Christine Lagarde

Lagarde says ECB may need to tighten above neutral rate

ECB president confirms central bank will announce QT plans in December

ECB increases rates by 75bp for second consecutive time

Governing council tightens TLTRO III rates and lowers reserve remuneration

Is the ECB taking the right policy path?

Facing an energy supply shock, analysts ponder whether sharp rate increases and QT alone will serve to bring inflation back to target while avoiding a major recession

ECB will not consider QT until rates back to normal – Lagarde

Central bank holds close to €5 trillion in eurozone securities, over €4.2 trillion in public assets

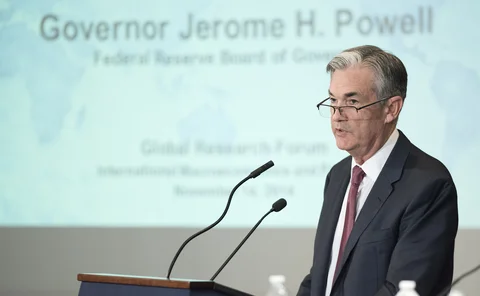

Rate rises reveal defi weaknesses – Powell

Regulating algorithms highlighted as key crypto challenge at Banque de France conference

ECB raises rates by 75bp for the first time

Lagarde warns monetary policy will not bring energy prices down

ECB expected to deliver first-ever 75bp rate hike

Record-high inflation of 9.1% in August and a weak exchange rate put pressure on divided governing council

Banknotes: July to September 2022

A round-up of news and salient issues that have affected central bankers in the past three months

Gontareva on Ukraine’s funding, NBU policy and reconstruction

Former NBU governor Valeria Gontareva speaks about donor funding shortfalls, NBU policy and financial stability challenges, Nabuillina and the seizing of Russian assets, and post-conflict rebuilding and modernisation

Markets likely to test ECB’s anti-fragmentation tool

ECB could struggle to avoid political disputes over TPI instrument, some observers warn

ECB surprises markets with a 50bp rate hike

Central bank unveils new instrument to prevent sharp increases in sovereign bond spreads

ECB readies first hike since 2011 as it faces policy ‘trilemma’

Central bank may be forced to choose two options among price stability, fragmentation risk and market functioning

ECB introduces green asset policy

Moves aim to “gradually decarbonise” Eurosystem’s bond holdings, ECB says

Top central bankers admit inflation models fell short

Reliance on Phillips curve and demand-driven models may have created blind spots

ECB emergency meeting pledges sovereign bond support

Governing council says eurozone will accelerate efforts to create “anti-fragmentation mechanism”

ECB announces 25bp rate raise and QE slowdown for July

September increase may be steeper, as ECB forecasts higher inflation and lower growth

Global climate standards ‘badly needed’ but elusive, say central bankers

“I am not sure we are going to get there,” ECB president says

Is this the end for ECB QE?

High inflation makes it increasingly difficult for the central bank to justify asset purchases across the eurozone, despite rising fragmentation risks

Lagarde says ECB likely to abandon negative rates in September

Central bank would need to confirm end to asset purchases in June, and hike in July and September

Lagarde signals first ECB rate hike in July

Nagel stresses risk of acting too late, as Villeroy says fiscal-monetary alignment no longer possible

ECB officials change to more hawkish tone

Schnabel and Villeroy de Galhau signal openness to July hike while Lane and Panetta stay cautious

How high can the ECB take interest rates?

Despite rising inflation, eurozone central bank is seen as unlikely to take rates over 1.5% in coming years

Lagarde sees risks in ‘new global map of economic relations’

ECB president says fragmentation through “friend-shoring” and regionalisation is rising

Climate change, invasion, recession: policy-makers flag mounting risks

Christine Lagarde and Jerome Powell discuss “ripple effects” of war in Ukraine, while the Barbadian prime minister highlights need for reform at global institutions