Turning forward guidance into 20:20 vision

Turning forward guidance into 20:20 vision

The Monetary Policy Committee (MPC) of the Bank of England’s adopted form of forward guidance, introduced in August, is incomplete as it fails to allow people either to understand the complete path of policy rates back to neutral or the underlying uncertainty attached to that path. This is because it reduces a complex policy problem (when to hike) into a seemingly simple solution (set policy using a single indicator) and it is silent on what happens after the first hike.

After the near-loss of price stability in the 1970s, it was generally felt that rules would dominate discretion. Central banks throughout the world then gradually gained a position of monetary control and came to the view that making policy predictable became the best way to get forward-looking people to adjust to shocks. Monetary policy is now so closely monitored that even statements by central banks about future statements have considerable power over financial markets. In part this strategy stems from the view that rules were felt to dominate discretion and making policy. Rather like air traffic controllers, central bankers have come to believe that the glide path to a successful economic landing is significantly easier to achieve, if it has been mapped out in advance, particularly when the weather is very inclement. So along with inflation targets, operational central bank independence, transparency and macro-prudential instruments, the next step on the road to ‘optimal’ rules is thought to be forward guidance. But it has to be a more complete form than that offered by the MPC in August.

In the standard policy framework adopted during the past 25 years, an independent central bank pursues an inflation target. This implies a need to generate an inflation forecast conditional on a given path of policy rates. So agents are asked to infer from the likely state of the economy and from their knowledge of the central bank’s models and policy-makers’ preferences the likely path of policy rates that will bring that forecast into line with the target. If forward-looking agents, when formulating their plans, can work out future policy, their plans are more likely to be in line with the policy-makers’ objectives. So the basic case for forward guidance is either a statement that the existing plans are too opaque to be worked out or that there has been some change in monetary practice or goals for which some tutorials may be required. Given the UK chancellor of the exchequer George Osborne’s new remit for the Bank of England, unveiled in March, did not change the fundamental goal for monetary policy1, the MPC was restricted to clarifying its modi operandi. But it has missed an opportunity to tutor the markets in the various ways it thinks the UK economy might eventually emerge from this crisis. Rather, it has offered one incomplete answer by asking market participants to focus on one single indicator rather than mapping out a more complete set of scenarios.

The Old Lady’s brand of forward guidance

The MPC opted on August 1 for ‘state contingent’ forward guidance that is subject to three ‘knock-out’ conditions not being breached.2 The MPC argues that the guidance can enhance the effectiveness of monetary policy in three ways: clarifying the committee’s loss function; reducing uncertainty around the monetary stance in economic recovery; and providing an environment in which the committee can learn about “the potential sustainable level of employment and output” and the appropriate policy response.3

The MPC guidance links the policy stance to a single measure of spare capacity: the bank rate will not be raised4 and the stock of purchased assets will not be reduced at least until the International Labour Organization measure of the unemployment rate (derived from the Labour Force Survey) has fallen to a ‘threshold’ of 7%, which the committee judges is around 50 basis points above its uncertain forecast of equilibrium rate.5 However, if the MPC judges that inflation is more likely to be 2.5% or higher 18 to 24 months into the future, or medium-term inflation expectations are not sufficiently well anchored, or the Bank of England’s Financial Policy Committee judges that the stance of monetary policy is deemed to pose a significant threat to financial stability, then that guidance will no longer apply.

One potential problem with these price and financial stability ‘knock-outs’ is that they rely on the accuracy of policy-makers’ beliefs about the future, which in turn reflect an assessment of the structure of the economy and the shocks working through the system (or in the case of the inflation expectations knock-out, beliefs about how to extract a signal from noisy indicators). It would not be surprising if it took a significant amount of evidence to convince policy-makers to revise those beliefs (for example, about the extent to which the credibility of the monetary policy framework anchors the medium-term inflation outlook) and therefore it may take some time before these knock-outs are triggered in a world where a policy error is being made. Moreover, there is no presumption that the expiry of the guidance will automatically lead to an immediate change in the stance. It is also not clear what further form of guidance might then be adopted as the bank rate approaches the moment of liftoff.

