Central Banking

British bankers lobby Banking Commission

British Bankers’ Association chief executive Angela Knight warns against breaking up the banks; argues Basel III does not need to be buffered by national measures

Transition for 2012 will prove tricky, FSA officials acknowledge

Hector Sants says project will be complete by year after next, but acknowledges strain on those involved; Turner echoes comments

HKMA measures cost of regulatory reform

Hong Kong Monetary Authority finds positive effect from Basel III

White emphasises use of Austrian school in policymaking

Bank for International Settlements former economic adviser William White says use of Austrian school assumptions about the financial system could help prevent further crises

Trichet: ESRB to review counter-cyclical capital buffers

European Central Bank president Jean-Claude Trichet says counter-cyclical capital buffers a good starting point for European Systemic Risk Board

Zeti: EM central banks aided by development role

Bank Negara Malaysia governor Zeti Akhtar Aziz says central bank’s financial market mandate helped emerging market economies address credit market disruptions during crisis

ECB could offer governance concession on T2S

European Central Bank could modify governance arrangements of its settlement platform in a bid to entice sterling to join

Ireland’s regulator moots new capital facility for banks

Central Bank of Ireland head of financial regulation Matthew Elderfield says creation of standby contingent capital facility for banks from European Union and IMF bailout money will help ease markets

Chinese sovereign debt to be issued using HKMA platform

Hong Kong Monetary Authority and China’s finance ministry reach agreement to allow issuance of renminbi bonds using central bank tendering platform

BoE’s Haldane offers a case for macroprudential policy

Andrew Haldane says credit cycles arise from collective action failures, justifying systemwide measures; argues against leaning against the wind

Irish bailout fails to restore faith in PIIGS debt

CDS spreads on peripheral eurozone debt widen despite €90 billion in aid

Despite Ireland’s bailout, the eurozone’s problems remain

Ireland’s bailout merely delays the day of reckoning for the euro project, Geoffrey Wood argues

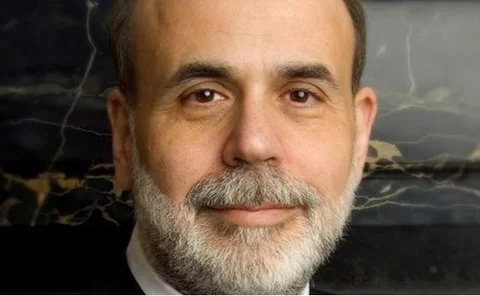

Bernanke: QE2 a misleading moniker

Federal Reserve chairman Ben Bernanke says $600 billion Treasury purchase scheme not officially quantitative easing

BoJ: liquidity strains alter investor behaviour

Bank of Japan study shows investors sell or buy a liquid asset more quickly in distressed environments

Sarb’s Mminele on payment system reform

South African Reserve Bank deputy governor Daniel Mminele says international payment system should receive special attention

HKMA, PBoC react to QE2

Hong Kong Monetary Authority and People’s Bank of China counter Fed’s quantitative easing programme with regulatory and monetary policy measures

Plosser: focus on real, not nominal, rates

Philadelphia Federal Reserve president Charles Plosser suggests targeting interest rates to lean against strong asset-price growth

ECB approves Target2-Securities baseline price

European Central Bank’s Governing Council agrees to fix the transaction cost for Target2-Securities at 15 cents per transaction but attaches conditions

Irish woes may spread to other PIIGS

European Union action on Ireland’s bank debts points to fears over contagion spreading across peripheral Europe

BoJ’s Noda: Japanese growth moderating

Bank of Japan policy board member Tadao Noda says Japan’s economy expected to moderate following weakness in exports

SEC risk chief to step down

First head of regulator's risk division will return to academia in January

Italy’s Enria voices concern over regualtory arbitrage from Basel III

Bank of Italy head of the supervisory regulations and policies Andrea Enria says rigourous introduction of Basel across all countries and financial sectors will reduce risk of regulatory arbitrage

RBA’s Battellino: US households worst off from recession

Reserve Bank of Australia deputy governor Ric Battellino says US households share greater burden with every recession

Gjedrem on the Norges Bank’s history

Norges Bank governor Svein Gjedrem discusses transition of Norges Bank from government advisor to fully fledged central bank