Central Banking

Further tightening may be needed in Colombia, IMF says

Staff in Washington, DC, welcome “resolve” of central banking in latest tightening cycle; current account deficit and inflation expectations may call for further action

Same factors can have different effects on bank risk profiles, ECB staff say

Factors that increase default risk for large and complex eurozone banks can decrease it for smaller banks, ECB staff say; results are based on new model of bank risk

BoE economists map current account dangers across OECD

Treating the current account as equivalent to the balance of trade could blind economists to the risks posed by large deficits, say Kristin Forbes, Ida Hjortsoe and Tsvetelina Nenova

Kenyan central bank sets out Imperial Bank progress

Several court cases to be heard in coming weeks regarding central bank’s handling of receivership; one matter sees two depositors seeking 1 billion shillings

China appoints new deputy governor

Former IMF official Zhang Tao appointed to deputy governor role at People's Bank of China; local media speculates he may return to the IMF as deputy managing director

Norges Bank reveals methods used to monitor banknote quality

Central bank to conduct ‘fitness surveys’ twice annually, analysing a host of variables to define which banknotes are suitable for circulation

Fischer: improve estimates of long-run equilibrium rate

Fed vice-chair speaks at conference honouring US economist Michael Woodford; stresses need for "faster potential growth" as US nears full employment

Central Bank of Bahrain launched range of initiatives in 2015 – annual report

Last year the bank set up a Sharia supervisory board, launched Islamic liquidity facilities, set to work on Basel III and upgraded its IT systems

Bank of Italy creates secondary market for trading in its own shares

Italy’s central bank has created a secondary market for dealings in its own shares as part of a plan to limit individual firms’ holdings to 3% of total shares

Embracing digital tech could reduce systemic importance of banks – RBNZ article

Bulletin discusses risks surrounding digital disruption in the banking sector; if unregulated entities provide "significant portion" of banking services, new risks may emerge

Denmark outsources coin minting to Finland

Mint of Finland wins tender to produce krone coins, as National Bank of Denmark seeks to cut costs by closing down its coin and banknote operations

Haldane admits BoE communications can be ‘impenetrable'

Chief economist notes ever-longer publications have not tallied with better understanding among the UK public, suggesting the message needs to be clearer and simpler

Researchers propose new measure for US fixed-income market liquidity

Authors say it is the first index to apply financial stress indicator methodologies to both US government and corporate debt securities

ECB governing council welcomes markets' increased risk appetite

Governing council members happy with increased risk appetite in eurozone and global markets, minutes show; worried by slow pace of structural reform and no clear trend of rising inflation

June hike an option but Fed officials split on prospect

Minutes from FOMC meeting in April show “most” participants happy to hike next month if incoming data continues to improve, but some suspect gains may not come fast enough

Sarb ‘pauses’ hiking cycle on improved inflation outlook

South African monetary policy committee votes five-to-one to leave rates on hold; governor stresses central bank is not reversing policy

HKMA prepares cyber security ‘fortification’

Monetary authority seeks to build a framework for assessing cyber risks as well as providing training and building infrastructure for sharing “threat intelligence”

Riksbank’s Skingsley sees potential in helicopter money

Small, open economies will have limited room for manoeuvre if global real rates stay low, so central bankers should be willing to consider more radical options, deputy says

Colombian paper sees role for international co-ordination of housing policy

This may be needed where national policies have “important” cross-border effects; discusses macro-prudential policy and capital controls

People: Turkey gains a deputy as Brazil loses one

Kilimci promoted to deputy governor at Turkish central bank; Hamilton set to leave Brazilian central bank for role in new finance ministry; and more

Dissent affects size but not clarity of minutes – paper

Study looks at BoE, BoJ, Fed and Riksbank; when dissent in monetary policy meetings increases, so does the size and content of the minutes, but readability is preserved

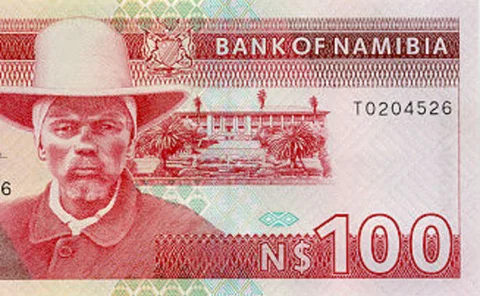

Bank of Namibia conducts ‘sting operation’ on bribery concerns

Governor says two Chinese nationals attempted to bribe senior officials in an attempt to retrieve funds blocked under exchange control regulations

ECB looks to add eight more O&Ds to guide

European Central Bank proposes guidance on the application of another eight options and discretions in banking supervision; public consultation will run until June 21

BIS’s Tissot says micro data can plug macro gaps

Data is abundant in many areas, but making micro data work with macro is still proving tricky for statisticians, says BIS head of statistics