Bank for International Settlements (BIS)

Bank of Thailand names digital currency partners

Central bank says first phase of ‘Project Inthanon’ should be completed by first quarter of 2019

The perilous road to normality

Many central banks are starting to tighten policy, but their room for error is limited and their final destination unclear. What more can they do?

BIS paper links Japan’s household debt to consumption behaviour

The researcher examines how Japanese household debt affects marginal propensity to consume

Capitalising on regtech

Regulatory technology could prove effective in improving data reporting and supervisory monitoring, but central banks have a long way to go to making this a reality, writes Joel Clark.

US dollar credit to emerging markets growing faster, reveals BIS data

Growth in dollar-denominated debts up 9%, with growth in debt securities even faster

BIS paper compares current Asian vulnerabilities with 1997 crisis

Global banking statistics could have given warning signals ahead of Asian crisis, authors say

FSI paper urges supervisors to develop ‘suptech strategy’

Supervisors are well placed to benefit from technology but need a clear plan, says the paper from Basel’s FSI

FSB launches crypto asset monitoring framework

Metrics will focus on the financial stability risk of crypto market; much of the data will be pulled from public sources

‘Low for long’ endangers stability, warns BIS committee

Some banks could face solvency issues if faced with a “snapback”, warns Philip Lowe

Book notes: China’s Great Wall of Debt, by Dinny McMahon

McMahon is too pessimistic about the chances of China managing to get its great wall of debt under control, writes Michael Taylor, but he is undoubtedly right about the scale of the challenge

BIS paper outlines lower-bound risk model

Model estimates probability of hitting ELB, helping to guide policy

People: BIS appoints RBA’s Lowe to succeed Dudley on financial system committee

Lowe will chair committee charged with financial stability; IMF gets new media chief; and more

Carstens pushes for greater transparency from BIS

New general manager says greater transparency will improve dialogue with central banks

BIS sees ‘narrow’ path to safety as global risks build

BIS softens message on tighter monetary policy, but calls for concerted action as global debt reaches fresh highs

Fed policy’s global effects differ in booms and busts – BIS paper

Monetary policy appears to impact global bank lending differently depending on the “regime”

BIS calls for ‘redrawing of regulatory boundaries’ around crypto

Regulation will have to adapt to a “new reality”, BIS says, suggesting new ways the underlying technology could be applied to improve financial efficiency

BIS authors document ‘significant’ shifts in CDS risks

Credit default swaps market has changed “markedly” since 2008, authors say

Have central banks created a ‘debt trap’? No, but ...

Tougher regulation has helped ensure extraordinary monetary policy has not caused a dangerous rise in private debt

HKMA has no plans to launch digital currency - Treasury official

Hong Kong’s efficient payment infrastructure lessens incentive to go digital, official says

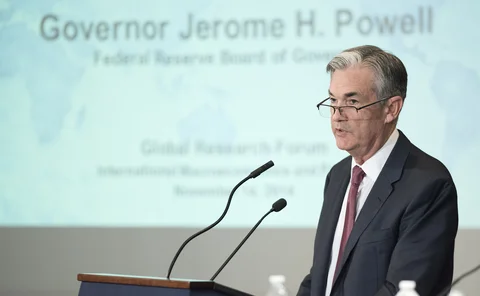

Powell says central banks cannot take independence for granted

Leading governors reflect on the future of central banking at Riksbank’s 350th anniversary

Small depositors do not pose greater run risk – BIS paper

Authors say their findings imply financial inclusion need not create instability

People: Weidmann re-elected as chair of BIS board

Korea appoints deputies; new Malaysian prime minister appoints team of economic advisers; new vice presidents in Richmond and Atlanta

CPMI puts forward strategy to tackle wholesale payments fraud

The Federal Reserve and the ECB welcome the proposal

The hunt for a crypto taxonomy

Cryptocurrency, crypto asset, crypto token – or something else? Finding the right term helps shed light on the structure of the fast-growing crypto market