Financial crisis

ECB’s Nouy advocates global banking supervisory co-operation

The international nature of the financial system demands regulation across borders

CCPs say central bank access needed to avoid liquidity crisis

Uniform access to deposit accounts and overnight liquidity vital, say market participants

Banking industry has ‘consistently failed customers’ – Ireland’s Sibley

Banks should focus on whether outcomes are desirable, not just whether they are legal, says deputy governor

Blanchard and Summers call for rethink of stabilisation policy

Both economists question consensus on fiscal prudence and advocate stricter financial regulation

IMF cautions global vulnerabilities put growth at risk

Fund calls central banks to provide needed monetary support while tackling underlying threats

Fed policy has had bigger impact on global liquidity since 2009

A 25bp rate cut causes a cross-border lending growth to rise of two percentage points, versus 0.8 before the crisis, researchers find

Low volatility challenges central banks – BSP deputy governor

BSP deputy governor examines the correlation between volatility and uncertainty, and the calibration of monetary policy and macro-prudential policy in the Asean region

Banco Sabadell relocates outside of Catalonia

The bank wants to ensure it remains under the supervision of the ECB

China’s deleveraging efforts pose global financial risks, research says

A sudden financial shock may imperil demand, trade and commodity prices

ECB targets NPLs with tougher prudential rules

The proposed regulation will only apply to new distressed assets from January 1, 2018

Data shows growing medium-term risk for global economy – IMF

Researchers assess three types of financial data as predictors of GDP growth risk

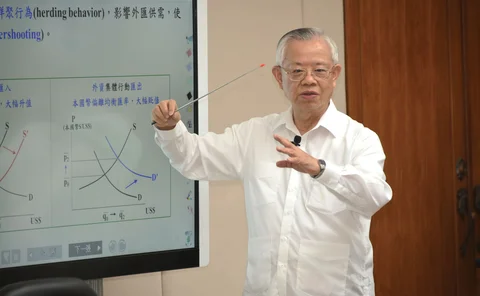

Perng Fai-nan on how Taiwan has eluded crisis for 20 years

Taiwan’s governor explains how pragmatic interventions have engendered two decades of financial stability, despite the island’s status as a small, open economy

Fed paper constructs ‘loan frontier’ for mortgages

Method mimics literature on estimating production frontiers, allowing authors to study credit provision around the 2008 crisis

BoE asks banks to allocate $154 billion to new MREL requirements

UK central bank introduces new internal capital requirement for large banks with subsidiaries; banks have net shortfall of £4 billion to meet by 2022

Fixing the banks is not enough – Adair Turner

Robust banks can supply credit but the real damage from financial crisis is caused by lack of credit demand, former FSA chief says

John Williams on the neutral rate of interest and mandate change

The president of the Federal Reserve Bank of San Francisco speaks about the plunge in the natural rate of interest, and why it means central banks should work together to review their price stability targets

Portuguese governor clashes with government

Treasury intends to transfer banking resolution competencies out of the central bank

BoE issues consumer credit warning to banks

Preliminary stress-test results show UK banking system could incur £30bn loss over three years; UK central bank says financial system is “underestimating losses”

‘Fault lines’ may be re-emerging, warns Bini Smaghi

Societe Generale chairman says supervisors should not rest easy until they have a better understanding of the “fundamental causes” of financial crises

RBNZ proposes tougher rules for bank outsourcing

Banks must show they can open at 9am the day after entering resolution; foreign-owned banks need to supply separation plans

BoE economist discusses danger of ‘virtual’ bank run

Faster payments and rise of smartphone technology have made it possible for consumers to drain commercial banks without having to leave their homes, official says

Spanish ex-governor will not face charges over Bankia case

Former IMF managing director will face charges over collapse of Spanish commercial bank

Ugandan stress tests reveal banking sector vulnerabilities

Banking sector could face a loss of $140 million if three largest banks default; governor says it has been a “difficult year” for banks

Sovereign debt crises hit non-tradable sectors harder

A 1% increase in bond spreads is associated with an average decline of 3% in growth of zero-traded industries