Central Banks

Podcast: Payment networks of the future

Liz Oakes (Mastercard) and Somya Patnaik (ACI Worldwide) discuss how central banks can ensure consumers get the most out of new payment infrastructure

Weidmann to step down as Bundesbank president

After over 10 years leading the German central bank, Weidmann will leave for “personal reasons”

Kenya’s banks told to prepare climate risk plans by 2022

Central bank publishes guidance urging banks to integrate climate risk into broader risk management

Iranian court sentences former governor to 10 years in prison

Valiollah Seif convicted of currency offences, but reportedly remains free pending appeal

Gita Gopinath to leave IMF

Fund’s first female chief economist is set to return to Harvard

Forecaster surveys improve eurozone inflation modelling – ECB paper

Households’ and firms’ expectations do not provide useful data on inflation

Delta variant had smaller impact on US consumer spending

Cleveland Fed finds weaker or no link between hospitalisation and spending in 2021

Securities lending prevalent in European central banks

Monetary policy, market maturity and currency variation may limit adoption in other regions

ECB paper examines ‘euroised’ economies

European countries’ informal adoption of euro places limits on central banks, says working paper

BoE launches ‘exploratory’ CCP stress test

Central bank will test credit and liquidity exposures, and will also conduct “reverse stress tests”

National income not only determinant of reserve management staff numbers

Salaries ranged between $11,968–$138,768 among benchmark participants

PBoC suffers headaches from growth, energy and Evergrande

Yi Gang mulls property sector risks, as China’s growth hits one-year low

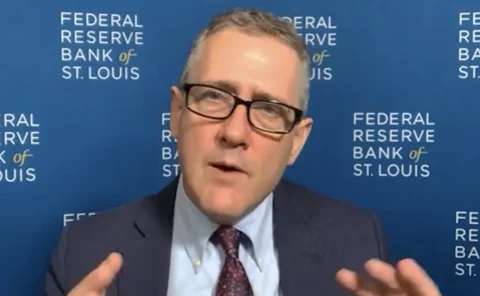

Fed’s Bullard believes a ‘five-year window’ for AIT is ‘realistic’

St Louis Fed president says “big tent language” was a reason overshoot details were not specified; “precise numerical implementations” can “get you into trouble”

Hiking rates before asset sales may constrict credit – paper

Kansas City Fed research says raising the fed funds rate first may cause yield curve inversion

Payments Benchmarks 2021 – presentation

Central Banking’s payments subject matter specialist Rachael King speaks with Christopher Jeffery about payments, staffing and salaries, mandates, oversight, and RTGS renewal

Most central banks invest in derivatives

External managers facilitate wider use of these instruments

Permanent or transitory? Officials wrestle with inflation uncertainty

Bailey warns of possible damage to credibility, but Carstens urges caution amid high uncertainty

People: FCA chair steps down; Esma chair steps up

UK FCA chairman to depart; Verena Ross to chair Esma; new boards for Ecuador’s central bank

Dallas Fed predicts 2022 core inflation above 2%

Economists expect auto and transportation costs to abate, but spike in housing prices

IMFC backs new trust to channel resources to vulnerable economies

Resilience and Sustainability Trust would offer support to a wider set of countries and could be used to share out special drawing rights

James Bullard on Fed policy, action and governance

St Louis president calls for tapering amid “exceptional” job market and risk of “more persistent” inflation, quantifies ‘big tent language’ for pioneering AIT move, and details Congress’s role in Fed ethics oversight