Federal Reserve System

BoJ’s Shirai says Japanese forward guidance is different from BoE and Fed's

Sayuri Shirai emphasises differences between Bank of Japan’s forward guidance and that employed by the Fed and Bank of England; refutes BoE claim that BoJ’s guidance is ‘open-ended’

Rajan unveils rate hike - and cut - as QE lingers on

RBI raises repo rate but cuts MSF rate as focus shifts from defending the rupee to keeping inflation in check; Rajan warns Fed taper ‘only postponed'

US fiscal stance is creating inflation, says Riksbank paper

Researchers show the existing unsustainable levels of US federal debt are generating inflationary pressures, but these are difficult to spot as they are being dwarfed by Fed policy and economic slack

IMF's Lagarde backs Fed over asset purchases

The IMF’s managing director believes the Fed should take a 'gradual' approach to reversing its asset purchases and rate cuts; stresses the importance of unemployment figures

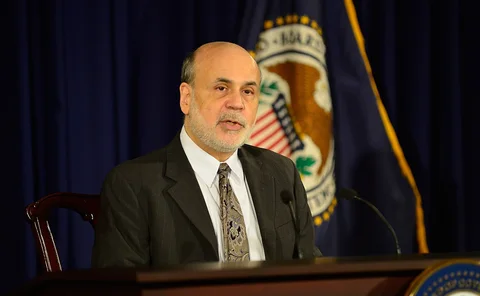

Bernanke defends Fed communication after QE surprise

Ben Bernanke says FOMC communication in June was justified as Fed shocks markets by ploughing on with asset purchases; economists question why markets were focused on September meeting

Panellists hit out at Fed’s forward guidance in CBP debate

Federal Reserve gets mixed scorecard for its extraordinary monetary policy and communication performance, according to panellists in Central Banking On Air debate

Publishing minutes is vital for central bank comms, say markets

Market participant survey gives Fed highest score for policy and communication in the wake of the financial crisis; ECB scores worse in the absence of published minutes

A sad ending to Summers versus Yellen

The politicisation of the debate over who should be the next chair of the Federal Reserve may be a sign of the times, but it is a sad day for central banking, argues Thomas Cargill

Summers drops out of race for Fed chair

Larry Summers writes to Barack Obama to withdraw his name from consideration as the next chairman of the Federal Reserve, citing likely 'acrimonious' confirmation hearings

Dallas Fed highlights transformation of FOMC statements over past 20 years

Before 1994, markets were left in the dark over interest rate changes; statements have expanded seven-fold in the past 20 years, reflecting the evolution of monetary policy operations

Regional Fed presidents stand their ground on MMFs

Presidents of the regional Federal Reserve banks push the Securities and Exchange Commission to impose more stringent reforms on money market funds including requiring a floating net asset value

Regional Feds launch push for faster payments

The 12 Federal Reserve regional banks outline a broad 10-year plan for generating a faster, more efficient payment system; look to industry for specifics

Bank of Mexico deputy welcomes QE taper

Manuel Sánchez singles out downshift in yield curves pushing domestic interest rates for different maturities to all-time lows as the biggest effect of lax monetary conditions on emerging economies

San Francisco Fed president warns asset price bubbles are ‘here to stay’

John Williams discredits economic theory on asset price movements; says bubbles are inflated predominantly by expectations of future price increases

US jobs data disappoint raising doubts over September taper

Unemployment fell to 7.3% in August, but modest improvement in jobs data eclipsed by big negative revisions of June and July figures; analysts split over how numbers affect Fed's decision to taper QE

FOMC policy rate guidance pushes up US equity prices

Netherlands Bank research paper finds policy rate guidance also leads to significant reduction in implied volatility for US government bonds

Fed minutes ‘significantly affect’ US asset prices

New York Fed economic policy review finds that US asset price volatility increases when the Fed releases minutes from policy meetings, but less so since FOMC has become more transparent

Fed presidents opposed as September meeting nears

John Williams backs reducing asset purchases ‘later this year’ while Narayana Kocherlakota says the Fed should be providing ‘more stimulus… not less’

Implicit government guarantees leads to increased risk-taking at banks

Fed discussion paper argues that strengthening market discipline by reducing bank complexity is needed to address moral hazard

BIS economists find Fed's QE helps curb tail risk perception

Paper published today finds the effect of the Fed's announcing unconventional monetary policy measures is strongest when used in conjunction with forward guidance on low interest rates

Central banks are getting more transparent, study finds

Study conducted by Barry Eichengreen and Nergiz Dincer finds trend towards greater transparency was not knocked off course by the financial crisis; independence, however, is more patchy

Sovereign default spreads drove European bank risk exposures during crisis

Systemic risk of European banks reached its height in late 2011 at around €500 billion, based on a measure introduced in a recent Fed working paper

Fed struggles with same issues as 100 years ago, says Lacker

There has been a debate over which assets the Fed should hold since its founding in 1913, Richmond Fed president Jeffrey Lacker says

Summers trails Yellen and Fischer in Central Banking Fed poll

Readers of CentralBanking.com make Janet Yellen first choice to succeed Ben Bernanke as Fed chair - with Stanley Fischer a strong second; Larry Summers joint third with Christina Romer