Federal Reserve System

Disjointed regulation could spell end of global banking era

Report says global banks must move faster with reform if their global operations are to weather the 'balkanisation' of financial markets caused by mismatching regulation between jurisdictions

FOMC members saw QE continuing ‘through midyear’ at March meeting

Participants at the FOMC’s last meeting broadly agreed to continue QE at existing pace ‘through midyear’ but failed to reach a consensus on when to slow asset purchases

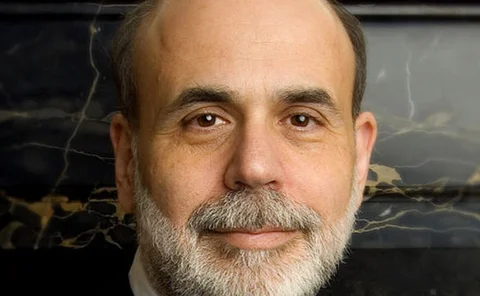

Bernanke says Fed stress tests were a ‘critical turning point’ in crisis

Fed chair says stress tests offer macro-prudential dimension to supervision; US banks have more tier 1 common equity under a severe stress scenario than they did in reality in 2008

Fed tightens rules for retail forex banking

Federal Reserve publishes final rules for banks engaging in foreign exchange transactions with retail customers; includes requirements for risk disclosures, good conduct, capitalisation and margining

US non-farm payroll stats strengthen case for more QE

Boston Fed president joins calls to continue QE programme as US employment recovery falters

Yellen calls quantitative thresholds a ‘major improvement’ in forward guidance

Federal Reserve vice-chair justifies move to unemployment-based guidance; says clear ‘exit principles’ are important for ending quantitative easing safely

San Francisco Fed president predicts mid-year asset purchase slowdown

John Williams says economy has shifted into ‘higher gear’ and a substantial labour market improvement could trigger decline in asset purchases

Fed doves disagree over FOMC's next move

Boston Fed’s Rosengren sees scope to continue asset purchases at current rate throughout 2013; Cleveland Fed’s Pianalto wants to slow programme down if labour market improvements hold

McKinnon says Fed must raise rates to stimulate growth and employment

Leading academic says positive real interest rates are the only way out of a credit crunch that's holding back lending to the productive economy

Fed ‘stimulus’ chokes indirect finance to SMEs

Low interest rates in the US are crowding out indirect finance to SMEs and distorting financial markets generally. The Fed needs to act by raising rates to 2%, argues Ronald McKinnon

Fed working paper measures FOMC comms effect against theory of UIP

Paper finds 'little evidence' for a changed relationship between FOMC announcements and US interest rates since the 'onset of the zero lower bound'

US agencies clamp down on leveraged lending

Fed, FDIC and OCC issue updated standards for leveraged lenders amid concerns standards are again slipping and many institutions have ‘proven less than satisfactory’ in risk management practices

Fed pays $88bn in profits to US Treasury

Federal Reserve makes large profit on securities holdings in 2012; follows warnings from Ben Bernanke and Fed researchers that remittances are not likely to remain elevated

BoJ changes represent the death knell for central bank independence

The growing policy crisis caused by central banks taking on roles beyond price stability and lender of last resort is not down to 'independence' – as the BoJ case points out

Fed stress tests reveal potential for losses of $460 billion

Stress tests show banks would suffer heavy losses if another financial crisis hits, with some hovering very close to the US Federal Reserve’s minimum core capital requirements – and one falling below

Fed’s Beige Book optimistic on labour market

Economic expansion still ‘modest or moderate’ in most Federal Reserve districts; labour market conditions improving but hiring is restrained

Philadelphia Fed president demands end to QE

Charles Plosser says asset purchases should be phased out gradually and halted before the end of the year; ‘meagre benefits’ are outweighed by threat to price stability

Top US regulators restless over too-big-to-fail

Fed’s Jerome Powell and FDIC’s Martin Gruenberg stress the need for ongoing progress in bid to eliminate ‘too-big-to-fail’ problem

Bernanke evaluates long-term interest rates

Federal Reserve chair Ben Bernanke expects long-term interest rates to rise gradually; says upside and downside risks to rate level are 'roughly symmetric'

Yellen says monetary easing needed to support labour market

Federal Reserve vice-chair says labour market should take centre stage in Fed’s monetary policy; does not believe asset purchases are threatening financial stability

Stockton’s Bank of England review offers forecasting lessons for central banks

The Stockton review of the Monetary Policy Committee at the Bank of England offers valuable lessons for central bankers and economists around the world.

Deutsche Bundesbank’s losing struggle in European integration battle

The Deutsche Bundesbank was once the cornerstone of European monetary stability but has become little more than a bargaining chip for politicians negotiating European integration.

State Bank of Vietnam needs a single mandate not independence

Lessons from South Korea, Japan and the US indicate a single mandate would benefit the State Bank of Vietnam more than an IMF call for legal independence.

Bernanke commits to continuing asset purchases

Fed chairman says benefits of ongoing monetary policy stimulus are clear; urges US government to delay bulk of impending spending cuts