the allocation in a total portfolio context. There is, of course, no direct connection between economic growth of a country and stock market performance or its size. We allow for a wide range of uncertainty in our return expectations to account for the multiple ways that China’s economy and markets can evolve, and are not driven solely by the assumption that higher economic growth may result in higher expected returns. Instead, we establish our estimates from fundamental considerations such as the outlook for interest rates, valuations and the path of returns. For example, we allow for a large amount of uncertainty in our equity assumption, primarily reflecting the historical volatility and the level of conviction in forecasts. By contrast, the uncertainty bands for Chinese government bonds are lower, given limited historical volatility.

Even with the large levels of uncertainty, the return and diversification benefits lead us to notable allocations. In both model reserve portfolios discussed this year, we observe an allocation of 2.5% to China across bonds and equity in the risk-constrained portfolio, and allocation to 5% in the 2.5% return targeting portfolio.

Source: BlackRock Investment Institute (November 2019), Bonds and ballast: Testing the limits

Green bonds – Reserve management and the climate challenge

Climate change is one of the biggest challenges the world faces today. While climate change can be a significant source of financial risk, a central bank’s role in solving the climate emergency is widely debated, and the solution depends on each central bank’s official mandate, among other factors.

Thanks to green bonds, the two outcomes are not mutually exclusive. It is possible for a central bank to help advance the transition to a lower-carbon economy while confining its portfolio holdings to the universe of allowable issuers, minimum ratings, maturity limits and yields, with little concern about conflicting the stated purposes of reserves. Anecdotally, some reserve managers already purchase green bonds as a result of relative-value investment decisions; however, dedicated allocations are on the rise. According to a reserve manager survey conducted by the Bank for International Settlements (BIS), more than 70% of respondents indicated green bonds as their preferred instruments for sustainable investing.

Using broad indexes as proxies, the total market value of the Bloomberg Barclays MSCI Green Bond Index was $382 billion as of February 2020, a fraction of the Bloomberg Barclays Global Aggregate’s value at just shy of $57 trillion. Still, the growth of the market has been phenomenal, with $234.37 billion issued in 2019 alone – a 30% increase on 2018. Our analysis of liquidity and pricing using interpolated Z-Spread weight average life curves across 40 euro and US dollar issuers found no material differences between green and non-green counterparts. The green bond market is certainly reaching critical mass and is sufficiently accessible for reserve managers.

Based on research from Morgan Stanley, Green bond performance amid the volatility, we observe that green bonds have exhibited better resilience or traded inline with conventional peers so far in 2020.

One of the nuances of investing in green bonds is the potential reputational risk from ‘greenwashing’ – holding bonds that are labelled green but with questionable parameters around the use of proceeds. Although some level of standardisation has been achieved by the likes of the Green Bond Principles and the Climate Bond Initiatives, there can still be discrepancies between conventions, and additional due diligence is warranted.

Green bonds provide central banks with an efficient way to achieve environmental impacts while staying within existing investment parameters. In itself it does not mitigate risks related to sustainability issues in reserve portfolios, and should be considered alongside a full integration of sustainability in the broader investment framework.

Sources: BIS, Morgan Stanley

Real assets – Strength in diversity

Most reserve portfolios need to be liquid. Indeed, the notion that reserve portfolios should be readily available for policy needs has set the tone for most central banks’ reserve portfolios. However, low yields and more varied potential stress scenarios have prompted reserve managers to take a closer look at their key objectives and constraints, and be much more deliberate when balancing between them.

We observe central banks diversifying into investment-grade credit and even equity, acknowledging that as long as the preset liquidity requirements are met, there can be a modest allocation away from government bonds to achieve more diversified risk exposures and higher yield, improving portfolio efficiency during normal market environments. This has continued to evolve following the global financial crisis that began in 2007–08, accelerated by the ever-lowering yields, with real assets also coming into focus.

It is not entirely novel for central banks to invest in real assets – in fact, real estate has featured in many central bank portfolios. Across objectives such as uncorrelated return, reliable consistent income, capital appreciation and efficient portfolio construction, central banks have explored the use of real estate and infrastructure across the capital structure, including public and private market investments.

In this diverse asset class, it is important to first define what role the allocation will play before allocating to the appropriate risk spectrum and investment instrument. For example, the global renewable power market offers a variety of potential financial outcomes, with divergence in contracted revenues, size of opportunity and supply of capital all influencing return characteristics. It allows investors to target consistent uncorrelated returns while contributing to the global energy transition. On the other hand, real estate markets tend to be on unsynchronised cycles driven by local economic and supply dynamics, with core real estate providing stable income stream, while value-add assets target capital growth over the holding period.

While liquidity needs should be prioritised unequivocally, illiquidity only causes an issue if a sale of asset has to be realised in forced circumstances. A modest allocation to real assets where appropriate can help further improve portfolio efficiency and make the total portfolio more resilient – something we have observed during the Covid‑19 pandemic. In the risk-constraint model portfolio, for the first time we have introduced an allocation into real assets at 6% for the risk-constrained portfolio.

Sources: BlackRock (January 2020), 2020 Real Assets Outlook

J Boivin, P Chan, V Paul and J Wittlin (March 2019), The core role of private markets in modern portfolios

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com