United States

Alan Greenspan says gold standard would have reined in debt

Former Fed chair says US would not be so indebted if it was on the gold standard; gold is the “primary global currency”, Greenspan says

Yellen calls for “sustainable” fiscal policy

Bank lending has grown since passage of Dodd-Frank Act, Fed chair tells Congress

Fed’s Fischer: econometric models are still flawed

US Fed vice-chair says models still cannot capture the complexities and rapid evolution of the economy – despite his hopes as an undergraduate

Tarullo resigns from Fed board

Early departure may give Trump a chance to reshape US regulation

US uncertainty puts Bank of Mexico on edge

Central bank hikes rate by 50bp as uncertainty from the US threatens inflation; international fuel prices are also a concern

UK’s PRA fines Japanese banking group for withholding information

Two arms of banking giant MUFG fall “significantly short” of regulators’ expectations, resulting in fines totalling £26.8m

BIS paper tracks US and eurozone QE spillovers

Shadow rates approach helps authors show US QE spilled across borders more strongly, though impact differed between countries

Fed paper flags risk of low rates misallocating capital

Where firms rely heavily on intangible capital, lower rates could harm firms’ investment and contribute to secular stagnation, economists warn

Fed unveils stress scenarios under revised testing approach

Tests now include model enhancements, new phase-in methods and lighter requirements for some banks; the severe scenario has been turned up a notch

US congressman: Yellen must stop international negotiations

Fed must allow President Trump to appoint new officials, Republican lawmaker says; calls for “fundamental review” of Basel III and other recent accords

China hikes interbank lending rates

PBoC “very worried” by banks’ credit expansion, expert says; raises medium-term lending facility rate by 10 basis points

US Treasury secretary shows early support for Fed

Mnuchin says Fed is organised with “sufficient independence”, going against early expectations he would support the Audit the Fed movement

ECB paper compares financial inclusion in US and eurozone

Encouraging transfer payment recipients to open accounts has positive effect, study finds

Minneapolis Fed launches new research institute

“Opportunity and inclusive growth institute” will draw on multiple disciplines to extend the Fed’s research

Xi says China is open for business as US turns away

China to become a bigger player in global markets as US seems to be turning inwards, says President Xi; firms looking to invest overseas

Eichengreen sees danger in US fiscal stimulus

Veteran economist warns infrastructure spending in the US may prove damaging to both the domestic and global economy, without necessarily fixing secular stagnation

IMF raises projections for US and eurozone growth for 2017

US policy mix still uncertain, but IMF staff do not yet believe changes will trigger an international trade shock; growth projections for emerging economies revised downwards

Measurement error a big part of ‘missing growth’ – Philippe Aghion

Statistics fail to capture creative destruction, French academic argues; US researchers say productivity in IT sector points to continued puzzle

Harker optimistic in first speech as FOMC voting member

Inflation target set to be met this year, says Philadelphia Fed governor, noting labour force participation issues need to be addressed with legislative action

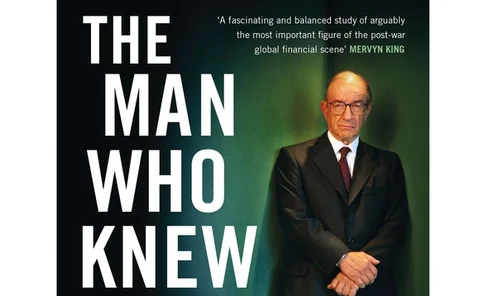

Book notes: The Man Who Knew: The Life & Times of Alan Greenspan, by Sebastian Mallaby

An extensive account of Greenspan's life and achievements, but would have benefited from a closer analysis of his relationships with comrades at the Fed

US may not experience fiscal stimulus – Atlanta Fed president

Dennis Lockhart says the US economy has reached a “transitional” juncture; says declines in key growth factors are holding the economy back

Leveraged markets not a financial stability risk – Powell

Powell examines state of highly leveraged markets with eye to financial stability, judging they are not yet a problem

Regional Fed presidents call for further rate rises

Richmond and Boston heads say the Fed should reach inflation target in 2017

Ex-Barclays trader pleads guilty in price-fixing conspiracy

Jason Katz, a former EMFX trader at Barclays and BNP Paribas, pleads guilty in New York