Financial Stability

Canadian astronaut launches polymer banknotes

Former commander of the International Space Station marks the new $5 and $10 banknotes entering into circulation; senior deputy governor Tiff Macklem insists there is 'no chance' they will melt

ECB says no treaty change needed for SRM

Central bank pushes for introduction of ‘lawful' SRM by 2015; warns delay of bail-in tool may undermine resolution efforts by creating regulatory inconsistency and uncertainty

Italian interbank market kept working through crisis

A study of interbank lending in Italy from 2007-2011 finds the hypothesis of liquidity hoarding in times of crisis did not apply in the instance examined

Danish authorities tackle mortgage bond refi risk

Lars Rohde hails a new bill forged by the central bank and the government as the solution to the ‘excessive refinancing risk’ in Denmark’s mortgage bond market

Bank of Slovenia lifts lid on bank health checks

The 10 banks under investigation will be subjected to asset quality reviews and bottom-up stress tests; results will be challenged by an outside consultancy

BoE's Kohn stresses predictable nature of FPC ‘knockout'

Financial Policy Committee member Donald Kohn tells Oxford audience the Bank of England's new macro-prudential powers should allow monetary policy to act more effectively

RBI tries to persuade foreign banks to put down roots

Revamped framework unveiled by India's central bank yesterday will make it easier for foreign lenders currently operating through branches to set up wholly owned subsidiaries in the country

BoE and FDIC campaign for end to ‘early termination’ of derivatives contracts

International authorities want a ‘short-term suspension’ of the rights that allow derivatives contracts to be terminated ahead of schedule when a major financial institution is being resolved

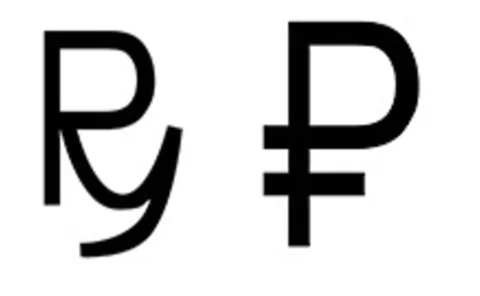

Russians vote to choose new rouble symbol

Central Bank of Russia says more than 102,000 people voted in the first day of its online poll to choose a symbol to represent the nation's currency; voting is open until December 5

Constâncio insists private sector will play ‘major’ role in filling capital shortfalls

The ECB’s vice-president says banks will be able to fill any capital holes turned up in the central bank’s comprehensive assessment at least partly through private funds

ECB faces parliamentary grilling on Troika track record

Senior managers from European Central Bank and European Commission defend the accountability and forecasting track record of the Troika in European Parliament hearing

Bank of England waging payment system war on three fronts

Chief cashier Chris Salmon says the central bank must contend with issues relating to cyber security, user access and new regulation within the UK payments infrastructure

ECB’s Asmussen urges Denmark and Sweden to sit at banking union table

Jörg Asmussen says the single supervisory mechanism will be the envy of those outside the eurozone; tells Denmark and Sweden they will get more of a say if they have ‘a chair at the table’ now

Federal Reserve reveals new, tougher stress tests

Details of stress tests for 2014 include scenario based on severe global recession, with some banks facing additional criteria; tests will be applied to 12 more banks than before

BoE official calls for greater transparency on CCP margin modelling

Central counterparties should compete on quality of risk management, rather than a race to the bottom on margins, says Bank of England's head of payments and infrastructure

Cypriot commission criticises ‘cumbersome’ managerial structure at central bank

Independent commission wants to see more power handed to the executive and non-executive directors at the Central Bank of Cyprus; says senior management dropped the ball on financial stability

Thailand’s Prasarn highlights ‘dramatic’ turnaround caused by Fed taper-talk

Embattled emerging market central banks trying to resist capital inflows suddenly had the opposite problem as Fed hinted at QE taper, but some may have tightened too fast, says Thai governor

Tax relief for debt finance helps banks and non-banks, IMF paper finds

There is no significant difference in corporate tax bias towards debt finance between banks and non-banks, according to IMF working paper; Size and leverage levels of firms matter

Norges Bank governor heralds countercyclical capital buffer

Øystein Olsen says 'primary purpose' of prudential tool is increasing banks' resilience as systemic risk increases; buffer will vary between zero and 2.5% of risk-weighted assets

Leading central banks make emergency swap lines permanent

Six leading central banks are leaving bilateral swap agreements introduced during the financial crisis in place until further notice; US dollar liquidity-providing operations will continue as normal

Swiss researchers sceptical about advanced settlement algorithms

SNB working paper says overhauling the algorithms used in the Swiss Interbank Clearing system would produce an ‘economically irrelevant’ reduction in settlement delay and ‘low’ cost savings

Portugal governor: banks are stronger now than pre-crisis

Bank of Portugal's Carlos da Silva Costa argues stringent capital requirements 'well above the EU 8% benchmark' are starting to pay off; banks' average loan-to-deposit ratio was 123% in June

Bank of Spain's Linde touts comeback of local banks

Governor says lenders' solvency position has improved noticeably from a year ago; highlights 'drastic reduction' in toxic assets on banks' balance sheet

RBI paper finds Indian banks were not spared by financial crisis

Working paper says that despite the global financial crisis being concentrated in advanced economies, weaker Indian banks saw their margins ‘impaired significantly’