Liquidity

Bank of England prepares for first public CCP stress test

Discussion paper sets out eight components of supervisory stress test for key market infrastructure

Charles Goodhart on inflation targets, financial stability and the role of money

The LSE professor says inflation targets should have been 0%, the Fed’s move to AIT is a mistake, independence is under threat from inflation, big balance sheets support liquidity, AI can help supervisors and climate stress tests are unconvincing

Bank of Ghana launches local gold-buying programme

Central bank aims to double gold reserves over the next five years and support local mining industry

El Salvador’s bitcoin currency experiment

Move by first nation to approve bitcoin as legal tender raises important issues

Fed extends nine dollar swap lines to year’s end

Federal Reserve established liquidity arrangements with foreign partners at start of pandemic

BoE says stablecoins must be as trustworthy as commercial bank money

Stablecoins may require tailored regulation and access to emergency liquidity facilities, paper says

RBI doubles size of quantitative easing programme

Central bank readies additional 1.2 trillion rupee purchase programme as virus “dents” demand

Fed adopts single interest rate for reserves

Amendment eliminates separate figure for excess reserves

NY Fed prepares to sell corporate bond portfolio

Holdings of $13.7 billion were bought under emergency SMCCF programme

How the Fed’s Fima addressed the 2020 dollar liquidity shortage

The fifth chapter of HSBC's Reserve Management Trends 2021 explores how the Fed's repo facility supported markets during the Covid-19 pandemic

New York Fed announces record use of reverse repo facility

Value of transactions exceeds December peak and number of counterparties nearly doubles

Central bank mandates differ between advanced and emerging economies

Governance Benchmark 2021 data shows emerging economy central banks more likely to have financial stability mandate

Should the Fed’s Fima facility be made permanent?

The emergency repo facility reassures reserve managers about access to dollar cash during a breakdown in the US Treasuries market

Benoît Cœuré on CBDCs, stablecoins and central bank fintech co-operation

BIS Innovation Hub chief voices concerns about the timing of stablecoin and CBDC roll-outs, fintech risks for supervisors and monetary policy, and details development plans for eight innovation locations

Central Bank of Kenya to liquidate bank after ‘severe violations’

Action on smaller lender comes as CBK looks to complete long-running resolution of Chase Bank

Paycheck protection facility supported lending – Fed paper

Study finds liquidity facility helped banks lend more to small businesses during the Covid-19 crisis

UK regulators launch plan for less liquid fund structure

Aim is to allow productive investment for the long term while curbing vulnerabilities

BlackRock research pushes back at concerns over bond ETFs

BIS paper had suggested ETF sponsors may have sold illiquid assets to discourage redemptions amid Covid stress

RBI steps in with liquidity amid worsening Covid outbreak

Central bank “stands in battle readiness”, governor says, as virus death toll climbs

BoE prepares to break with EU rules on smaller banks

Central bank signals a more tailored approach to regulating non-systemic banks

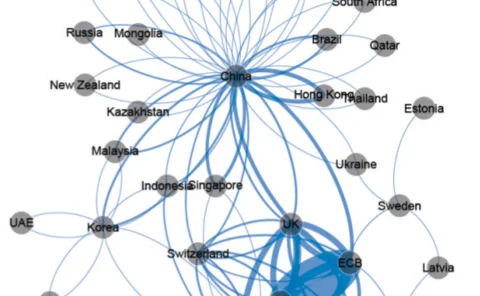

BIS to operate sterling liquidity facility backed by BoE

Move echoes 20th century arrangements when BIS acted as intermediary in swaps network

BoE publishes emails showing unsuccessful lobbying by former PM

David Cameron urged BoE to support Greensill Capital during pandemic, correspondence shows

Capital and liquidity rules work better together, BoE paper finds

Literature review finds having both requirements is better than just one, but “significant gaps exist”

PBoC to more than double scope of stress tests

Chinese central bank will stress-test over 4,000 banks and plans to include all banks by 2023