Consistent with the principle of individual accountability, on which the committee was founded, the guidance framework allows each member to form their own independent assessments of whether or not the knock-outs have been breached. Indeed, one member of the committee, Martin Weale, felt unable to support the final specification of the knock-out conditions, favouring a shorter time horizon over which to assess the risks to price stability. The guidance is therefore not as binding as it might first appear because individual members retain significant latitude within the guidance framework – an individual can vote for an increase in the bank rate if they perceive mounting risks to the medium-term inflation outlook even when their colleagues do not.

Why the sudden change?

Given the financial crisis started six years ago, one might ask why the Bank of England has stumbled into a new regime of forward guidance just now.6 Following the publication of influential research showing that the expected stance of policy had as significant an impact on forward rates as the actual level of policy, there was a parallel debate about whether or not the MPC should publish the expected path of the bank rate in 2006 and 2007 – another form of forward guidance – that was firmly rejected as being too cumbersome.7

The previous Bank of England governor, Mervyn King, thought that the bank rate and, subsequently, the level of asset purchases should be treated as a new decision every month based on the economic news relative to expectation. The perception was that it was not possible to tie the hands of future policy-makers as one cannot know today what shocks might transpire. The new governor, Mark Carney, strongly believes that forward guidance might help the transition back to normal interest rates by preventing expectations of rate hikes from being priced in prematurely by market participants. It seems to us that the two positions are not completely incompatible as the latter might simply involve the revelation of a path left opaque by the former. We shall return to the issue of path revelation later.

Furthermore, there are a number of conjunctural reasons why forward guidance might reduce unwarranted uncertainty. First, the zero lower bound regime is rather novel and agents may not be able to work out the path back to the normal regime very easily. Second, any normalisation of interest rates will sooner or later be associated with some exit from quantitative easing (QE) and so some need for the private sector to absorb government bonds, which will tend to put downward pressure on bond prices.8 And so if markets start to expect a simultaneous normalisation of interest rates and a reversal of QE, bond yields may rise sharply and stifle a nascent recovery. Some form of UK-specific guidance is also likely to help differentiate clearly between the likely path of policy rates here and overseas, particularly in the US and the euro area. Finally, we have developed the idea of flexible inflation targeting in the monetary lexicon, which implies that a target may not be strictly binding at all times and so forward guidance may be rather useful in explaining the degree of flexibility. So there may be a number of good reasons why we might want central banks to be clearer about the likely stance of policy – but why does forward guidance have to take the form the Bank of England has chosen?

It’s all Greek to me

The bottom line with any central bank communication is the fundamental message that it conveys about monetary strategy. The message in forward guidance can be boiled down to one simple question9: is the central bank trying to communicate a change in the reaction function or something more mundane?

One way to inject additional stimulus at the lower bound is to commit credibly to keep rates low in a future recovery beyond the point at which the standard (forward-looking) reaction function would demand that accommodation be withdrawn.10 The problem is how to make that seemingly time-inconsistent promise credible – the market should expect the central bank to renege on this promise when that recovery materialises.11 Like Odysseus’ solution of how to pass the sirens without hitting the rocks in Greek mythology – by binding himself to the mast and filling the ears of his sailors with wax – instances where central banks attempt to signal a change in the reaction function and then bind themselves to it can be referred to as ‘Odyssean forward guidance’.12

Not all the forms of Odyssean forward guidance are the same. The threshold conditions in state contingent forward guidance may be set in such a way as to indicate an atypically late departure from the lower bound. However, unless those conditions respect history, in the sense that they reflect the macroeconomic consequences of policy being constrained at the lower bound in the past, then the guidance does not implement the-commitment-to-create-a-boom-solution.13 That Herculean labour may require bolder state contingent guidance – for example, linked to the projected trend of nominal GDP – which the MPC considered and rejected.

‘Delphic forward guidance’ is more in keeping with standard central bank communication. The central bank makes implicit or explicit statements about the future stance of policy that reveal information about the central bank’s assessment of the economy or the timeless reaction function. Those statements can still serve a purpose even if the reaction function is known, so long as the central bank is believed to have a superior information set or forecasting capacity, although there is a risk that such guidance could ‘spook the market’ by revealing just how weak (the central bank believes) the economy is performing.14

Carney described the MPC guidance in emphatically Delphic terms at an August press conference: “It’s not a change in the reaction function, but it gives a better sense of the MPC’s reaction function to financial market participants,” he said. Deputy governor Charles Bean went further, arguing that it was not possible for the MPC to engage credibly in Odyssean guidance.15 However, it is something of a stretch to describe a strategy of keeping the bank rate at the floor at least until the unemployment is within 50 basis points of the Bank of England’s inevitably imprecise estimate of the equilibrium rate as orthodox strategy. Nor is it obviously consistent with either the past views or votes expressed by current members of the committee.16

As a signal about the timing of the first hike in the bank rate, the guidance seems to have done little to convince the financial markets – in fact, quite the opposite - certainly in comparison with the impacts of the announcements of central bank independence and of quantitative easing.17 The combination of central bank communication18 and strong UK data during August led market participants to raise their expectation of the level of the bank rate in summer 2015 by a full 25bp hike.

