Central Banking

US Treasury secretary shows early support for Fed

Mnuchin says Fed is organised with “sufficient independence”, going against early expectations he would support the Audit the Fed movement

Lebanon’s innovative financial operations not sustainable – IMF

Central bank used a complicated mechanism to simultaneously boost foreign reserves and improve banks’ capital positions, but it cannot be used without limit, the fund warns

‘Flash’ currency moves will continue to surprise markets – BoE’s Salmon

Bank of England executive director says there is “growing potential” for flash events to occur in core markets, despite markets now being able to identify risks

Irish governor calls for better international finance data

Links between holders and issuers of instruments are badly understood, Lane says

Turkey keeps policy rate on hold, despite weakening lira

MPC trying to keep a “balance” between government pressure and market demand, analyst says

Russian central bank declares moratorium on bank's creditor payments

Peresvet Bank is 49.7% owned by Russian Orthodox Church; size of debts or political connections may make central bank’s task hard, analyst says

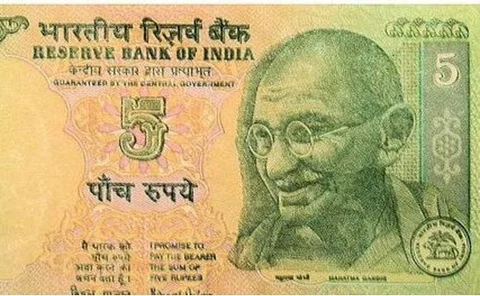

IMF: Indian demonetisation to have ‘limited impact’ on Nepal

Some households have been affected, the IMF says, but holdings of Indian rupees were “small”; the Central Bank of Nepal is offering an exchange facility to those wanting to exchange cash

Cross-border claims shifting in favour of non-banks

BIS international banking statistics show claims on banks fell in third quarter of 2016 but claims on non-banks continued to grow

Protectionist ‘threats’ from US could harm emerging markets – Kganyago

International concerns high on Sarb’s list at latest MPC discussion; uncertainty surrounding US economic policy leads to revision of headline inflation forecast

Fresh investigations into Sri Lankan bond scandal launched

Central bank and Sri Lankan president both investigating possible malpractice around bond sales to the central bank pension fund

CLS signs MoU with Chinese think-tank

The forex utility will work with the National Institution for Financial Development to support the renminbi’s internationalisation

Coeuré: Europe must redistribute gains from new technologies

Automation might destroy jobs faster than it creates them, ECB official says

Bank of Russia closes more small banks

Institutions shuttered for liquidity shortages and AML/CFT breaches, central bank says

Venezuelan president replaces central bank governor

Serving governor asked to resign, local reports say; new governor is strong political supporter of president

LatAm should pursue regional financial integration – IMF paper

Timing is “ripe” for region to pursue financial integration as means of counterbalancing effects of departing global banks, authors say

Bank of Mexico launches cost-cutting drive

Central bank move follows government austerity drive, and includes a target of a 10% cut to the wage bill

BoE paper maps contagion via CDS market

Economists identify mechanism whereby declining creditworthiness can spill from one bank to another via credit default swaps

People: Frank Smets to head ECB economics department; new Chilean board member

Long-serving ECB economist becomes director-general; Chilean senate ratifies the appointment of Rosanna Costa; new communications director for Banque de France

Yellen: Fed asset holdings provide automatic policy tightening

Downward pressure on long-run rates is expected to diminish, making the need to hike short-term rates less pressing, the Fed chair says

EBA and Esma request clarification of CCP regulations

Agencies query areas of ambiguity for clearing houses’ derivatives transactions

Dutch paper looks at effects of public capital on advanced country growth

Researchers present data on 20 OECD countries

Non-banks may amplify risks from policy divergence, Nakaso warns

Non-banks may be less constrained than banks in supplying dollar funding, but it could dry up at the first sign of trouble; the BoJ starts stress testing foreign currency liquidity

EU watchdog enquires into Draghi’s membership of G30

NGO accuses ECB of being too close to financial industry

ECB paper compares financial inclusion in US and eurozone

Encouraging transfer payment recipients to open accounts has positive effect, study finds