Financial Stability

Basel Committee reveals data behind G-Sib designations

Bank for International Settlements publishes figures used to calculate systemic importance and the thresholds for ‘buckets’; FSB designates new bank a G-Sib and shuffles existing list

Lautenschläger enunciates Buba's macro-pru approach

Focus on individual banks must be complemented by efforts to stem 'pro-cyclical' tendencies of the financial system as a whole, says Bundesbank deputy

RBI's independence under threat, says former chief general manager

Grace Koshie says proposed changes could give the government greater involvement in the Reserve Bank of India’s operational areas; warns other central banks' legal independence is being ‘altered’

Dominican Republic seeks damages after printer loses 8,500 banknotes

Defective banknotes worth an estimated 17 million Dominican pesos disappeared from French contractor in July; detected in the Caribbean country earlier this month, central bank says

NY Fed researchers study how, and how not, to co-ordinate policy

Staff report looks at best ways to co-ordinate monetary and macro-prudential policy, and highlights a number of potential pitfalls; model suggests macro-prudential policy should lead

Crisis a 'classic panic' in novel institutional context, says Bernanke

Speaking at the IMF annual research conference in DC, Fed chair warns of moral hazard arising from actions to limit crisis early on; outlines US long-term measures aimed at curbing such externalities

Taiwan upgrading payments tech in RMB push

A deputy governor at the Taiwanese central bank reveals plans to expand the country’s new foreign currency clearing system to create technological backbone for offshore renminbi market

UBS buys back ‘bad bank' from Swiss central bank

Switzerland's biggest bank is reacquiring vehicle set up by the Swiss National Bank in 2008 to relieve it of illiquid assets and save it from potential collapse; Deal earns SNB $3.8 billion in profit

NY Fed's Dudley says Sifis must build firmer foundations

Reducing the chances of a systemically important financial institution (Sifi) failing - and bringing the system down with it - is key to overcoming 'too big to fail', says Bill Dudley

Canadian astronaut launches polymer banknotes

Former commander of the International Space Station marks the new $5 and $10 banknotes entering into circulation; senior deputy governor Tiff Macklem insists there is 'no chance' they will melt

ECB says no treaty change needed for SRM

Central bank pushes for introduction of ‘lawful' SRM by 2015; warns delay of bail-in tool may undermine resolution efforts by creating regulatory inconsistency and uncertainty

Italian interbank market kept working through crisis

A study of interbank lending in Italy from 2007-2011 finds the hypothesis of liquidity hoarding in times of crisis did not apply in the instance examined

Danish authorities tackle mortgage bond refi risk

Lars Rohde hails a new bill forged by the central bank and the government as the solution to the ‘excessive refinancing risk’ in Denmark’s mortgage bond market

Bank of Slovenia lifts lid on bank health checks

The 10 banks under investigation will be subjected to asset quality reviews and bottom-up stress tests; results will be challenged by an outside consultancy

BoE's Kohn stresses predictable nature of FPC ‘knockout'

Financial Policy Committee member Donald Kohn tells Oxford audience the Bank of England's new macro-prudential powers should allow monetary policy to act more effectively

RBI tries to persuade foreign banks to put down roots

Revamped framework unveiled by India's central bank yesterday will make it easier for foreign lenders currently operating through branches to set up wholly owned subsidiaries in the country

BoE and FDIC campaign for end to ‘early termination’ of derivatives contracts

International authorities want a ‘short-term suspension’ of the rights that allow derivatives contracts to be terminated ahead of schedule when a major financial institution is being resolved

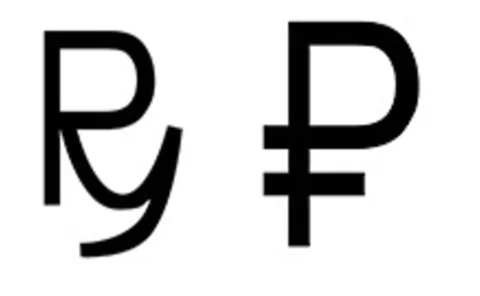

Russians vote to choose new rouble symbol

Central Bank of Russia says more than 102,000 people voted in the first day of its online poll to choose a symbol to represent the nation's currency; voting is open until December 5

Constâncio insists private sector will play ‘major’ role in filling capital shortfalls

The ECB’s vice-president says banks will be able to fill any capital holes turned up in the central bank’s comprehensive assessment at least partly through private funds

ECB faces parliamentary grilling on Troika track record

Senior managers from European Central Bank and European Commission defend the accountability and forecasting track record of the Troika in European Parliament hearing

Bank of England waging payment system war on three fronts

Chief cashier Chris Salmon says the central bank must contend with issues relating to cyber security, user access and new regulation within the UK payments infrastructure

ECB’s Asmussen urges Denmark and Sweden to sit at banking union table

Jörg Asmussen says the single supervisory mechanism will be the envy of those outside the eurozone; tells Denmark and Sweden they will get more of a say if they have ‘a chair at the table’ now

Federal Reserve reveals new, tougher stress tests

Details of stress tests for 2014 include scenario based on severe global recession, with some banks facing additional criteria; tests will be applied to 12 more banks than before

BoE official calls for greater transparency on CCP margin modelling

Central counterparties should compete on quality of risk management, rather than a race to the bottom on margins, says Bank of England's head of payments and infrastructure