ASEAN and China – Boundless opportunities

In the face of current global economic uncertainties, a partnership between China and the wider region of the Association of Southeast Asian Nations (ASEAN) is becoming an important and strategic channel for promoting global growth. Financial co-operation is undoubtedly significant in facilitating economic activities, raising the quality of growth and enhancing the wellbeing of the region’s people.

ASEAN recognises the necessity of collaboration and the boundless financial potential it can bring to its socioeconomic development, integration and community-building. Over the years, Cambodia has been delighted to witness the ever-expanding co-operation between ASEAN and China, which is one of our major partners in dialogue.

Following the 1997 East Asian financial crisis, ASEAN focused more closely on its monetary and financial co-operation. The association continues to further deepen its commitment to fostering friendly relations with China – a relationship that promises to be mutually beneficial, and bring peace and prosperity.

For instance, with the Master plan on ASEAN connectivity 2025, China’s Belt and Road Initiative (BRI) and the China–ASEAN 3+X co-operation framework, China and ASEAN have implemented a series of concrete measures as part of their joint efforts to synergise the various connectivity strategies on political security, the economy and people-to-people exchanges.

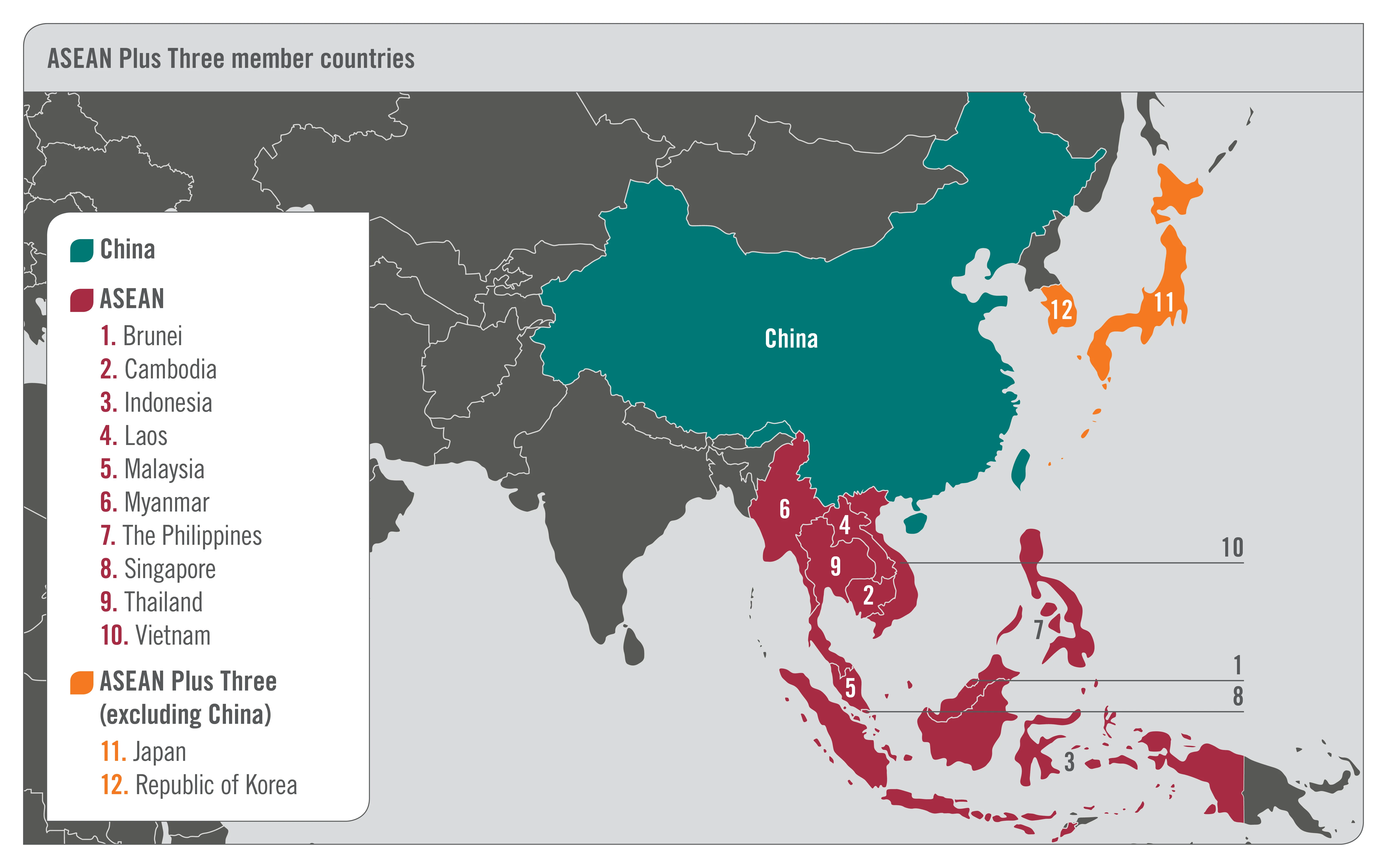

Furthermore, the ASEAN Plus Three member countries – ASEAN, China, Japan and the Republic of Korea – have also inaugurated the Chiang Mai Initiative, which is a multilateral currency swap arrangement among its members. This has expanded a foreign exchange reserves pool worth US$120 billion in 2010 to $240 billion today, which aims to manage regional short-term liquidity problems and to avoid heavy reliance on the International Monetary Fund.

In addition, efforts are under way to develop a regional bond market known as the ASEAN Bond Market Initiative to strengthen financial stability and reduce the sudden reverse of the capital flows witnessed by much of the region. In this context, it is important to consider how we can realise the objectives of both the Master plan on ASEAN connectivity 2025 and the BRI.

Due to the strong ties in this region, China has maintained its position as ASEAN’s largest trading partner since 2009. In 2018, it became the third-largest external source of foreign direct investment (FDI), and acted as an important source of foreign tourism to the ASEAN region.

In 2018, FDI flows from China to ASEAN amounted to $10.2 billion, accounting for 6.6% of the region’s total FDI. Both regions plan to intensify their efforts to meet the joint target of $1 trillion in trade volume and $150 billion in investment by 2020. It is hoped this can be achieved through the deepening of economic linkages and improvement in connectivity.

