Speech

Fed’s Harker ‘pencils in’ rate hike for December

Philadelphia Fed governor expects rates to rise 25bps before 2018, adding balance sheet normalisation is likely to “take some time”

SNB’s Jordan defends central bank independence

In contrast to monetary policy, macro-prudential should also be shaped by government

Confidence key for South Africa’s economic recovery – Kganyago

Consumer confidence has been “sapped”, but governor remains optimistic nation can “turn things around” by implementing investor-friendly policies

Visco cautions ECB against forced sales of NPLs

Move to set minimum sell-offs could hamper banks’ recovery, Bank of Italy governor says

Poloz: standard inflation theories still work

Old relationships “are as applicable today as they ever were”, says Bank of Canada governor

BoE’s Taylor pushes back against complaints of over-regulation

Capital requirements could have been made much tougher, and the FPC strives to achieve balance and accountability, Martin Taylor says

Dudley: use ‘paring knife not meat cleaver’ on Dodd-Frank

New York Fed president accepts that some elements of Dodd-Frank could be improved, but also says vulnerabilities remain

Korea suffering from ‘missing inflation’ – deputy governor

Core inflation is still in the mid-1% range despite economic improvement

Mauritius governor opens new currency museum named after first governor

Museum ‘Aunauth Beejadhur’ will exhibit Mauritian currency throughout the ages, with plans to expand scope to include financial literacy at a later date

Risk of protectionist policies not yet factored in – Poloz

Bank of Canada governor says household debt, wage growth and labour market are all considered for monetary policy projections

Inflation shocks in Mexico temporary, Carstens says

Medium and long-term inflation expectations remain close to 3% target, governor says

Too soon to start celebrating economic improvements, says Mminele

Sarb deputy warns against complacency in latest economic roundup, saying it is too soon to start celebrating lower inflation and a more stable external environment

DLT has ‘more potential for change’ outside US – Boston Fed VP

Jim Cuhna says distributed ledger technology can transform financial services not only in payments but also in securities settlement; challenge is finding use cases

IMF’s Lipton says global growth is not ‘strong enough’

Deputy director says some emerging markets risk getting left behind

ECB’s Nouy advocates global banking supervisory co-operation

The international nature of the financial system demands regulation across borders

Sri Lanka working to introduce ‘proactive’ policy – governor

Central bank in the past tended to do “too little, too late”, leading to big swings in interest rates, says Coomaraswamy

Banking industry has ‘consistently failed customers’ – Ireland’s Sibley

Banks should focus on whether outcomes are desirable, not just whether they are legal, says deputy governor

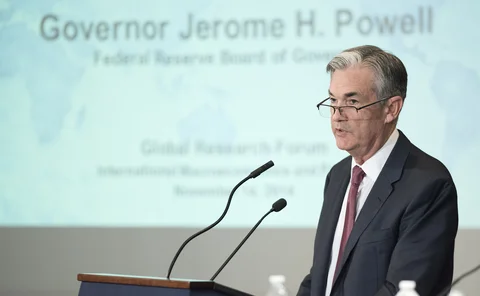

Fed’s Powell: banks still have important role in payments

Fintech is disrupting the sector, but banks still form a major part of payments infrastructure, so they must be included in work on faster payments, says governor

Goldfajn stresses current target remains ‘credible’

Central bank pushed back against calls for the target to be raised during 2016 debate

Inflation target supports price setting and wage formation – Ohlsson

Target contributed to economic recovery in Sweden, Riksbank deputy governor says

Rand still at risk despite recovery – Mminele

Sarb deputy warns against complacency as risks to exchange rate linger on the horizon; both internal and external threats remain

Williams: weak productivity, population growth keep rates low

The “new normal” implies a federal funds rate at 2.5%, says San Francisco’s John Williams

Basel Committee in ‘last few metres’ of post-crisis marathon

Secretary-general says it would be unwise to quit with the finish line so close, but adds the committee won’t be running another marathon for a while

Fed’s Powell: normalisation will be ‘manageable’ for emerging markets

Fed governor says current capital flows appear to be in line with fundamentals; corporate debts a vulnerability but “situation is not alarming”