Central Banking

ECB publishes online newsletter on financial market infrastructure

Newsletter will be published three times a year, covering central bank’s work as operator and overseer of financial market infrastructure

Fed members differ on monetary policy, as Trump again attacks Yellen

Rosengren calls for “modest, gradual tightening”, while Kashkari sees slack in labour market; Republican candidate questions Fed’s political impartiality

BoE’s Salmon warns forex industry on adherence

Chris Salmon, the Bank of England's executive director for markets and lead on global code adherence, says regulation could be on the horizon as soon as 2020 if market participants don't adhere to the new Global Code

Fed’s Tarullo: stress testing needs to evolve

Fed is planning to toughen its stress-testing framework with better alignment with regulation and incorporation of dynamic “amplification” effects – though more research is needed

Factors behind weak growth in advanced economies do not apply to South Africa – Sarb deputy

Mminele says 2008 recession did not create savings glut in South Africa, suggesting other factors such as a shortage of skills are responsible

ECB says it has learned lessons from simulated cyber attack

Federal Reserve, eurozone central banks and private firms took part in exercise to test Target2 payment system

Non-banks’ asset purchases should be capped, paper argues

Researcher puts forward model of impact on economy of secondary market trading

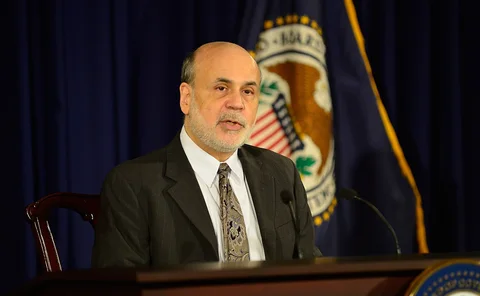

Inclusion of renminbi in SDR is ‘symbolic’, says Bernanke

Former Fed chair sees inclusion of renminbi in SDR basket as a ‘symbolic’ gesture rather than a major shift; Eswar Prasad argues currency will never be a safe haven

Fiji governor encourages wider use of stock market

Stock market an “excellent” platform for savers and businesses looking to expand, says Barry Whiteside, who expects the number of firms listed on the stock exchange to increase over time

Sama intervenes to ease liquidity pressure on banks

Saudi central bank makes deposits worth over $5 billion at commercial banks struggling with low liquidity, and introduces new repo facilities

BoJ paper harnesses census data to improve industry surveys

Researchers aim to make the Bank of Japan’s Tankan survey more accurate from a smaller sample, based on Japan’s economic census

RBNZ floats idea of bank regulatory dashboard

Bringing regulatory disclosures together in one place could impose market discipline and allow more straightforward comparison of risks, central bank says

Crane invests $100 million in new banknote plant

New banknote facility in Malta to add to existing operations in Sweden and the US, employing 200 people

Yemen’s president sacks governor and announces new central bank in Aden

Move may increase humanitarian crisis as former central bank head managed to prevent worst outcome in “dire” circumstances, expert says

New model shows eurozone output gap remains large, researchers argue

Other models fail to capture interplay of inflation and output, paper says

ECB officials and Borio disagree on falling real rates

Vítor Constâncio and François Villeroy de Galhau emphasise importance of saving-investment mismatch, while Claudio Borio stresses financial cycle, but speakers find some points of agreement

Distributed ledgers ‘too much of a moving target’ to write business standards, says Swift

Paper addresses questions about how DLT automation can run smoothly in multi-party network environment; Swift recognises full-scale standardisation of distributed ledger use is premature

Carney: green finance could help reverse long-run rate decline

Bank of England governor says green finance has the potential to send capital where it is most needed, and help advanced economies escape the problem of falling equilibrium interest rates

Stress tests should consider wider range of resilience metrics – BoE article

Metrics including liquidity and funding resilience should be considered as stress tests become an important part of a central bank’s regulatory toolkit; current liquidity and funding stress scenarios are “less advanced”

Bank of Israel moves to eight-meeting policy cycle

Cut in number of meetings reflects stability of economic indicators and will allow for more detailed analysis at each meeting, central bank says, though one member criticises loss of flexibility

Central Bank of Barbados launches biannual economic magazine

Barbados launches financial magazine after “ironing out” issues; central bank’s latest venture “demystifies” economics for the general public

ESRB publishes guide to OTC derivatives database

Draghi repeats pledge to extend central clearing regulation to all forms of derivatives; ESRB paper sheds light on “opaque” markets

Sarb governor fends off political criticism

Central bank would co-operate should inquiry into supervision powers be launched; monetary policy committee leaves rate on hold with the prospect of an end to the hiking cycle nearing

IMF warns over problems in Belarusian banking system, but central bank disagrees

Systemic liquidity risks are “elevated” because of dollarisation, fund says; central bank claims country’s first asset quality review shows banking system is sound overall