Central Banking

Bail-ins win further support

Bail-in capital meets with favour from speakers at London School of Economics conference

Take more proactive role in macroprudential policy, DSK tells Asia

IMF managing director Dominique Strauss-Kahn says emerging markets should lead by example and complement strong recovery with sound macroprudential policies

Korea’s Kim hints at move into gold: reports

Bank of Korea governor Kim Choong-soo tells lawmakers central bank must cautiously consider increasing gold reserves

CEPR finds bias in fiscal forecasting model

Centre for Economic Policy Research study shows that failure to incorporate changing preferences when modeling fiscal forecasts may create inaccurate predictions

BoE’s Fisher: further QE a possibility

Bank of England rate-setter Paul Fisher says central bank could provide stimulus should conditions warrant it

Bank of Israel: FX intervention successful

Bank of Israel study shows rise in frequency of foreign currency interventions caused depreciation in shekel-dollar exchange rate

Yilmaz: Turkish economy booming

Central Bank of the Republic of Turkey governor Durmuş Yilmaz says growth in Turkey outpaced most emerging markets in second quarter

Bank of Finland shuffles board members’ remits

Bank of Finland distributes Sinikka Salo’s responsibilities; parliamentary overseer wants board to run with three members

Ex-Bank MPC’s Kate Barker joins equity firm board

Former Bank of England Monetary Policy Committee member Kate Barker named non-executive director at Electra Private Equity

The Fed is being asked to do too much

Marcelle Arak and Sheila Tschinkel argue that more outright purchases of US Treasuries by the Federal Reserve will do little to stimulate US growth

US Treasury stalls on decision to name China ‘manipulator’

US Treasury says it will delay publication of report on exchange rates until after G20 gathering in Seoul

ECB’s Bini Smaghi: vital to acknowledge structural flaws

European Central Bank executive board member Lorenzo Bini Smaghi says politicians risk underestimating the need for structural reform

Malaysia’s Ibrahim: bank cooperation key to regulatory reforms

Bank Negara Malaysia’s Muhammad bin Ibrahim says successful implementation of regulatory reforms requires cooperation with banks

Riksbank’s Wickman-Parak: crisis days are over

Riksbank deputy governor Wickman-Parak says central bank can return to conventional monetary policy following convincing economic recovery

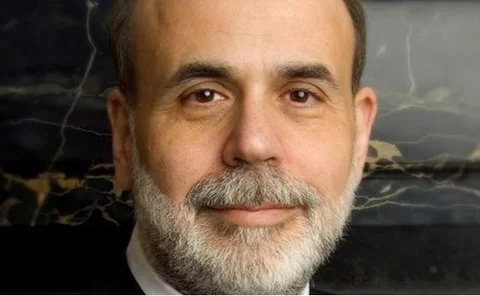

Bernanke hints at further round of QE

Federal Reserve chairman Ben Bernanke says Fed is prepared for further stimulus

Botswana’s Mohohlo in call to spur capital market growth

Bank of Botswana governor Linah Mohohlo tells CentralBanking.com that growth will require a greater degree of financial literacy

Riskier investment strategy rewards GIC

Government of Singapore Investment Corporation Annual Report reports rise in portfolio returns after investment in riskier assets

Basel Committee releases proposals for pay

Basel Committee on Banking Supervision releases guidelines on methodology for compensation practices; says proposals seek to more closely align risk and performance at financial institutions

Academics embark on €1.8m project to predict crises

European Union-funded project will see economists, computer scientists and physicists cooperate in bid to improve financial forecasting

FOMC minutes discuss QE options

Federal Open Market Committee meeting’s minutes discuss possibility of further investment in long-term Treasury securities

IMF: currency crises studies inaccurate

Fund research finds earlier studies on currency crises fail to identify volatile market fundamentals

Google price index gets analysts’ thumbs-up

Commentators praise the innovation underlying Google price index; despite limitations, index could work as a CPI subset

Pakistan’s Shehzad: corruption burdens banking sector

State Bank of Pakistan deputy governor Muhammad Shehzad discusses central bank’s campaign against corruption

Central banks should not get accustomed to QE: France’s Noyer

Banque de France governor Christian Noyer says central bank intervention was essential during crisis but should not be perceived as regular practice