Building back better

What challenges does the global economy face, and what significant changes and development opportunities could Covid-19 afford?

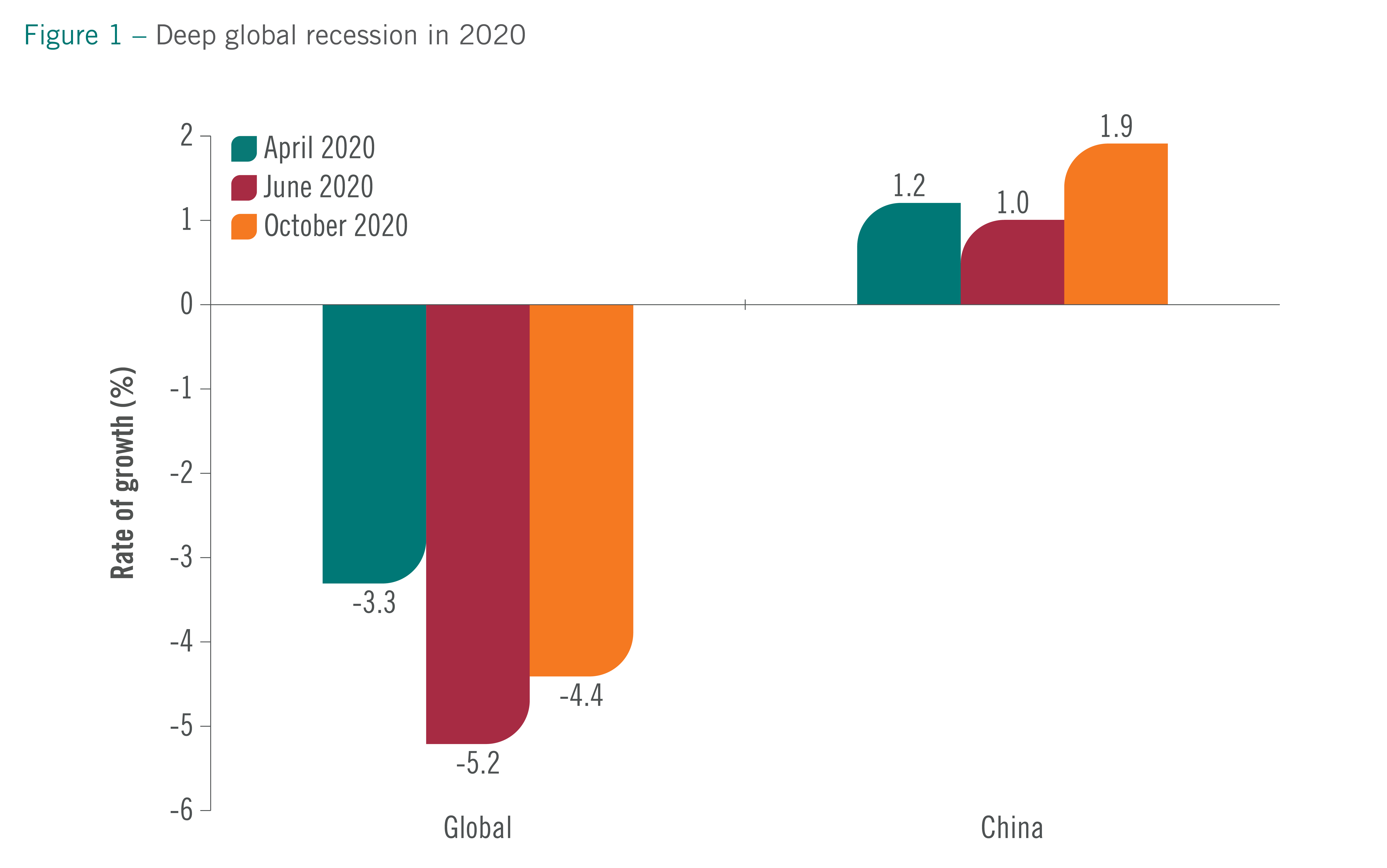

The Covid-19 pandemic hit 2020 hard, triggering the worst global recession since the Great Depression of the 1930s. How will the global economy now evolve? The outlook remains highly uncertain. According to the International Monetary Fund’s (IMF’s) October 2020 forecast, the global economy was estimated to contract 4.4% in 2020.

