Federal Reserve System

People: Kristin Forbes to depart BoE; Fed’s general counsel to retire

Monetary policy committee member will leave at end of term; Scott Alvarez to step down from Fed; Bank of Portugal replaces prudential supervision head; and more

Fed officials emphasise risks despite improving outlook

“Risk management” approach to policy needed despite improving outlook, say Evans and Kashkari; Bullard notes balance sheet adjustment also an option for tightening

Fed paper flags risk of low rates misallocating capital

Where firms rely heavily on intangible capital, lower rates could harm firms’ investment and contribute to secular stagnation, economists warn

Fed unveils stress scenarios under revised testing approach

Tests now include model enhancements, new phase-in methods and lighter requirements for some banks; the severe scenario has been turned up a notch

US congressman: Yellen must stop international negotiations

Fed must allow President Trump to appoint new officials, Republican lawmaker says; calls for “fundamental review” of Basel III and other recent accords

Only ‘gradual’ increases in interest rates on the cards at the Fed

FOMC members think only “gradual” adjustments to monetary policy are warranted; current pace will strengthen the labour market and see inflation rise

Global financial safety net hits snag in regional finance

Jeromin Zettelmeyer warns moral hazard problems are now more serious with the rise of regional funds; central bank swap lines could be a partial solution

US Treasury secretary shows early support for Fed

Mnuchin says Fed is organised with “sufficient independence”, going against early expectations he would support the Audit the Fed movement

Yellen: Fed asset holdings provide automatic policy tightening

Downward pressure on long-run rates is expected to diminish, making the need to hike short-term rates less pressing, the Fed chair says

Yellen: Fed expects rates to hit long-run level by end-2019

Fed chair warns there could be a “nasty surprise” down the road if policymakers wait too long to raise rates

BIS paper finds Fed’s QE had little discernible impact on real economy

Results are still preliminary, authors say, but “cast some doubt” on the effectiveness of US quantitative easing

Davos panellists highlight risks posed by strong dollar

At the World Economic Forum, experts underline the risks of a strengthening dollar on not only US monetary policy, but also on emerging markets’ economies

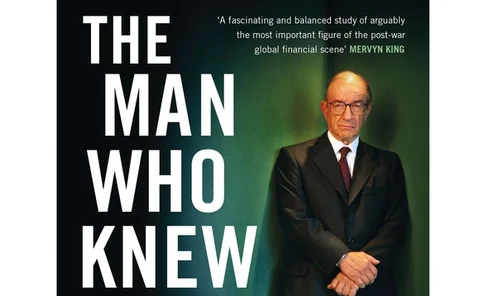

Book notes: The Man Who Knew: The Life & Times of Alan Greenspan, by Sebastian Mallaby

An extensive account of Greenspan's life and achievements, but would have benefited from a closer analysis of his relationships with comrades at the Fed

US may not experience fiscal stimulus – Atlanta Fed president

Dennis Lockhart says the US economy has reached a “transitional” juncture; says declines in key growth factors are holding the economy back

Leveraged markets not a financial stability risk – Powell

Powell examines state of highly leveraged markets with eye to financial stability, judging they are not yet a problem

Lacker to retire from Fed after 28 years

Jeffrey Lacker, who has a reputation as a monetary policy hawk, is to step down as Richmond Fed president in October; the search is on to find successor

Regional Fed presidents call for further rate rises

Richmond and Boston heads say the Fed should reach inflation target in 2017

J Dewey Daane, 1918–2016

Former Fed governor and adviser to the International Monetary Fund played key role in founding of the Central Bank of Paraguay

Fed could raise rates faster than anticipated, minutes show

Prospect of undershooting the longer-run employment target has increased, the FOMC reports, but expansionary fiscal policies should improve growth prospects

New data sheds light on policy spillover channels – BIS paper

Expanded data published by the BIS show how US dollar, euro and yen affect cross-border lending flows

US card fraud higher than in countries with chip technology – Fed study

Study finds card transactions are on the rise but cheques still important; limited adoption of chip technology seems to be contributing to fraud

2016: The year in review

The past year was characterised by dramatic political events, and central banks did not always manage to stay above the fray; we look back at some of the biggest stories

Yellen underlines the importance of education for the economy

Globalisation and technology are driving the demand for educated workers, Fed chair says, emphasising the important role education has to play in the evolving US economy

US and EU outline final rules on loss-absorbency

Fed adopts final rule on loss-absorbency, while EBA makes final recommendations to European Commission; US rules include grandfathering and exceptions for foreign firms