Securitisation

EU cannot fully disconnect from US, say Nagel and Kocher

German and Austrian governors say bloc can take steps to gain more sovereignty

Ukraine’s Andriy Pyshnyy on the US minerals deal, ongoing reforms and post-war plans

The National Bank of Ukraine’s governor speaks about managing inflation, financial sector reform, FX reserves, international aid and actions in the event of a peace deal

Capital markets union faces ‘death by a thousand cuts’ – Lagarde

ECB president tears into European leaders’ inaction over innovation and wealth creation

Draghi report calls for step change in EU investment

Former ECB chief says bloc should revive securitisation and finish capital markets union to stay competitive

Credit rating agency failures continue despite EU reforms, paper finds

Bond issuers are still “shopping” for good ratings, ECB paper says

NBER paper tracks shift to ‘arms-length’ finance

Authors assess three drivers of move from bank lending to securities-based finance

Bank of Ghana clarifies losses after Reuters report

Research director explains $5.4 billion loss for 2022 mainly due to debt restructuring

FSB finds implementation of non-bank reforms still ‘incomplete’

Banks are well insulated but more progress needed on liquidity management and securities financing

The international effort to manage NBFI risks: where do we stand?

The Covid-19 shock demonstrated more needs to be done to address stability risks posed by the NBFI sector. Maurizio Trapanese details progress made during the Italian G20 presidency as well as outstanding macro-prudential issues

Regulating big tech and non-bank financial services in the digital era

Big tech incursions into financial services in China and elsewhere demonstrate the potential benefits of adopting a digital-bank or holding-company approach to financial regulation

Shadow banks play key role in business cycle – BoE paper

Contraction in securitisation can spill into wider credit conditions, researchers say

Non-banks exposed to riskiest CLO tranches – Fed research

Risky holdings appear to be larger than market participants believe, economists say

Securitisation can increase risk – Bank of Italy paper

Periods of high demand for safe assets can lead to riskier originated loans, authors say

Wider use of LEIs will improve stability, says DNB president

LEI system should be improved and made compulsory for more types of financial data – Klaas Knot

ECB calls on Greece to redraft securitisation plans

Government should consider setting up new regulator for NPL-backed assets, says European Central Bank

Banks could be stuck with riskiest corporate loans during downturn – Fed paper

Researchers say loan syndication may leave banks unable to offload leveraged debt in downturn

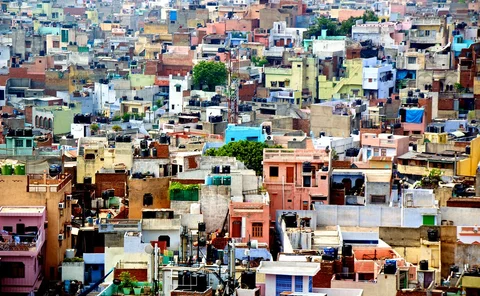

RBI weighs plan to boost securitisation market

Government-sponsored intermediary could be formed to act as market maker and standard setter

Boston Fed’s Rosengren warns about Japanese banks’ loan holdings

Exposure to CLOs now above Common Equity Tier 1 in one of Japan’s largest banks, data shows

US corporate debt could amplify economic downturn, Kaplan says

Dallas Fed president warns about “historically high” corporate debt levels in economic letter

Securitisation did not increase for most banks before 2008 - BoI paper

Data from 1991 to 2007 shows banks improved capital ratios after securitising assets

The IFF China Report 2018: Chinese financial system reform

China is focusing greater effort in tackling the build-up of risks in its banking and financial system, while also seeking to ensure credit is more effectively distributed in the real economy. At the same time it is has embraced fintech but policymakers…