Open versus time versus state-contingent

Apart from the question of revelatory (Odyssean) or confirmatory (Delphic) guidance, one then has to ask if the guidance should be open (O), time (T) or state-contingent (S). Unfortunately, a casual glance at each of these options reveals that none are actually that helpful:

- Policy will remain ultra-accommodative until the recovery is well established (O);

- Policy will remain ultra-accommodative until 2016 (T);

- Policy will remain ultra-accommodative until unemployment falls to the natural rate (S).

The ‘O’ statement leads to uncertainty about which factors comprise a recovery and how we jointly forecast the point in the future when we will know that they signal a recovery. The ‘T’ statement solves the time dimension as it tells us to hold rates constant for three years, but asks us to work out what implication that has for the economy as we seem to have no traction on the economy at all over this period. The ‘S’ statement asks us to focus on the path of unemployment, which is a noisy and lagging indicator of spare capacity.

Actually, by reducing uncertainty in one dimension or another, each of these types of guidance introduce it in another and, in any case, we have to make some statements about ‘knock-outs’, which broadly speaking are manual overrides over forward guidance to compensate crudely for the fact that sticking to the guidance – whether of the ‘O’, ‘T’ or ‘S’ variety – could lead to a sub-optimal policy stance. So, on reflection, it appears that not only are the differences between these forms of guidance more apparent than real, but also they do not provide effective guidance because they are incomplete characterisations of the policy problem. Each form of short-run guidance begs the question of what happens at the end of forward guidance as we have introduced an end-point problem for policy-makers, which means that as the terminal condition approaches, central banks will be pressed to provide yet more guidance or suffer the consequences (in terms of increased uncertainty about the outlook for policy around a likely higher expected path, and all that follows from that). Furthermore, given that any simple-minded form of guidance is always state-contingent, why do we not work harder at explaining what we think we know and what we think we do not know and encourage the mining of data or views that policy-makers, and hence the market, would value?

From Threadneedle Street to the High Street

Common sense suggests that a message should be crafted with the intended audience in mind if it is to have the desired effect, and the design of forward guidance is no exception. The guidance is aimed, at least, in part at households and companies. Whether the MPC’s message is sufficiently clear and has been repeated a sufficient number of times to ensure that it has been understood remains to be seen.

The agents that populate the workhorse models of macroeconomics are sophisticated and well informed. Delphic statements about the outlook or the timeless reaction function would be redundant in this world, so the fact that central banks are engaged in a constant dialogue with market participants and the wider world reveals that central bankers do not believe this is a reasonable description of how the world works. That view is consistent with the more nuanced and fallible description of how individuals think and behave that can be found in the wider literature. Theories of rational inattention emphasise how agents may have limited appetite for gathering information and limited capacity to process it, and may update their behaviour infrequently in response to the ‘news’ as they understand it.19 And when individuals do take decisions, they may use simple rules of thumb that deliver an acceptable (as opposed to the optimal) outcome, imitate others or even stick with a default strategy to avoid making a choice altogether.20

Critically, the extent of this bounded rationality and the severity of these behavioural flaws will vary significantly across different potential audiences for the guidance. It is reasonable to assume that those who work in financial markets will hear the message and should be able to process the news in the announcement. Indeed, the concern here is that the audience may pay too much attention. Guidance on rates might serve as a co-ordination device for private-sector beliefs in an environment where agents care about what others think, meaning private beliefs about the state of the economy do not get traded into market prices.21 But one cannot make the same assumptions where households and companies are concerned – there is ample scope for policy announcements to be misunderstood or missed altogether by an unsophisticated and inattentive audience. This can lead to undesirable outcomes.

