The transformation of China towards a modern economy

Stability and sustainability are two vital ingredients as is structural reform

At the National People's Congress (NPC) in March 2015, Chinese premier Li Keqiang articulated the government's work plan for the year with a much stronger focus on stabilising growth, while accelerating structural reforms towards an inclusive, sustainable, innovative and open growth.

With the country's slowing economy and declining inflation rates, Li lowered the GDP growth target from 7.5% for 2014 to around 7% for 2015, stressing that the authorities have ample macroeconomic policy space to support growth if necessary.

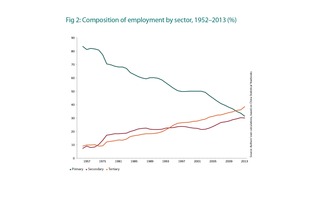

He also pointed out that China's structural transformation has been dramatic over the past few decades, and is still continuing in at a healthy pace, where the tertiary sector has grown to surpass the secondary sector in GDP, reaching 48.2% in 2014 (see figures 1 and 2). Additionally, household consumption has also risen strongly.

Throughout his report to the NPC as well as the policy statements from key macro authorities such as the National Development and Reform Commission (NDRC), the Ministry of Finance (MOF) and the People's Bank of China (PBOC), the emphasis has been on the implementation of accelerated and deeper structural reforms. This is particularly the case in repositioning the government's role from controlling the economy towards enabling and supporting the market while downplaying the role of short-term cyclical macro stimulus.

Although the MOF raised the central government's fiscal deficit from the actual

level of 1.8% in 2014 to a target as high as 2.7% in 2015 in light of slowing growth, the key policy measures focus on improving the transparency and discipline of local budgets.  This includes the announcement of a 1 trillion yuan programme - possibly the first batch of similar measures - for replacing about half of the local government loans that are due in 2015 with new long-term local government bonds that will have much lower interest rates and much longer payback periods. This would mean that the cost and term structure of the bonds would be much more consistent with the nature of local infrastructure projects being financed than the ad-hoc short-term banking and shadow-banking loans at high interest rates.

This includes the announcement of a 1 trillion yuan programme - possibly the first batch of similar measures - for replacing about half of the local government loans that are due in 2015 with new long-term local government bonds that will have much lower interest rates and much longer payback periods. This would mean that the cost and term structure of the bonds would be much more consistent with the nature of local infrastructure projects being financed than the ad-hoc short-term banking and shadow-banking loans at high interest rates.

Similarly, although the PBOC has relaxed the monetary conditions through

a gradual lowering of interest rates and reserve requirement ratios, the target for the growth of money supply (M2) in 2015 is set at 12.2% - lower than the target of 13% and slightly higher than the actual growth of 12% in 2014. The inflation target for 2015 is set at 3%, lower than the 3.5% target in 2014, but higher than the actual infl ation rate of 2% in 2014.

The PBOC also highlighted that the exchange rate for 2015 is likely to be stable, given healthy two-way cross-border capital flows so far. The PBOC reiterated its intention to further relax its control on interest rates by implementing deposit insurance reform in 2015 as well as to gradually further open China's capital account.

Clearly, even with slowing growth as well as rising challenges in inequality, pollution, corruption, and the global economic, political and security environment, China's policy-makers are determined to deepen structural reform and are confi dent they could maintain a balance between stable growth and effective change.

In the past two years, China's macro authorities appear to have put more effort into micro and structural problems - such as controlling overcapacity, property bubbles and local government debts - than into preventing deflation and providing an accommodative macro environment for positive risk-taking by innovative and productive companies.

This regulatory risk aversion reflects challenges in structural reforms as well as a lack of effective tools for implementing structural changes, such as deposit insurance and a bankruptcy mechanism. As a result, more targeted measures are being employed to deal with structural problems, such as supporting small and medium-sized enterprises (SMEs) and housing for low-income people through the targeted release of central bank funds.

Moving away from a regulatory mentality

China's bureaucracy is still struggling to get rid of the central planning mentality, where regulators such as the NDRC and the PBOC are tasked to support priority sectors, institutions and projects. There is an implicit assumption that regulators know better than the market about which sectors, companies and projects are sound, and deserve access to credit, when the fact is that even markets are unable to predict winners and losers from within its own ranks.

It is therefore important for macro regulators and policy-makers to intervene less on structural problems and to tolerate more market-orientated failures, as they are symbiotic with success in the ecology of market competition. In other words, ghost towns and large cities, overcapacity and bottlenecks, excessive debts and excessive savings are all normal in a dynamic and fast-growing market economy - and China needs to find a sustainable way to live with that reality.

As China's market matures, the good parts will expand at the expense of the bad parts. What governments need to do is provide the correct platforms for facilitating structural changes, such as deposit insurance, a bankruptcy mechanism and negative lists, which are micro-tools for dealing with specific cases.

Quality, not speed

Global development experiences, including those from China, confirm that it is the quality of growth - with its emphasis on inclusivity, poverty reduction, equity, environmental sustainability, and innovation - not the pace of growth that improves people's wellbeing.

Among developing countries that were studied by the Growth Commission, only 13 economies were able to sustain an average growth rate of 7% for over a decade and nine out of the 13 were from east Asia. Among them, China was the only country that has made three historical transformations: from a centralised planning system to a market-orientated economy; from a closed economy to an open and export-orientated one; and from an agrarian economy to the manufacturing centre of the world.

During these transformations, China achieved the fastest poverty reduction in the world: more than 660 million people have been lifted above the World Bank poverty line of $1.25 per person per day.1

However, China's old growth model, which emphasised more export, GDP and investment, is inadequate for equity, environmental sustainability and innovation.2 The accumulation of capital in urban industry widened the productivity differences with rural areas, leading to large income inequalities. With an estimated Gini coefficient of more than 0.47, China is now less equal than the US and Russia.

Although China has improved the use of natural resources and energy in some respects, environmental constraints on growth now loom large. As the world largest producer of carbon emissions, China has 16 of the 20 cities with the most polluted air. A recent World Bank study found that the health costs of air and water pollution in China amount to about 4.3% of its annual GDP. Adding the non-health impacts of pollution, estimated at about 1.5% of its GDP, brings the total cost of air and water pollution to about 5.8% of GDP.3

Can China raise the efficiency and the quality of its growth through reforms and structural change? To answer this question, we need to closely examine its evolving growth model.

Notes:

1 Ravallion, M and SH Chen (2004), China's (Uneven) Progress Against Poverty, World Bank Policy Research Working Paper no. WPS 3408, World Bank, Washington, DC. And World Bank, 2012, China 2030: Building a modern, harmonious, and creative society, http://documents.worldbank.org/curated/en/2013/03/17494829/china-2030-building-modern-harmonious-creative-society

2 Thomas, V, RE López and Yan Wang (2008), Fiscal Policies for the Quality of Growth, IEG Briefing 9, World Bank.

3 World Bank (2007), Cost of Pollution in China: Economic Estimates of Physical Damages, http://siteresources.worldbank.org/INTEAPREGTOPENVIRONMENT/Resources/China_Cost_of_

Pollution.pdf

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com