Quantitative easing

Orthodox Banxico policies ‘paying off' amid emerging market volatility

Loose monetary policy in Mexico has been made possible by progress on inflation anchoring, according to bank's quarterly report

Fed's Plosser wants to end asset purchases by summer

Philadelphia Fed president and FOMC member who voted for the Fed's ‘measured' $10bn taper in January reiterates earlier calls to scale back QE at ‘faster pace'

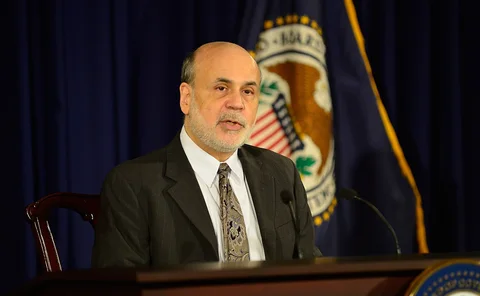

Bernanke passes torch to Yellen as poll shows US torn on his legacy

Janet Yellen to be sworn in as Federal Reserve chair on Monday, but de facto takes over when Bernanke bids farewell today

Unanimous Fed decision to taper 'sets precedent'

FOMC scales back monthly purchases by another $10 billion, makes no mention of EM turmoil; unanimous decision seen as making dissent less likely in coming meetings

Draghi spells out QE possibilities

Mario Draghi says the European Central Bank could purchase banks' loans if they are packed in the ‘proper’ way, in contrast with market calls for GDP-weighted sovereign debt purchases

BoE's Miles finds market context decisive for QE impact

Impact of QE working through a portfolio rebalancing channel is weak in an environment of 'functioning financial markets'; implications for purchases made in dysfunctional markets unclear

Fed's Williams says ‘highly effective' forward guidance has a ‘number of limitations'

San Francisco Fed president defends the policy's record in a paper written for the Brookings Institution, but also says it is ‘prone to misinterpretation'

History likely to vindicate Fed's crisis policies, says Bernanke

The Federal Reserve has developed ‘all the tools needed' to manage monetary policy; costs of extraordinary measures exaggerated, Bernanke says

Fisher says Fed must stop QE ‘as soon as feasible'

Exit from quantitative easing is ‘daunting' according to Dallas Fed president Richard Fisher, who compared it yesterday to passing a camel through the eye of a needle

Fed minutes reveal QE wind-down balancing act

Reduction in monthly asset purchases of $10 billion meant to signal slow rather than quick tapering; thresholds becoming less relevant as economy improves

Robert Pringle’s Viewpoint: Janet Yellen - that honeymoon feeling

Comparing what the new Fed chief should do with what is likely

Yellen approved as Fed chairwoman

US Senate approves Janet Yellen as Federal Reserve's first female chair, in closest vote to date; adjusting unconventional policies to improving economic conditions ‘greatest challenge', says analyst

Bernanke looks back on his time at the top

Fed chairman, who steps down on February 1, offers his take on an array of issues, including the long-term implications of asset purchases, central bank accountability and financial stability reforms

Farmer says ‘qualitative easing' should be a permanent tool

The ability of a central bank to alter the composition of the assets it holds is a powerful tool in the fight against unemployment and economic stagnation, and should be kept on hand at all times

Fed taper met with calm, but questions remain

Markets take ‘expected' tapering in stride, but analysts warn of persistent emerging market vulnerabilities and changing FOMC dynamics in 2014

Carney defends forward guidance as UK unemployment falls closer to BoE threshold

Bank of England governor says reaching 7% unemployment threshold does not presuppose monetary tightening, but rather incorporates a deliberate buffer before full employment is reached

Kuroda says Japan is on track to hit price target

Bank of Japan governor says the central bank’s QQE has brought about ‘positive developments’ that are spreading throughout financial markets and the real economy; sees inflation hitting 2% by 2015

OECD’s White says ECB supervision is back to front

William White says ECB should be managing the current crisis rather than trying to prevent the next one; warns that the global economy remains vulnerable, partly because of central bank actions

Departing Bernanke takes stock of Fed's unprecedented actions

Federal Reserve chairman discusses the ups and downs of the bank's asset purchases and attempt to guide market expectations; admits shortcomings but maintains policies are warranted

OECD joins calls for eurozone QE

Organisation says ECB should consider ‘institutional changes' to allow it to buy corporate and sovereign bonds; suggests a timetable for US taper

Caruana flags evidence of ‘manifold’ QE spillovers

BIS general manager presents evidence of varied spillovers from advanced economies' monetary policy; says policy-makers should do more to take them into account

Emerging markets will 'suffer' as QE ends, say panellists

Guillermo Calvo, Vittorio Corbo and Maurice Obstfeld say emerging markets face a bumpy landing when Fed winds down QE, and some are better prepared than others

Yellen defends QE in congressional confirmation hearing

Prospective Fed chair says asset purchases have had ‘meaningful' impact on financial wellbeing of normal Americans; hints at further banking regulations ‘down the line'

Fall in OECD inflation highlights advanced economy monetary policy dilemmas

New OECD figures show lower annual inflation rates despite Japanese CPI turning positive; pressure mounts on ECB and Fed to counteract trend, but analysts unsure with what tools