The MPC guidance is a complex conditional statement about the path of rates. But there is a risk that the general public will hear an unconditional promise – indeed, that seems the likely outcome given some of the coverage of the Bank of England guidance in the press.22 It appears that many households did push back their expectations of when interest rates will start to rise following the publication of the guidance, in contrast to the expectations of market participants, which moved in the opposite direction.23

The Bank of England’s own Financial Stability Report is already warning that “a significant cohort of UK borrowers could experience financial difficulties if interest rates were to rise during a period of subdued income growth”.24 It would be unfortunate for the individuals concerned – and perhaps for the central bank’s reputation – if people misunderstood the guidance as an unconditional promise and got further into debt. However, it is unclear whether the Bank of England considers household financial fragility rather than that of the financial sector as a sufficient cause to justify aborting the guidance.

Gone today, but back tomorrow? Guidance and volatility

One of the stated aims of the guidance is to reduce uncertainty about the future path of monetary policy as the economy recovers. Excessive volatility in interest rates – that is beyond what is warranted given the shocks and structure of the economy – is undesirable from a monetary stability perspective since it will tend to delay and deter irreversible investments in physical and financial assets.25 The more pressing concerns are in the financial stability domain, where volatility in asset prices can drive households, companies and financial institutions close to, and beyond the default boundary. Indeed, it is fear of these financial stability consequences when policy rates do eventually normalise that is driving one of three knock-outs on guidance.

The guidance should help dampen volatility at the front-end of the yield curve by stabilising expectations about the circumstances under which rates will exit the lower bound – particularly in the face of good news at home or news about rising rate expectations abroad – although in practice, the guidance has failed to anchor the front-end of the yield curve. Further out, the guidance could compress term premiums, at least in theory. Moreover, by pledging not to reduce the stock of purchased assets and to reinvest the cashflows associated with maturing gilts in the Asset Purchase Facility (APF)26 until the threshold is breached the guidance could help stabilise yields further out along the curve.

Unfortunately, the capacity of the guidance to squeeze excessive volatility out of the system may prove short-lived. Reduced uncertainty about the near-term path of rates and the timing of the exit from the lower bound could quickly give way to increased uncertainty about the rate of ascent from the lower bound and the need for rates ultimately to overshoot neutral. The impact on nominal yields could be amplified by an increase in breakeven inflation rates, reflecting both higher expected inflation and increased uncertainty around the future path of inflation, since take-off is likely to be delayed until there is little spare capacity left in the economy. Last, but by no means least, the gilt market will quickly have to adjust from QE feast to famine, with the decision to suspend reinvestment of the proceeds from maturing gilts and potentially the start of asset sales closely synchronised with the departure from the lower bound.

If that shift in market beliefs was to happen in a short space of time, it would be likely to prompt a sharp revision in the price of sterling assets, which might then trigger further amplification through positive feedback effects, leading to a potentially significant financial stability event.27 As the Bank of England’s executive director for financial stability, Andrew Haldane, succinctly put it: “Let’s be clear, we have intentionally blown the biggest government bond bubble in history. That is where we are, so we need to be vigilant about the consequences of that bubble deflating more quickly than we might otherwise have wanted.”

Completing incomplete guidance

The problem with the current vogue for providing guidance on the likely timing of the departure from the lower bound is that it is incomplete, both in the sense that it does not discuss what happens ‘afterwards’, either to the bank rate or the stock of asset purchases, and that it does not provide sufficient colour about the range of views within the committee. We believe that the optimal guidance strategy would involve three key ingredients.

