Central Banking

BoE’s new MPC members disagree on future path of hikes

New deputy Dave Ramsden sees current degree of slack to be too great to warrant removal of stimulus, while Tenreyro believes it cannot “persist for too long”

Williams: weak productivity, population growth keep rates low

The “new normal” implies a federal funds rate at 2.5%, says San Francisco’s John Williams

Basel Committee in ‘last few metres’ of post-crisis marathon

Secretary-general says it would be unwise to quit with the finish line so close, but adds the committee won’t be running another marathon for a while

FSB members press ahead with new cyber-risk rules

Over 70% of FSB members say they plan to launch new measures in the next year; private sector emphasises need for better training

US Treasury hands CCP resolution powers to FDIC

Mnuchin regulatory review explicitly refers to FDIC as receiver under a Title II resolution

People: FSB appoints new secretary-general

ADB’s East Asia department and International Association of Deposit Insurers also gain new heads

Fintech is the future – Menon

Central bankers weigh in on potential of fintech, agreeing there is a need to separate use cases from the hype

Colombian banking sector not at risk despite homogeneity – paper

Economist examines diversity of Colombian banking sector and notes “distance” between banks is low; lending and funding portfolios are most similar, author says

Philippines central bank seeks to allay concerns on FDI slowdown

Foreign direct investment into the Philippines dropped 37.9% in the year to July; government is struggling to meet ambitious growth targets

Moldovan parliament expands central bank’s supervisory powers

Major bank crime saw theft of approximately 12% of GDP in 2014

Riksbank simulates a payments crisis scenario

Central bank deems offline payments and withdrawals a suitable alternative to credit cards

PBoC targets stability ahead of party congress

China's central bank has taken several measures to boost stability in the run-up to the Communist party congress, which starts on October 18

Blanchard and Summers call for rethink of stabilisation policy

Both economists question consensus on fiscal prudence and advocate stricter financial regulation

BoE paper sheds light on global policy transmission

Comparison of UK and Hong Kong based on bank-level data finds evidence of both portfolio and funding effects

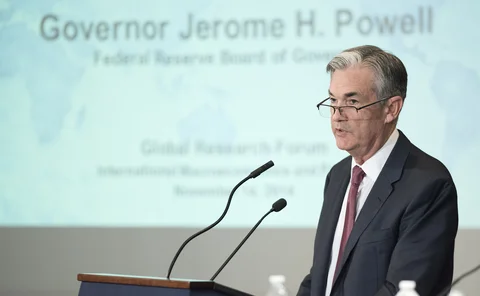

Fed’s Powell: normalisation will be ‘manageable’ for emerging markets

Fed governor says current capital flows appear to be in line with fundamentals; corporate debts a vulnerability but “situation is not alarming”

ECB strongly criticises Slovenian draft law on central bank

Proposals would put legal burden of proof in banking crisis cases on central bank, ECB says

Bank of Lithuania bans banks from virtual currency activities

Lithuanian financial firms must disassociate themselves from virtual currencies, says central bank, warning licences may be revoked

Birr plunges 15% as Ethiopia devalues currency

Move aims to tackle “severe” forex shortage; IMF recommends higher interest rates and more flexible exchange rate

FOMC split over inflation forecasts, minutes show

Participants expressed concern that low inflation this year might reflect not only transitory factors

London-based banks face ECB Brexit power grab

Drive to supervise swaps books from Frankfurt threatens cross-border balance sheet management

IMF cautions global vulnerabilities put growth at risk

Fund calls central banks to provide needed monetary support while tackling underlying threats

Bahamian central bank proposes law change to cap government debt holdings

New legal framework for Bahamas central bank would enforce “comprehensive” limits on government debt; holdings of long-term government debt stand at 12.52%

Emerging market incomes continue to grow despite trade impacts – Lagarde

Trade has not impacted emerging markets as negatively as their advanced counterparts, Lagarde says, as incomes continue to grow

BoE introduces new counterfeit initiative for ‘front line of defence’

New checking scheme will employ “targeted training” for cash handlers while retailers will help central bank gather data on current practices