The Americas

Neutral interest rates at pre-pandemic levels, Bank of Canada finds

Nominal neutral interest rates in both countries sit between 2.25% and 3.25%

Email and social media still top two-way comms channels

Only teams from Asia-Pacific central banks report use of live website chat

Comms staff rarely hold PhD qualifications

Social media and writing skills remain leading areas for capacity building

Female staff make up over 60% of average comms team

Employees most likely to fall in age category of 40–49

Media relations, social media and website are top comms tasks

International communications, museum visits and speechwriting rank least

US needs to change bank takeover rules, FDIC official says

Rohit Chopra criticises SF Fed over bank linked to Sam Bankman-Fried firms

Press releases, conferences and website are top external channels

Email remains main tool for internal communications among central banks

One in five communications teams use AI for their work

Data suggests uses of AI are still at an initial stage among communications departments

Comms teams average less than 2% of central bank workforce

Majority of units operate centralised communications models

High interest puts pressure on US cattle farms – research

Wildfires and rising input prices are exacerbating factors, Kansas City Fed research says

Central banks reveal top staffing constraints

Career progression limits, skills gaps and red tape identified as challenges

Most high income central banks lack formal recapitalisation agreements

Seven respondents report launching recapitalisation in past year

Bank of Canada holds rates for sixth consecutive time

Central bank optimistic that rate cuts are ahead and inflation will gradually fall

Central banks’ profit distribution widely agreed with governments

Few institutions have arrangements with other parties or private shareholders

Two-thirds of central banks report profit in last fiscal year

Few institutions seek recapitalisation and technological advancement for operational goals

Board non-execs more likely to be appointed by governments

Middle income central banks tend to have more government officials on board

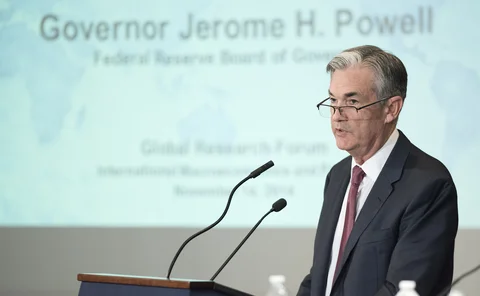

Fed officials say strong economy gives them flexibility and time

Kugler, Barkin and Powell say upside and downside risks are evening out over time

Central bank independence usually safeguarded by law

But one in 10 respondents see their autonomy threatened

Slight majority of US consumers ‘warm’ to CBDC, survey says

Respondents most interested in free use and widespread market adoption, Philadelphia Fed finds

Most central banks have policy independence

But some respondents provide details of pressure they have faced to change policy

AI threatens labour’s share of income, research finds

AI could increase inequality and social unrest, Philadelphia Fed paper argues

Monetary policy may have counterintuitive housing price effects – research

Researchers from the Dallas Fed say indirect effects may undercut policy’s aims

Middle income central banks lag on diversity and green policies

But code of ethics and whistleblower schemes remain common standards

Governors’ salaries tend to rise with country income

Low income developing countries less likely to disclose data