Central Banking

Belgium’s Quaden defends IMF

National Bank of Belgium governor Guy Quaden says political independence of Fund makes its surveillance meaningful

BIS on renminbi management

Bank for International Settlements research results consistent with the renminbi having been managed in 2006-08 against a basket of currencies

Basel III could distort monetary policy: ECB’s Bini Smaghi warns

European Central Bank executive board member Lorenzo Bini Smaghi says Basel III may have unintended consequences on monetary policy

CEPR advocates rule-based approach to central bank projections

Centre for Economic Policy Research study says central bank projections based on interest rate rule yield same results as one on market expectations

Why Brazil’s economy survived shaky markets

Central Bank of Brazil Financial Stability Report says external shocks did not hamper economic recovery in Brazil owing to sound macro fundamentals

CNB creates stability wing in bid to beef up systemic oversight

Czech National Bank separates financial stability and economic research department; says independent department move will enhance financial stability mandate

Look to markets for head supervisors: De Larosière

Jacques de Larosière says heads of new European Supervisory Authorities should think like market participants and have their respect

Central bankers, politicians splinter on reach of ESRB

Weber, Constâncio specify limits of European Systemic Risk Board's authority over national regulators; politicians advocate one unified European stand

China opens up secondary loan market in bid to reduce systemic risk

China has further liberalised its interbank market to let banks transfer loans to each other

FDIC seeks to raise standards of securitised assets

Federal Deposit Insurance Corporation approves final rule requiring banks to hold 5% of securitised assets on their balance sheet

SF Fed: SWFs trump central banks on foreign investment returns

San Francisco Federal Reserve study shows central banks are more risk averse than sovereign wealth funds, producing lower average returns on investments in foreign assets

BoJ vigilant over financial risks

Bank of Japan Financial System Report warns decline in quality of bank loans could undermine progress in financial markets

Fed’s Lacker: constructive ambiguity is unworkable

Richmond Federal Reserve president Jeffrey Lacker says fudging tactics over bailouts will be short-lived

ECB: excess liquidity expansion induces financial fragility

European Central Bank study shows that over expansion of credit can lead to increased fragility in financial markets

Bank’s Posen makes case for further stimulus

Bank of England Monetary Policy Committee member Adam Posen advocates use of more “monetary action” to stimulate economy

IMF makes FSAPs compulsory

Fund says 25 countries with systemically important financial sectors will be required to undergo check-ups every five years

Bank of Thailand opens shop in China

People's Bank of China says Bank of Thailand's new representative office in Beijing will aid cooperation

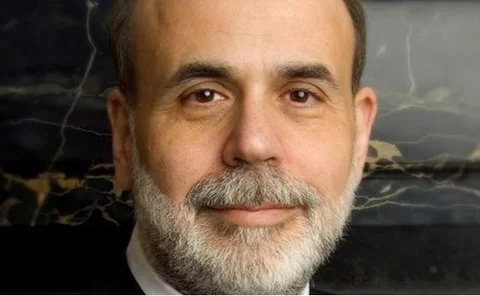

Bernanke charts new course for Fed economics

Federal Reserve chairman Ben Bernanke suggests research must veer away from assumptions based on classical paradigm; stresses models must better capture irregular behaviour

Nigeria limits state bond holdings; cleans up microfinance

Central Bank of Nigeria places limits on banks’ holding of state government bonds; revokes over a quarter of microfinance licences after serious problems revealed in sector

Fed’s Plosser calls for rules for crisis-fighting measures

Philadelphia Federal Reserve president Charles Plosser says Fed risks undermining its credibility if it does not provide clear policy rules for the exceptional policy measures seen during the crisis

BoJ doing all it can to bolster growth, says Shirakawa

Bank of Japan governor Masaaki Shirakawa points to central bank’s multiple efforts to boost activity

Fed's Alvarez favours balanced incentive compensation design

Federal Reserve general counsel Scott Alvarez says overly restrictive compensation packages may create risk to organisations

Banks fear soaring regulatory compliance costs: industry survey

Survey of financial firms shows three quarters of respondents expect costs of complying with Basel III, Dodd-Frank to exceed costs in past three years

Bank of Italy’s Visco calls for social programmes to address ageing population

Bank of Italy deputy director-general Ignazio Visco calls for social programmes to retrain new and old labour force entrants