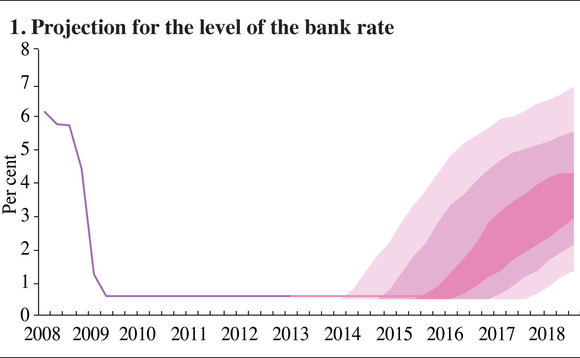

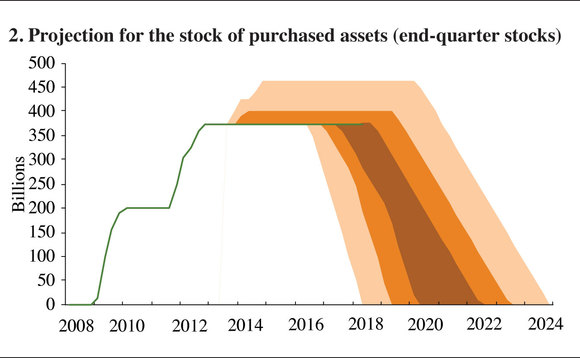

First, and most important, the committee needs to speak about the entire path back to equilibrium. The pace at which stimulus is withdrawn and the mix between rate hikes and asset sales is unclear, not least given the likely limited margin of spare capacity left in the economy at the point of liftoff. Complete guidance would fill in those blanks, sketching out a path back to the neutral rate of interest and the ultimate wind-down of the APF portfolio over time.

Second, that statement needs to reflect the uncertainty about the future stance, both in terms of the outlook for the economy, the appropriate policy stance and the range of views within the committee about those issues. Consistent with the bank’s favoured mode of communication and the precedents set elsewhere, the MPC could publish complete guidance in the form of fan charts for interest rates and the stock of purchased assets, although the latter would have to extend beyond the usual three-year horizon. That fan chart would emphasise the uncertainty around the end point (the neutral rate) of the journey back, as well as the route taken. Information on the range of views within the committee could be communicated by members publishing their own estimates of the modal path back to neutral (as the US Federal Open Market Committee does) – estimates that would need to be produced for the committee to agree the parameters of the interest rate fan chart. Failing that, the Bank of England could go back to the future and publish information on the range of views within the Committee on the state of the economy.28

Third, the MPC needs to shed some light on the nature of the uncertainty that drives the guidance. The committee could publish stylised paths for monetary policy in specific ‘off central case’ scenarios – which probably already feature in the policy debate – and under alternative strategies (interpretations of the loss function). Such a path forecast could also be made for the level of holding by the APF. Rather than spoon-feeding the market the answer on how long rates will remain on hold, or suggesting that they focus on some new ‘magic’ indicator, the MPC would then be teaching the market how to think about the conduct of policy. Within these paths, various scenarios might be assessed and explored.

These three elements would provide more complete guidance, a vision if you will, on the path back to neutral that respects the uncertainty and informs the market about the policy debate. Figures 1 and 2 illustrate the sort of fan chart we have in mind for the bank rate and the holdings of the APF, which makes explicit an assertion that in all likelihood the bank rate is currently at the lower bound and the relationship between the stock of assets held and future movements in the bank rate. Obviously this vision of the future does not solely depend on unemployment forecasts but is inherently more coherent because the best we can do is to portray uncertainty because that is what a normal person, as well as the policy-maker, has to contend with when formulating plans for the future. Because the future is uncertain we do not make it less uncertain by ignoring uncertainty.

1 See Osborne G, 2013, Remit for the Monetary Policy Committee, March 20

2 Time-dependent or open-ended commitments are the other forms of forward guidance that are typically discussed. See Bank of England, 2013b, Monetary policy trade-offs and forward guidance, August

3 See Carney M, 2013, Letter to the Chancellor, August 7

4 The MPC has chosen not to adopt the language used by the ECB Governing Council, which deliberately leaves the door open to rate cuts. Instead, the MPC indicated that it stands ready to undertake further asset purchases if additional stimulus should be deemed necessary. The bank rate appears to be at the lower bound by revealed preference (except perhaps in the most dire of circumstances)

5 This forecast is based on the best guess of a number of structural models and varies over the business cycle and so is highly uncertain. In the very long run, the equilibrium rate is likely to be near 5%

6 To the impartial observer, it might appear that guidance is the policy remedy for all seasons: first touted as a means to provide additional stimulus (by lowering rate expectations) back in late 2012 when the economy was flat-lining; now presented as a means to safeguard the recovery (by preventing rate expectations rising). See Carney M, 2012, ‘Guidance’, Speech, December 11

7 The Treasury Committee (2007) considered the issue of publishing interest rate forecasts in paragraphs 105 to 108. See Treasury Committee, 2007, The Monetary Policy Committee of the Bank of England, Ten Years On, Volume 1, London: The Stationary Office

