Federal Reserve Bank of New York

Iraq’s KRG launches payment system for government bills

Central bank-approved platform forms part of digitisation efforts in autonomous Kurdistan Region

12 angry members: why dissent is growing on the FOMC

Hardening views on wisdom of further cuts mean committee’s next meeting is unlikely to be harmonious

Permissionless payments may be the future – NY Fed study

Stablecoins’ accessibility makes them different from other fast payment options, say authors

Cryptogeddon: a user’s guide for central banks

How might monetary authorities react if a digital asset crash destabilised the financial system?

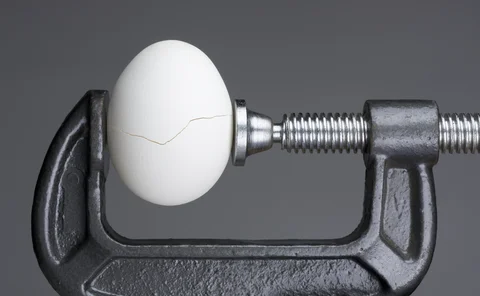

Stress-test transparency: how much is too much?

The transparency drive to disclose bank stress-test results comes with costs

News coverage drove 2023 US bank runs – NY Fed study

Equity investors only became attuned to lenders’ weak fundamentals after mass panic began

Book notes: Bankers’ trust, by Aditi Sahasrabuddhe

A novel investigation into how trust among central bankers – or lack thereof – helped and worsened crises of the past

Options for realising gold revaluations

Is monetary gold a special case in central bank revaluations accounting?

US consumers’ expectations of finding work hit new low – study

Mean perceived probability of a newly unemployed person finding a job fell to 44.9%

On the eve of the Fed’s framework review

Experts speak about the Fed’s monetary strategy review, including the role of flexible average IT and the need to better communicate policy trade-offs

BoE’s Benjamin on market resilience, non-bank liquidity and the modern financial system

The UK central bank’s executive director for financial stability strategy and risk speaks about leverage in the gilt repo market, minimum haircuts and central clearing, and securing liquidity to where it’s needed

Tobias Adrian on the integrated policy framework amid tariff shocks

The IMF’s financial counsellor speaks about policy reaction functions to supply and demand shocks, scenario-based analyses, Treasury market dynamics and emerging market resilience

NY Fed’s push for repo haircuts gets a tepid response

New risk management standards could make it harder to finance US Treasury purchases

Chance of US recession lower, but still high – NY Fed study

Authors say model puts chances at 75%, compared with 83% at beginning of 2024

CCAR at a turning point, but which way is forward?

Banks sniff an opportunity to push the Fed for more openness over stress test models – and seize capital benefits

Supply chains more normal than they seem – Richmond Fed study

Research says index compiled by New York Fed points to business as usual

Mr Bessent goes to Basel: the fate of global bank regulation

US resistance to international standards could spark greater fragmentation of prudential rules

GSEs not lending as much as they appear to be – NY Fed paper

Much of enterprises’ loans to “real economy” are in fact financed by other types of institution

NY Fed and BIS explore monetary policy in a tokenised world

Project Pine’s smart contracts are designed so central banks can adapt them to their currencies and frameworks

Fed holds rates as experts sound alarm over stagflation

FOMC says risks have risen on both the employment and inflation sides of its mandate

Legal framework key to keeping money’s singleness – study

Interoperable blockchain payment systems could present challenges, say NY Fed researchers