Barry Eichengreen

Argentina and the fear of floating

Economists believe the country’s authorities must fully liberalise the peso before it is too late

Markets bet on cuts when Trump threatens Powell – research

Economists link attacks on Fed independence with expectations of policy easing

Economist flags stability risks if Genius Act becomes law

Runs on stablecoins could spill over to traditional financial markets, warns Barry Eichengreen

China needs dollar reserves to bolster renminbi – Eichengreen

Authorities must reassure global markets to make renminbi reserve currency, paper argues

ERM’s 1992 crisis offers lessons for today, academics say

Barry Eichengreen, Maurice Obstfeld and Richard Portes discussed “accident waiting to happen”

Will the dollar remain the world’s reserve currency?

Bank of Russia sanctions are unlikely to undermine the US dollar’s central role in reserve portfolios. But a relative decline in US economic weight and technological innovation are benefiting other currencies

Labour market changes key to inflation – BIS’s Shin

Central banks may face “race against time” to prevent wage-price spiral, says Hyun Song Shin

How Turkey’s president created chaos in economic policy-making

Observers allege presidential domination of the central bank, unauthorised FX transactions and untrustworthy statistics

China’s capital controls: here to stay?

With China’s share of the domestic central government bond market significantly increasing in just a few years, and the International Monetary Fund including the renminbi in its special drawing rights basket of currencies, China is enjoying growing…

IMF research highlights limits of exchange rate flexibility

New dataset sheds light on role of dominant-currency invoicing for exchange rate dynamics

Why has the euro failed as a global reserve currency?

ECB's Klöckers says fragmented capital markets and incomplete banking union holding euro back; while sovereign crisis and low yields contributed to 'underperformance' as a reserve currency, survey finds

Stress levels rising: investment funds and the Covid-19 shock

Extreme market stresses due to Covid-19 are underscoring the central role non-banks play in crisis contagion, as in 2008. Were regulators better prepared this time?

Macro-prudential analysis is not fit for task – leading economists

Carney and Honohan warn of fund failures and Hélène Rey calls for better risk indicators

Banks ‘still groping toward’ macro-pru transparency – Eichengreen

Central bank governance expert says central bank transparency is getting better around the world, although New Zealand, Argentina and some Central American institutions could make improvements

Hysteresis can explain eurozone peculiarities – Eichengreen and Bayoumi

Eurozone has not responded to shocks in the way economic theory would normally imply, with the German economy tied surprisingly closely to those of ‘peripheral’ countries

Eichengreen sees danger in US fiscal stimulus

Veteran economist warns infrastructure spending in the US may prove damaging to both the domestic and global economy, without necessarily fixing secular stagnation

Fibre optics raise concentration of forex trading - paper

Barry Eichengreen and co-authors find technological gains from submarine fibre optic cables helped increase the concentration of foreign exchange trading

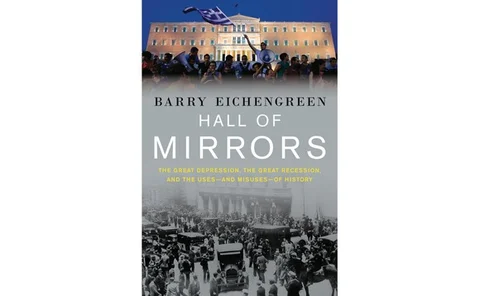

Book notes: Hall of mirrors, by Barry Eichengreen

A scholarly, but readable narrative that interleaves an account of the build-up to and course of the Great Depression with the similar course of events in the Global Financial Crisis

Will new reforms lift the veil of secrecy at the Bank of England?

The Bank of England has unveiled a broad package of reforms to its transparency. Daniel Hinge speaks with transparency experts to assess the changes

Eichengreen says central banks should worry more about deflation than 'profits and losses'

The Berkeley professor on what last week's SNB move says about big central banks 'wrong-footing' markets and the Fed's problematic response to financial crisis

Bank of England unveils sweeping transparency changes

Bank of England to publish transcripts of monetary policy meetings, cut number of meetings, revamp committee structures and more; Barry Eichengreen says benefits likely to ‘dominate’ costs