Regulation

Former Bank staff sceptical on FSA split

Ex-Bank of England officials view cultural factors as barrier to success of UK government's plan to return prudential regulation to Bank

Financial Services Authority - Annual Report (2009/10)

UK Financial Services Authority's annual report discusses the regulator's transformation since the financial crisis

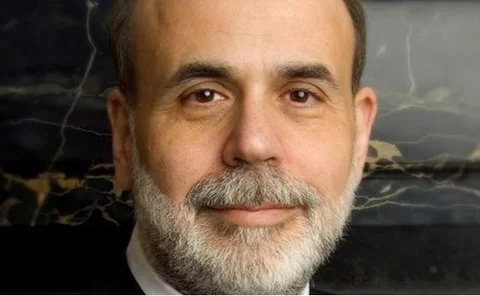

Bernanke supports greater macroprudential focus in regulation

Federal Reserve chairman Ben Bernanke says reform must focus on macroprudential financial regulation in line with Squam Lake report

FSA’s Sants calls on regulators to judge banks' culture

UK Financial Services Authority chief Hector Sants says supervisors can no longer back away from judging whether culture in banks complies with accepted standards

Corporates should be forced onto central counterparties – BIS

Central counterparties are wrongly perceived as being more expensive than OTC transactions, says a leading economist

FSA split as Britain switches to twin-peaks approach

Hector Sants to become deputy governor and chief executive of new prudential regulator, which moves to the Bank of England

UK Banking Commission proposes adoption of Volcker Rule

Report on banking reform proposes that modified version of Volcker rule be adopted

Ireland's Honohan outlines central bank's failures

Irish central bank governor Patrick Honohan cites failures in bank management for poor response to crisis in central bank review

Top economists call for central banks to oversee financial stability

Leading thinkers including former Federal Reserve Board governor Frederic Mishkin say central banks should watch financial stability; set of crisis prevention proposals include limits on bankers’ pay

US must clarify degree of Basel III implementation: Bini Smaghi

ECB executive board member Lorenzo Bini Smaghi says US needs to clarify its implementation of Basel III proposals

BIS’s Cecchetti: cross-border supervision worth the risk

Head of monetary and economic department at the Bank for International Settlements Stephen Cecchetti says benefits of global financial integration outweigh costs

Wellink says Basel III to be phased in gradually in bid to soothe fears

Basel Committee chairman Nout Wellink says proposals on new regulations on banking will be introduced in an orderly manner; unrepentant on costs to growth

UK FSA risk chief Dewar resigns

Financial Services Authority's head of risk Sally Dewar will leave the role in May 2011 as uncertainty persists over the regulator's future; Dewar to follow chief executive Hector Sants

Basel III will cost 9m G3 jobs by 2015, say banks

Institute for International Finance report estimates will lead to euro area growth being 4.3% lower in five years’ time

IMF: Sub-Saharan banks are cost efficient

Fund study on Sub-Saharan Africa finds banks in the region are cost efficient, but can do better if regulation is improved

Irish CB “taking action” to fix flaws, says governor

Governor Patrick Honohan tells CentralBanking.com the institution is rectifying cultural and structural problems flagged by his report into central bank’s pre-crisis performance

Europe raring to go on CDS rules, bank taxes

Brussels praises the political dynamic behind move for tightened financial regulation as French president Nicolas Sarkozy and German chancellor Angela Merkel call on Commission to speed up work

FDIC's Bair on mortgage reform

Federal Deposit Insurance Corporation chairman Sheila Bair makes the case for more responsible mortgage lending

Ireland’s Honohan to criticise central bank’s role in crisis: reports

Irish media say report authored by central bank chief Patrick Honohan will charge his own institution and the financial regulator with having failed in the lead up to the country’s banking crisis

G20 ditches controversial global bank tax

Finance ministers splinter on international banking levy, complicating individual countries’ promises to adopt a tax; group unites in call for Basel III to be completed by year-end

Ten legal gaps Europe’s regulators must close

René Smits identifies ten key issues that European financial legislators must consider when constructing the post-crisis regulatory framework

Brussels calls for European ratings supervisor

European Commission proposes new body to oversee all credit ratings agencies operating in the European Union; security issuers must provide information to all agencies to boost competition

Barroso moots European ratings agency

European Commission president's calls echo those of Michel Barnier; says proposals will be released in September