News

Central banks weigh use of OTC clearing houses

Survey finds nearly 40% of central banks are considering clearing their OTC derivatives

Zimbabwean governor attempts to stem panic as StanChart faces closure

Gideon Gono tells depositors not to withdraw their savings following a government announcement that Standard Chartered will be shut down for non-compliance with indigenisation laws

EU and OECD say weak supervision shares blame for Slovenia's impending bank crisis

European Commission follows OECD in highlighting Slovenia's 'excessive imbalances'; both bodies call for improved supervision from the central bank

Palestine Monetary Authority finds greater parity between West Bank and Gaza territories

Palestinian central bank develops business-cycle indicator to assess economic performance in real time; finds gap in performance between two territories is shrinking

FDIC vice-chair says Basel III capital requirements provide illusion of safety

Thomas Hoenig says capital ratios allow banks to leverage up while outwardly appearing safe; warns systemically important banks have much worse leverage ratios than smaller institutions

IMF says independent central banks have ‘muzzled’ the inflation threat

World Economic Outlook says central banks have little reason to fear inflation resulting from loose policy – so long as their independence is upheld

FOMC members saw QE continuing ‘through midyear’ at March meeting

Participants at the FOMC’s last meeting broadly agreed to continue QE at existing pace ‘through midyear’ but failed to reach a consensus on when to slow asset purchases

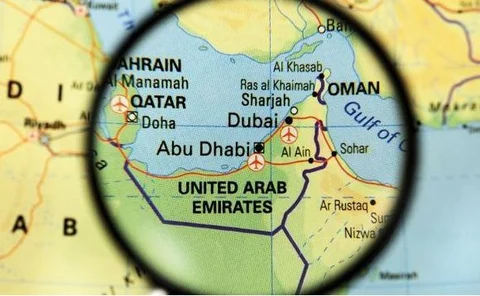

Emirates central bank to introduce direct debit system

Central Bank of UAE to bring in direct debit system to allow payment in instalments without the need for post-dated cheques

Norwegian authorities chase benchmark rate reform

Financial Supervisory Authority of Norway proposes new framework for Norwegian Interbank Offered Rate-setting process; central bank looks to push envelope further

Bernanke says Fed stress tests were a ‘critical turning point’ in crisis

Fed chair says stress tests offer macro-prudential dimension to supervision; US banks have more tier 1 common equity under a severe stress scenario than they did in reality in 2008

Sarb’s head of financial stability fears new powers may cause conflict

Hendrik Nel says the Reserve Bank was not given much choice but to accept new supervisory powers; warns of conflict with monetary policy and possible threat to independence

Ireland’s financial regulator quits central bank

Deputy governor for financial regulation announces departure to ‘pursue other interests’; term spanned turbulent period for Ireland’s economy

Cyprus deputy sacked after two months

President revokes contract of central bank’s first ever deputy governor, whose ethnic Greek heritage made his appointment unconstitutional

FSB to assess efforts to end ‘mechanistic reliance’ on credit ratings

Peer reviews aim to hasten a move away from rating agencies, with countries expected to eliminate references to credit ratings from laws and encourage better internal credit risk assessments

Hungarian deputy governor resigns over new central bank regime

Last remaining deputy from the previous regime cites lack of professional debate and 'Potemkin' approach to stimulating growth

IMF and Sarb push for stronger systemic supervision in Africa

Joint effort to highlight importance of macro-prudential approach in addition to scrutiny of individual institutions; IMF pushing for tighter supervision

Lagarde fears ‘unintended consequences’ of monetary easing

IMF managing director fears side effects from low interest rates and asset purchases; says there is a limit to the share of the burden of recovery that monetary policy can take

Asean pioneers lay foundation for economic union with capital markets move

Thailand, Malaysia and Singapore press ahead with capital markets integration in bid to jump-start Asian Economic Community

Reserve managers expanding into riskier assets, survey finds

Latest Reserve Management Trends reveal central banks are moving into ‘non-traditional' currencies; growing number of reserve managers investing, or considering investing, in equities

Fed tightens rules for retail forex banking

Federal Reserve publishes final rules for banks engaging in foreign exchange transactions with retail customers; includes requirements for risk disclosures, good conduct, capitalisation and margining

US non-farm payroll stats strengthen case for more QE

Boston Fed president joins calls to continue QE programme as US employment recovery falters

Bank of Spain reshapes supervisor to meet new demands

Banking supervision directorate restructured to meet the requirements of Spain’s memorandum of understanding and the move to European banking union

ECB on collision course with European Parliament over top supervisory appointments

Yves Mersch fears EP veto over supervisory board heads will 'institutionalise conflict' between the ECB and EP, and contravene the Maastricht Treaty

BoE chief economist says QE impact will vary, but not diminish, over time

Spencer Dale says effects of asset purchases depend on the time and place they are conducted; Bank of Japan’s shocking policy announcement may have been necessary to correct misperceptions