Developed economies were projected to shrink by 5.8%; emerging markets and developing countries, excluding China, by 5.7%; and the US economy and eurozone were forecast to contract by 4.3% and 8.3%, respectively. But if the pandemic can be brought under control, the global economy will pick up in 2021.

China was the only major economy capable of achieving positive growth in 2020, at an expected growth rate of 1.9% in 2020 and 8.2% in 2021. China has controlled the pandemic in an efficient and resolute manner, and adopted effective fiscal and monetary stimuli in the short term. These two factors contributed to China’s better-than-expected economic performance, which, by stabilising the global economy, benefits not only China but the world as a whole.

However, cases of Covid-19 are still on the rise in many countries, and so the global economy is still beset by significant uncertainties and downward pressure. These are mainly manifested in three ways.

Shocks around the corner

First, there will be a steep rise in economic vulnerability. The world’s public debt has hit an all-time high, equivalent to almost 100% of GDP. Many countries face growing debt risks. At the same time, corporate debt, default rates and the potential risk of bankruptcy are also climbing. Banks are now relatively well capitalised but, once the economic outlook worsens, banks could face more than US$200 billion of capital shortage.

Second, it will take time for the labour market to recover, and global employment is still far below the pre-pandemic level. According to a report from the International Labour Organization, global working hours decreased by 17% in the second quarter of 2020, equivalent to the loss of 495 million full-time jobs. As the labour market becomes even more divided, young people, women and those in low-income jobs are more vulnerable to unemployment. A crisis shows us how we need to care more about the lives and living conditions of the vulnerable.

Third, the global recession will exacerbate the income gap between developed and developing countries. The IMF predicts that, in the next five years, cumulative global output will shrink by $28 trillion. In 2020, the overall output of developing countries, except China, is expected to be lower than in 2019. The economies of many countries will not recover to pre-crisis levels until after 2022. To many developing countries, this means a decline in living standards and setbacks in efforts to catch up with developed countries.

Changes and opportunities

Looking forward, this health crisis will bring four major structural changes and opportunities to the global economy.

First, the rapid development of digital technology globally will play an increasingly important role in peoples’ work and lives. During the lockdown in Europe in spring 2020, about 50% of employees worked remotely; among them, only 10% want to return to the office in the future.

E-commerce has begun to gradually replace traditional retail. Many companies also adopted digital technologies to diversify supply chains and improve procurement efficiency.

Second, the service industry may become the key driving force for globalisation – specifically high-skilled jobs such as doctors, lawyers and accountants, whose businesses can be performed remotely more and more through the use of technology.

Third, the healthcare industry will likely see significant development in the coming years. The pandemic has demonstrated the significance and urgency of improving the healthcare industry, including infrastructure construction, drug and vaccine research and development, care for the elderly, rehabilitation centres and sanitary conditions. Pandemic control is a prerequisite for economic recovery, and healthcare development will lay a solid foundation for sound and sustained economic growth.

Finally, investment in environmental protection must rise rapidly. Studies show a correlation between poor air quality and higher infection and hospitalisation rates caused by Covid-19. Frequent natural disasters in recent years are also closely related to environmental pollution and rising temperatures. Therefore, investment in green projects and clean energy is expected to increase remarkably.

To enable global economic recovery, we must strike a balance between recovery and risk control in policy-making, and ensure there is policy co-operation worldwide. While responding to the crisis, we need to take timely advantage of the major trends and opportunities in global economic development. Only then can we create a more prosperous future.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com