Emerging markets

Emerging economies likely to lag advanced in AI-led growth – study

BIS report highlights divergence in technology’s impact on jobs and countries’ ability to adapt

Next-generation reserve management and monetary operations

Central bank modernisation is essential to ensure institutions can execute mission-critical operations and prepare for future opportunities.

Building the future of central banking by investing in people and technology

Technological upgrades focused on data mark the beginning of a digital transformation journey and AI adoption, not the end

Alexandre Tombini on LatAm resilience and growth amid uncertainty

The BIS Americas head speaks about the impact of the US tariffs, building resilience amid uncertainty and fostering inclusion through digital payments

Argentina and the fear of floating

Economists believe the country’s authorities must fully liberalise the peso before it is too late

Ex-BoT governor warns against EMs overusing policy space

Gap exists between expectations and what central banks can achieve in terms of growth, says Sethaput

Venetian lessons for today’s central bankers

Loose money and lost credibility in 17th century city state provide a cautionary tale about the importance of international investor confidence, argues Biagio Bossone

BIS article notes changing effects of dollar weakness on EMEs

Investment channel likely to become more important countervailing force, authors say

Digitisation of money brings more regulatory risks – IMF head

Georgieva says crypto regs are in early stages and not yet coherent internationally

Local bond markets seeing more domestic investors, IMF says

But EMDEs must be mindful of growing sovereign-bank nexus as foreign investors depart, latest GFSR chapter notes

EMs can adopt higher inflation targets – BoE Bulletin

Authors say more elevated goals reflect economies’ faster growth and susceptibility to supply shocks

Climate change harming global economy – BoK study

Study finds high income countries more vulnerable to climate change, in contrast to other research

Climate risks still on the fringe of monetary policy in Asia

Notwithstanding efforts by the PBoC and BoJ, there is still a need to observe persistent and measurable impacts on inflation and output before climate change truly influences interest rate policy, argues Sayuri Shirai

Barbados to launch instant payment system

Central bank says ‘revolutionary moment’ in country’s financial history will take place next March

Is this time different for Argentina?

Reserve shortage and overvalued currency cast a pall over an otherwise successful stabilisation campaign

Experts split over wisdom of Mexico’s 25bp rates cut

Economist says policy committee’s sole dissenter was right to vote to hold

Trump’s tariffs and the emerging market economies

Steve Kamin says EMEs are likely to escape the worst outcomes from capricious and chaotic trade policy

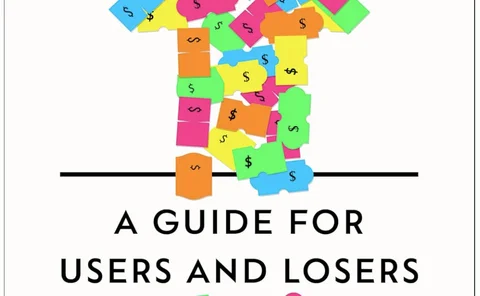

Book notes: Inflation, by Mark Blyth and Nicolò Fraccaroli

An accessible explainer about the narratives surrounding inflation – and who it benefits

The battle for the future of central banks

Inflation-targeting institutions must not simply defend against overt interference, they must also resist a sly erosion of their authority, writes Biagio Bossone

Tobias Adrian on the integrated policy framework amid tariff shocks

The IMF’s financial counsellor speaks about policy reaction functions to supply and demand shocks, scenario-based analyses, Treasury market dynamics and emerging market resilience

Brics leaders push for multilateral payments solutions

Central bank governors and finance ministers also call for reform of Bretton Woods institutions