Central Banks

Sudan central bank again pledges new banknotes as crisis continues

Rising prices fuel violence in capital as governor says he will seek foreign funds

BoE paper studies CoCo effects in ‘one-shot game’

Game theoretic approach suggests CoCos cut risk-taking in certain circumstances

Riksbank’s negative rates successfully passed through to economy – research

Findings contrast with recent work by Larry Summers and co-authors

RBI governor: India must ‘brace’ for global turbulence

Shaktikanta Das stresses need to stay firm on banks’ asset quality, despite earlier leniency

New chairman takes over at Bermuda Monetary Authority

Gerald Simons retires after six years in the post; chief executive now holds both senior posts

Paper proposes ‘re-engineering’ US statistics

System for compiling statistics is dated and overly complex, authors say

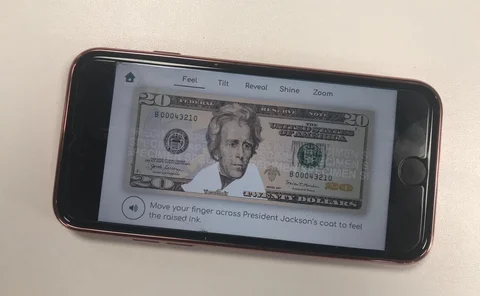

Fed launches banknote app for children

App provides details of security features, mimicking raised intaglio print through vibrations

Irish government nominates Philip Lane as next ECB chief economist

European governments have turned down two Irish nominations for senior ECB roles in last year

IMF expects global growth to slow further in 2019

“Significantly higher” and “increasingly intertwined” risks weigh on global growth, Lagarde says

Brexit unlikely to affect sterling’s reserve currency status

No-deal scenario could put major downward pressure on the currency

People: Albania appoints new deputy governor

Luljeta Minxhozi joins Bank of Albania; Netherlands Bank loses chief investment officer; Chile appoints first technology manager; and more

Innovation prompts firms to hold more cash – IMF paper

Firms must hold enough liquidity to insure against risky research and development

Establishing the Fed worsened the Great Depression – St Louis Fed paper

Setting up lender of last resort reduced banks’ incentive to manage risk, paper argues

Nigerian central bank to set up national micro-lender

Leading presidential candidate says he will not give governor a second term

Brexit might allow simpler regulation for small UK firms – PRA chief

Sam Woods says “simpler, not weaker” regulation might boost both competition and safety

BoJ must normalise policy to cope with ageing population – former official

Japanese firms face labour shortages and limited ability to raise prices- Shirai

Turkish central bank makes early payout to government

Extraordinary general meeting sees CBRT agree to similar actions in future