Central Banking Newsdesk

Follow Central Banking

Articles by Central Banking Newsdesk

Norwegian authorities chase benchmark rate reform

Financial Supervisory Authority of Norway proposes new framework for Norwegian Interbank Offered Rate-setting process; central bank looks to push envelope further

Polish paper scrutinises interest rate holds

Research finds that central banks keep interest rates unchanged on majority of occasions; proposes model that distinguishes between rate-holds in period of tightening, easing and neutrality

BIS' Caruana warns low rate environment allows reforms to be postponed

BIS chief warns regulators may be 'fighting the last war', and calls for central bankers to push for 'a return to sustainable government finances'

Ireland’s financial regulator quits central bank

Deputy governor for financial regulation announces departure to ‘pursue other interests’; term spanned turbulent period for Ireland’s economy

New model prescribes strongly counter-cyclical medicine for financial shocks

Working paper from the Bank of Canada suggests counter-cyclical bank capital rules can help steady the ship in the wake of financial shocks, in tandem with monetary policy measures

BoJ minutes reveal tensions over asset purchase programme

Minutes of final meeting under governor Masaaki Shirakawa show disagreement over whether to loosen policy further, including changes to quantitative easing

ECB paper examines shifts in fiscal regimes

Study finds responsibility for stabilising debt levels has swung between monetary and fiscal authorities in UK, Germany and Italy; most clearly defined in UK

FSB to assess efforts to end ‘mechanistic reliance’ on credit ratings

Peer reviews aim to hasten a move away from rating agencies, with countries expected to eliminate references to credit ratings from laws and encourage better internal credit risk assessments

IMF and Sarb push for stronger systemic supervision in Africa

Joint effort to highlight importance of macro-prudential approach in addition to scrutiny of individual institutions; IMF pushing for tighter supervision

Accumulating reserves to guard against inflation is 'misplaced'

Researchers at Bofit institute find that using reserves as a ‘bulwark against goods price inflation' is a mistake; say best protection against costly reserves accumulation is flexible exchange rate

Lagarde fears ‘unintended consequences’ of monetary easing

IMF managing director fears side effects from low interest rates and asset purchases; says there is a limit to the share of the burden of recovery that monetary policy can take

Asean pioneers lay foundation for economic union with capital markets move

Thailand, Malaysia and Singapore press ahead with capital markets integration in bid to jump-start Asian Economic Community

Payment pricing preventing electronic migration in Ireland

Article in central bank’s quarterly bulletin finds Ireland could save €1 billion by switching from cheques to a more efficient payment instrument

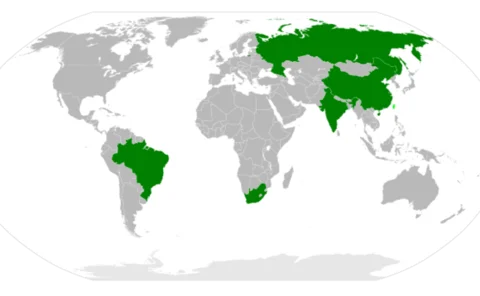

Chilean paper finds room to reduce risk by diversifying investment in Brics

Statistical analysis finds little co-integration of stock market vectors in Latin America and the Bric countries; says this gives investors a good opportunity to diversify, which would reduce risk

Reserve managers expanding into riskier assets, survey finds

Latest Reserve Management Trends reveal central banks are moving into ‘non-traditional' currencies; growing number of reserve managers investing, or considering investing, in equities

Fed tightens rules for retail forex banking

Federal Reserve publishes final rules for banks engaging in foreign exchange transactions with retail customers; includes requirements for risk disclosures, good conduct, capitalisation and margining

IMF paper uses monetary model to explain term premium

Study says central bank supply of liquidity influences asset prices; argues that this relationship can explain greater proportion of term premium than non-monetary models

Contribution of Irish financial sector to GDP ‘overstated’

Paper questions the statistical methodology behind claim that Irish financial sector contributes €15 billion to country’s output

US non-farm payroll stats strengthen case for more QE

Boston Fed president joins calls to continue QE programme as US employment recovery falters

Bank of Spain reshapes supervisor to meet new demands

Banking supervision directorate restructured to meet the requirements of Spain’s memorandum of understanding and the move to European banking union

Yellen calls quantitative thresholds a ‘major improvement’ in forward guidance

Federal Reserve vice-chair justifies move to unemployment-based guidance; says clear ‘exit principles’ are important for ending quantitative easing safely

Chilean paper finds central bank’s forecasts influence private sector expectations

Working paper finds evidence the private sector updates inflation expectations based on the Central Bank of Chile’s forecasts; suggests more central banks should publish forecasts to aid policy

Assistant governor says RBNZ should not be target of exchange rate ‘angst’

John McDermott deflects criticism that the central bank is failing to correct the exchange rate, warning hard-won inflation credibility could be lost and other factors are at play

Czech research examines macroprudential policy in small economies

Policy note stresses the importance of considering cyclical systemic risk when setting macro-prudential policy in a small EU economy