News

Fed’s Kohn rejects bubble claims

Fed deputy acknowledges carry trade but dismisses fears low rates are stoking asset-price bubbles

Oman signs up to new FX, payments system

Central Bank of Oman’s move represents part of a broader trend by emerging-market central banks to refine operational systems

Shirakawa cautions on carry trade

Bank of Japan’s governor becomes latest official to warn on dangers of low rates in advanced economies; notes balance-sheet adjustments will impact efficacy of monetary policy

UK regulator to be allowed to “tear up” bankers’ contracts

Britain’s financial regulator will have its powers increased, allowing it to punish errant banks and bankers for excessive risk-taking

Bank’s Tucker details root-and-branch reform proposals

Bank of England’s Paul Tucker outlines reforms necessary to curb systemic risk build-up

US policy threatens emerging markets: China’s top regulator

Chairman of China’s regulator says weak dollar and low rates are dangerous to the global economy; echoes recent comments from top Japan, HK officials

Spain’s Ordóñez plays down dynamic provisioning

Bank of Spain’s governor modest on much-vaunted regulatory tool

India announces payments overhaul

Root-and-branch reform will see Reserve Bank of India investigate the introduction of a new RTGS system, a domestic card initiative and mobile payments settlement

HK’s Tsang fears the Fed

Hong Kong’s chief executive says Federal Reserve is stoking next bubble through near-zero interest rates

Canada’s Longworth set to leave

Bank of Canada’s David Longworth announces retirement two weeks after senior deputy Paul Jenkins

Lisbon considering Constancio nomination for ECB VP

Senior lawmaker says other eurozone members receptive to the idea of Portugal’s governor succeeding Papademos next year

Fed bans ATM, debit-card overdraft fees

Federal Reserve says banks will no longer be able to charge overdraft fees for ATM and debit-card payments

Rules must cover link between liquidity and default: Goodhart, Tsomocos

Interrelationship between liquidity and defaults must be addressed by regulatory proposals

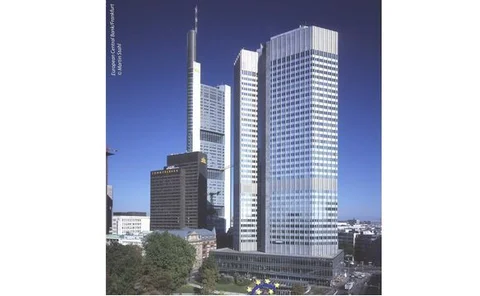

ECB publishes inaugural payments oversight report

European Central Bank reports on robustness of payments systems to increase transparency and public understanding

BIS data show rebound in OTC derivatives

Notional amount of OTC derivatives trades rises by 10% in six months to June after fall in final half of last year

China to keep policy “moderately loose”; hint at yuan appreciation

People’s Bank of China to maintain accommodative policy stance, suggests renminbi appreciation could be possible

Draghi calls for unity to back “major” changes

Financial Stability Board’s Mario Draghi says regulators from across the globe must co-operate to create a world in which no bank becomes too big to fail

Korea holds rates for ninth month

Bank of Korea keeps its base rate unchanged, citing resurgence in domestic economic activity

QE working, but growth levels to remain anaemic: Bank

Bank of England confident quantitative easing having some impact; more bullish on growth but stresses slack is set to stay until beyond forecast period

Senator calls for Fed’s powers to be cut

Chris Dodd, head of the Senate Banking Committee, submits bill demanding reduction in Fed’s supervisory ambit; calls for one overall regulator

Czechs set fixed time for policy announcements

The Czech National Bank will announce monetary policy decisions at 1 p.m. starting next February

King says credit easing not for central banks

Bank of England governor counters calls to target specific markets and industries through quantitative easing, says this is the responsibility of governments

ECB appoints new directors general

The ECB names new heads for information systems and human resources

Fed presidents focus on commercial property fears

Atlanta and San Francisco Federal Reserve chiefs echo William Dudley’s warning on commercial real estate