Economic modelling

Schnabel: ECB could replace central forecast scenario

ECB should consider using alternative scenarios and dot plots to convey uncertainty, official says

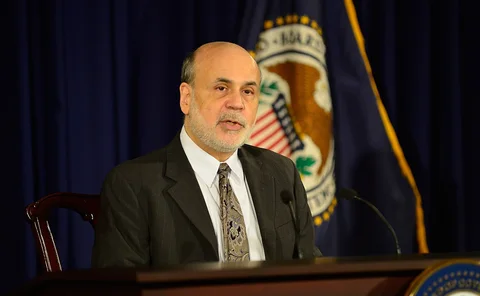

Taking stock of Bernanke: the original sin of forecasting

Jagjit Chadha says the Bernanke review of forecasting should be the start of a more profound discussion at the Bank of England

Bernanke calls for total redesign of BoE forecasting

Report calls for major changes to infrastructure, core models, staffing, communications and more

Bank of England: time for fourth-generation forecasting tools?

Economists suggest ways to improve BoE’s framework ahead of Bernanke’s report

ECB to explore nature-related risk in environmental plan

Climate change and biodegradation are “two sides of the same coin”

Bailey hints at possible outcome of Bernanke review

Bank of England may present range of scenarios around central forecast

Profit now key driver of inflation, BIS research finds

Recent surge in prices “fundamentally different” to that of the 1970s

Bank of Canada maps path to ‘fourth-generation’ models

Officials plan to create new workhorse model backed by variants focusing on key topics

Remittances to Mexico reach record high, says Dallas Fed

Researchers say strong US construction sector fuels funds transfers

FOMC members’ narratives add value to projections, finds paper

Both staff and FOMC members 'projections aid forecasting, refuting Romer and Romer

Canadian official says mortgage rates not big cause of inflation

Kozicki says taking home loans out would make only small dent in core reading

Colombian research offers advice on modelling Covid-19 shock

Pandemic is challenging to model due to its transitory impact, authors say

Jordan revamps forecast model with richer interactions

Jam2.0 adds a fiscal block and captures more complexities of central bank policy

Europe unlikely to see major gas shortage this winter – research

Risks remain if alternative sources of natural gas falter, says Fed economist

Focus is needed on improving central bank forecasts

Charles Goodhart believes tougher action over forecasting errors is preferable to policy-maker performance-related pay

Bernanke to lead BoE review of inflation forecasting

Former Federal Reserve chair will work with Bank of England officials

‘Supercore inflation’ is a key indicator, Fed paper argues

Non-housing core service prices behaved very differently in 2019 and 2021, researchers say

ECB’s monetary policy is taking effect rapidly, says Lane

But chief economist warns tighter financing conditions could cause eurozone contraction

Hank model sheds light on fiscal theory of the price level – paper

Adding heterogeneity allows FTPL models to reflect persistent government deficits, economists find

Central banks need short-run climate models – BdF governor

Governments may push central banks into ineffective climate action, Sarb governor warns

Hank model reveals monetary non-neutrality

Inequality and zero lower bound suggest monetary policy can impact long-term real rates

BoE adjusting main models after forecast misses

Bailey says policy-makers decided to “aim off” main forecast after repeated errors

Bank of Israel warns political turmoil could hit GDP

Central bank slows cycle with 25bp hike, raising key rate to 4.5%