News

Lehman crisis could have been averted with Dodd-Frank: FDIC

Federal Deposit Insurance Corporation report says orderly resolution powers in Dodd-Frank Act could have allowed for orderly wind-down of failed investment bank Lehman Brothers

Officials gather in DC for IMF/World Bank spring meet

IMF/World Bank spring meetings address global economy and financial stability, governance progress and Japanese disaster

Ireland’s central bank failed to alert regulators to mounting crisis: banking report

Ireland’s Commission of Investigation into banking crisis says Central Bank of Ireland missed opportunities to alert regulators to impending risks in banking sector

Denmark hires assistant governor, promotes two department heads

Jens Lundager returns to central bank as assistant governor and head of financial markets; Karsten Biltoft and Frank Nielsen promoted to director level

Nine securities regulators to join Iosco

International Organisation of Securities Commissions (Iosco) announces nine regulatory authorities have been invited to join

Asian Development Bank chief wants another term

Haruhiko Kuroda, the president of the Asian Development Bank, intends to run for re-election

Brazil slams IMF proposal on capital controls

Brazil’s finance minister Guido Mantega rejects IMF proposals for establishment of framework on capital controls; attacks Fund’s laissez-faire policy on capital movements

Standard & Poor’s changes US outlook to negative

Rating agency cites growing deficit and debt as rationale behind the change

China agrees $3.83 billion currency swap with New Zealand

People’s Bank of China and Reserve Bank of New Zealand sign $3.83 billion currency swap deal to further facilitate renminbi trade

South Africa’s chief banking regulator to retire early

South African Reserve Bank’s Errol Kruger to leave in the summer

China raises banks' required reserves again

China hikes reserve requirements once more; from April 21 banks must retain 20.5%

G-20 agrees guidelines to identify imbalances

G-20 representatives move forward with plans to establish guidelines to measure economic imbalances

Greek budget cuts raise default concerns

Markets prepare for the worst as Athens unveils new tougher austerity measures; IMF managing director Dominique Strauss-Kahn says cuts are necessary

Turkey appoints new governor

Turkish President Abdullah Gül approves government motion to appoint deputy governor Erdem Basci as head of central bank

Stress tests motivate Moody’s Ireland downgrade

Moody’s downgrades Ireland two notches to Baa3 after stress tests force Irish government to allocate additional funds to banks

China economy booms as inflation soars

National Bureau of Statistics of China reveals economic growth of 9.7%; inflation reaches three-year high

Russia launches Olympic coins

Bank of Russia launches Sochi 2014 coin series to “promote Olympic values in Russia and abroad”

Banks caught in ‘maelstrom of interlinked pressures’: IMF

IMF’s Global Financial Stability Report slams progress made by banking system reforms; calls for higher quality and quantity capital in Europe

Bank’s Fisher optimistic on winding down crisis facilities

Bank of England executive director of markets Paul Fisher says recent progress in markets reinforced decision to end special liquidity scheme next year

Fed Beige Book reveals concern over impact of Japanese tragedy

Federal Reserve releases Beige Book; shows improved economic activity across the US but concern over impact of tragedy in Japan

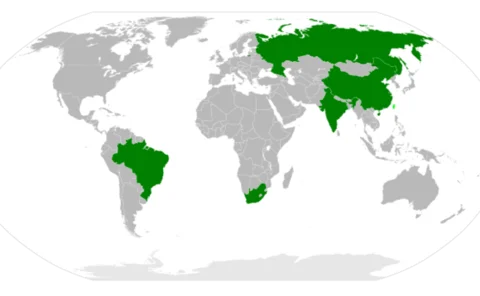

Brics demand "broad-based" international reserve currency system

Leaders of the five fast-growing emerging economies support reform and improvement of international monetary system; want a stable, reliable and broad-based international reserve currency system

Non-US sovereigns should collateralise swaps, say US bank regulators

Progress towards sovereign collateral posting has been slow. Now, US regulators are proposing to make it mandatory - for all non-US entities

Central bank reserve managers recoil at sovereign risk

Central Banking Publications survey finds fears over sovereign risk led reserve managers to limit or cut exposure to “peripheral” European countries; impact also felt in attitudes towards the euro

Slovakia closes four sub-branches of national bank

National Bank of Slovakia decides to close four of its nine sub-branches; study reveals cash circulation could be better managed with fewer branches