Ben Bernanke

Fed set to adopt ‘elements’ of price-level targeting

Covid-19 could act as a catalyst for a Janet Yellen-supported Fed move to adopt elements of price-level targeting. But questions remain about the timing of such a move

El-Erian on Covid-19 policy risks, ‘zombie’ markets and central bank capture

Former Pimco chief says Fed move into high yield is a step too far, new rules needed on leverage and false liquidity, and narrow window emerges for central banks to shed some of their policy load

Should the Fed be next to implement yield curve control?

The Reserve Bank of Australia is now the second G20 central bank trying to control longer-term interest rates. Could the Fed be next?

US banks increase discount window borrowing

Federal Reserve “encouraged by the notable increase” in use of the backstop facility

Macroeconomics is not broken

The discipline has moved beyond the neoclassical synthesis. Critics should too

Paul Volcker, 1927–2019

The Fed chair made his name battling inflation, and left his mark on independence and post-crisis financial regulations

The challenges facing Christine Lagarde

The new ECB president will need to focus on a successful review of the ECB’s monetary and communications policy, while encouraging fiscal stimulus and structural reform

Fischer and Hildebrand call for emergency policy tools

Former central bank chiefs say existing monetary tools are “almost exhausted”

Mark Carney on joined-up policy-making, forward guidance and Brexit

BoE governor rules out negative rates and change to inflation targets, offers update on too-big-to-fail and use of CCyBs, highlights challenges of an asymmetric monetary system, hits out at cumbersome payments and warns Facebook’s libra cannot ‘learn as…

Former Fed chairs stress importance of central bank independence

President Donald Trump has repeatedly criticised chair Jerome Powell for keeping interest rates too high

Powell plays down fears about record levels of corporate debt

Fed chair’s remarks strike similar chord to those of Ben Bernanke in 2007, but Powell says this time is different

Weakened international co-operation could hinder crisis response – Bernanke

Christina Romer ‘loses sleep at night’ about internationals' readiness to fight a future crisis

Interview: Sheila Bair on US regulatory reform and rollback since 2008

Crisis-era FDIC chair “saddened” by former Fed chairs’ focus on bailout powers

Former Fed chairs join over 3,000 economists in call for carbon tax

Economists including central bankers and Nobel laureates demand action on climate change

Bank of Canada to weigh up alternatives to inflation targeting

Central bank will hold “full horse race” between nominal GDP targeting and other alternatives, Wilkins says

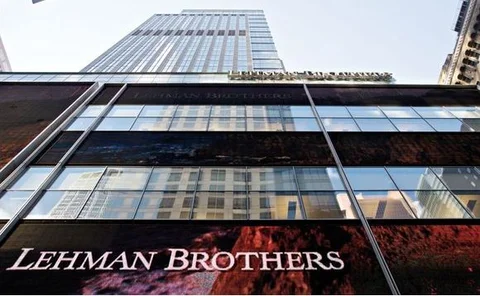

Book notes: The Fed and Lehman Brothers, by Laurence Ball

Ball claims the Fed could have lent to Lehmans, lawfully and prudently, had it chosen to do so, writes Reddell. But agreeing the Fed could have provided liquidity support does not automatically imply it should have

Yellen says Fed should begin forward guidance now

Action now could have equivalent impact to negative rates, says former Fed chair

A decade on: Lehman Brothers at the brink

On September 14, 2008, there remained hope that Lehman could be saved and a crisis averted. Events moved rapidly thereafter

Bernanke: household borrowing not the main factor in 2008 crash

Panic in financial markets and not household borrowing created deep crisis, former Fed chair says; economists should emphasise credit when modelling

Lender of last resort is not enough, says Geithner

There is a lot of “magical thinking” about what central banks can do, says former US Treasury secretary

‘Bernanke targeting’ may outperform Taylor rule – Fed paper

Paper tests Ben Bernanke’s proposal for temporary price level targets

Flattening yield curve opens questions about nine-year US expansion

Officials and market observers disagree about information conveyed by bond yields

Paper warns emerging markets of pitfalls of credit easing

While the effects of credit easing are benign for advanced economies, developing and emerging countries may experience macroeconomic repercussions

Yellen says central banks should consider moving inflation targets

But former Fed chair says changing targets would be “a tricky business”