Strong economic ties and relations have huge potential for the development of the financial market between China and ASEAN. To further deepen integration, co‑operation and connectivity, the two parties have been working diligently to finalise plans for the modern, comprehensive, high-quality and mutually beneficial Regional Comprehensive Economic Partnership (RCEP). This agreement will contribute significantly to the growth of global trade, and enhance economic growth for all partners. Moreover, the ASEAN–China Free Trade Area and protocol for the framework have been implemented to further promote trade and investment liberalisation.

Stocking up on financial firepower

The two parties are also focused on strengthening their financial collaboration through actively engaging with international financial institutions, such as the Asian Infrastructure Investment Bank. They have also advocated mobilising private capital and enhancing capacity building to support infrastructure development in the region.

The China–ASEAN Investment Co-operation Fund was founded in 2010. It is a dollar-denominated offshore quasi-sovereign equity fund sponsored by the Export-Import Bank of China, among other institutional investors, under the direction of the State Council of the People’s Republic of China and approved by the National Development and Reform Commission. The fund targets investment opportunities in large-scale infrastructure projects – such as roads and ports – energy and natural resources. The firm ultimately plans to raise $10 billion to invest in the ASEAN region. Such financial investment will significantly add to the firepower of the BRI.

Through close financial strategic partnership and collaboration, I am confident that both China and the ASEAN region will continue to grow and achieve new heights and mutual benefits for the future.

Without doubt, greater regional financial co-operation for lasting resilience and inclusiveness will accelerate and increase the quality of economic growth through a connected financial network. This will ultimately improve the wellbeing of our people, and it plays a critical role in promoting trade and increasing capital flows in the region. This can, to a large extent, help the ASEAN integration process, and contribute greatly to regional community building.

ASEAN and Cambodia look forward to an even more robust and long-lasting partnership with China, and Cambodia is ready to extend its commitment and contribution to realise new opportunities for a better future.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com