8 The whole question of how to sequence the end of QE and the normalisation of policy rates along with gauging the impact on bond prices is an area of deep uncertainty. See Chadha J, Turner P and Zampolli F, 2013, ‘The Ties that Bind: monetary policy and government debt management’, forthcoming in the Oxford Review of Economic Policy

9 See Campbell J, Evans C, Fisher J and Justiniano A, 2012, ‘Macroeconomic Effects of Federal Reserve Forward Guidance’, Federal Reserve Bank of Chicago Working Paper 2012-03

10 See Krugman P, 1999, ‘It’s Baaack: Japan’s Slump and the Return of the Liquidity Trap’, Brookings Paper on Economic Activity, 2, pages 137–187 and Eggertsson G and Woodford M, 2003, ‘The Zero Bound on Interest Rates and Optimal Monetary Policy’, Brookings Paper on Economic Activity, 1, pp.139–211

11 See Barro R and Gordon D, 1983, ‘A Positive Theory of Monetary Policy in a Natural Rate Model’, Journal of Political Economy, 91, pages 589-610

12 See Campbell et al, Ibid.

13 See Woodford M, 2012, ‘Methods of policy accommodation at the interest-rate lower bound’, paper presented at 2012 Economic Policy symposium at Jackson Hole

14 See Bullard J, 2013, ‘Monetary policy in a low policy rate environment’, OMFIF Golden Series Lecture, May 23

15 ”While such a time-inconsistent policy may be desirable in theory, in an individualistic committee like ours, with a regular turnover of members, it is not possible to implement a mechanism that would credibly bind future members in the manner required.” See Bean C, 2013, ‘Global aspects of unconventional monetary policy’, Panel remarks, August 24

16 For example, consider the following: “Of course, at some point, the bank rate will have to rise: interest rates will need to normalise if, once the spare capacity in the economy has been eliminated, monetary policy is to be consistent with the 2% target. And because of the lengthy lags involved, the bank rate will need to start the long journey back to more normal settings well before the degree of spare capacity is eliminated.” See Fisher P, 2011, ‘The economic outlook’, Speech, May 23

17 The response to the announcements of QE have been widely studied but let us also remember that the ‘surprise’ announcement of operational independence led to some 50bp response in medium term forwards. See Chadha J, Macmillan P and C Nolan, 2007, ‘Independence Day For The ‘Old Lady’: A Natural Experiment On The Implications Of Central Bank Independence’, Manchester School, 75(3), pages 311-327

18 Namely: no statement alongside the August decision, the Inflation Report, the Minutes and of course the publication of the guidance

19 See Reis R, 2006, ‘Inattentive consumers’, Journal of Monetary Economics, 53(8), pages 1,761-1,800 and Sims C, 2003, ‘Implications of rational inattention’, Journal of Monetary Economics, 50, pages 665-690

20 See DellaVigna S, 2009, ‘Psychology and economics’, Journal of Economic Literature, 47(2), pages 315-372 and Simon H, 1978, ‘Rational decision-making in business organisations’, Nobel Memorial Lecture

21 See Morris S and Shin H-S, 2002, ‘Social Value of Public Information’, American Economic Review, 92(5), pages 1,521-1,534

22 Headlines the morning after included: ”Bank puts new lock on interest rates”, “Carney rips up rulebook to keep rates low for three more years”, ”Three years of pain for savers”, ”Interest rates set to remain at historic low for next three years” and “New Bank chief says interest rates low for 3 years”

23 See results of the surveys published by Markit and the Bank of England/GfK NOP

24 See Bank of England, 2013, Financial Stability Report, June

25 See Dixit A and Pindyck R, 1994, Investment under uncertainty, Princeton University Press

26 Strictly speaking, the Bank of England Asset Purchase Facility Fund, the subsidiary of the Bank of England established to manage the various asset purchase programmes which the bank has conducted since the onset of the financial crisis

27 See Barwell R, 2013, Macro-prudential policy: Taming the wild gyrations of credit flows, debt stocks and asset prices, Palgrave

28 The Inflation Report Table 6.B in the early 2000s reported the consequences to the forecast of different assumptions of a key parameter. The bank could go further and make its model(s) implementable outside the bank

Richard Barwell is senior European economist at RBS Markets. Jagjit S Chadha is professor of economics at the University of Kent. The views expressed in this article do not necessarily represent those of their employers

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com