Financial Stability

Angolan central bank looks to boost BESA capital by $4.3 billion

National bank of Angola sets out plans to recapitalise BESA; Novo Banco will get a 9.9% stake in the bank and receive $850 million over ten years in restructuring deal

Dollar and renminbi can coexist as global currencies, Eichengreen says

Bank of Korea paper finds that ‘networks are open and several international currencies can coexist’, suggesting the dollar and the renminbi will share the role in the future

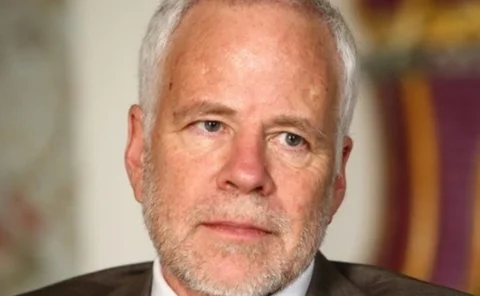

Robert Pringle’s Viewpoint: Stanley Fischer responds to the Fed’s foreign critics

The Federal Reserve vice-chair rightly insists that each nation should each keep its house in order; but the global village needs to be kept tidy as well

Fears surface over lack of trust among resolution authorities

Countries still do not trust one another enough to cooperate fully during the resolution of a globally systemic bank, participants at Chatham House event warn

Carney launches review into RTGS failure

Independent review will look into ‘technical issue’ that knocked RTGS system out of operation yesterday, and consider the central bank’s response

Constâncio says ECB needs new tools to tackle shadow banking risks

Vice-president says central bank will need a broader arsenal to cope with risks in the shadow banking sector, suggesting the US and UK both have powers that could be useful

IMF paper examines causes of financial market spillovers

Research finds financial market spillovers are affected by ‘bilateral portfolio asset holdings, as well as a country’s geographical preferences’

Bank of England resumes settlement after 'technical issue’

UK’s high-value payment system was ‘paused’ for several hours today, but is now back up and running; central bank extends opening hours to deal with backlog

Philippines central bank raises minimum capital requirements

The Central Bank of the Philippines has raised banks’ minimum capital level while unveiling new credit risk management rules that limit the collateral value of real estate mortgages

European Commission approves central bank’s BES intervention

Bankruptcy would have led to losses up to €28 billion; European Commission says central bank decision is ‘compatible with the internal market for reasons of financial stability’

CPMI-Iosco report recommends tools for recovering FMIs

Report lays out toolkit for maintaining critical services and restoring stability in the event a financial market infrastructure comes close to collapse

Bank of Russia to offer $50 billion through new FX repos

Russian central bank unveils new measures to boost short-term foreign exchange liquidity in markets, and will offer $50 billion between now and the end of 2016

Danièle Nouy: Fed facing similar data challenges as ECB

The supervisory board chair delivers concluding remarks to the ECB conference on statistics; notes similarities between approach of Fed and European authorities to data problems

Riksbank economist warns on corporate bond market

Economist at the Swedish central bank says it will become ‘increasingly important’ to consider the impact of the corporate bond market on financial stability as it expands

Colombian paper analyses financial networks

Working paper finds central financial institutions ‘tend to overlap across financial networks, thus their systemic importance may be even greater than envisaged’ in alternate models

European Banking Authority unveils framework for classifying high-quality securitisations

Consultation proposes system for classifying securitisations that are ‘simple, standard and transparent’ and therefore may benefit from more lenient regulation

ECB conference tackles ‘reconciliation’ of statistics as central bank’s powers expand

Senior central bank officials from across Europe discuss the challenge of creating an integrated approach to statistics across monetary policy, financial stability and supervisory functions

Bank of Korea turns focus to stability threats after rate cut

Bank of Korea cuts rates to historic low, but shift in language indicates growing concerns over financial stability

FSB moves to tackle shadow-banking risks from SFTs

Final framework for setting haircuts on certain securities financing transactions seeks to control leverage outside the banking system and reduce procyclicality

Kuwaiti governor argues for credit ratings regulator

Mohammed Al-Hashel says rather than reducing reliance on credit ratings, he would like to see an independent institution established to ensure high-quality ratings

Eurozone shadow banks increase share of assets to 33%

Shadow-banking entities now own a third of the €57 trillion worth of assets in the eurozone financial system according to ECB report; expansion has ‘gathered pace’ since 2012

Top UK and US officials join forces to enhance resolution

Officials including Mark Carney and Janet Yellen meet in Washington to improve transatlantic cooperation in the event of a global banking collapse

PBoC and Bank of Russia establishes $24.5bn swap line

Bank of Russia says deal provides opportunity to obtain liquidity 'whenever required'; trade between the two countries has more than doubled since 2008