Reserve Bank of New Zealand (RBNZ)

Covid case halts RBNZ rate hike plans

Central bank had been expected to raise rates but lockdowns signal further uncertainty

RBNZ welcomes reformed governance framework

Overhaul of the central bank law paves way for new decision-making body

Viruses of a different kind: bolstering central bank IT frameworks

Remote working on a large scale had never been done before, but central banks appear to have successfully adapted IT and cyber frameworks

The distant cry of hawks? Fed begins tightening talk

Richard Clarida gives a date for hiking interest rates, as debate on taper timing continues

RBNZ to tighten loan limits as house prices continue to rise

Tougher loan-to-value limits could be followed by rate floors or debt service limits

Disclosures and taxonomies vital for climate risk understanding – RBNZ official

Central banks also need to ensure staff are skilled in climate risk

Senior Fed officials differ on taper

Powell stands firm, but two regional presidents suggest a sooner-than-later approach

RBNZ calls halt to quantitative easing

Central bank has bought considerably less than its NZ$100 billion limit

RBNZ to consider CBDC as cash use declines

Assistant governor says trust in financial system may be weakened by fall in cash use

Charles Goodhart on inflation targets, financial stability and the role of money

The LSE professor says inflation targets should have been 0%, the Fed’s move to AIT is a mistake, independence is under threat from inflation, big balance sheets support liquidity, AI can help supervisors and climate stress tests are unconvincing

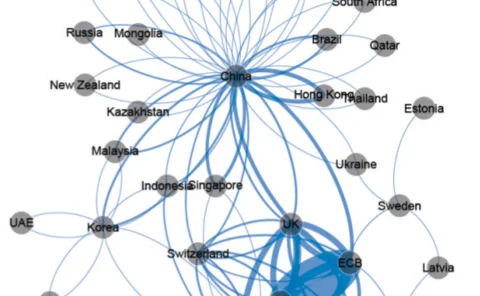

Fed extends nine dollar swap lines to year’s end

Federal Reserve established liquidity arrangements with foreign partners at start of pandemic

RBNZ gains tool to curb house price rises

Government approves debt-to-income limits to address hot housing market

Multiple expectations test communications

The Reserve Bank of New Zealand’s communications are being tested, and some recent exchanges have been combative, says Mike Hannah

Financial sector still a headache for central bank modellers

Macro-financial links are difficult to integrate into key models, with progress since the global financial crisis slow. But some central banks are making breakthroughs

RBNZ’s Orr admits ‘shortfalls’ on cyber security

But KPMG report also lays blame on vendor for delays in pushing out critical software update

The importance of diversity when selecting banknote icons

The former head of currency at the Reserve Bank of New Zealand, Brian Lang, explains why inclusion and diversity were such important factors for the country’s 1992–93 banknote redesign

RBNZ gains new FMI oversight powers

Central bank and FMA will be able to set standards for systemically important infrastructures

RBNZ does not have ‘adequate’ AML/CFT resource – FATF report

New Zealand central bank needs more AML/CFT resources and tougher penalties

Australia, Canada and New Zealand form network for indigenous inclusion

Ottawa will host symposium on indigenous economics later this year

Supporting Pacific islands should be ‘strategic priority’ for banks – Orr

RBNZ governor says banks must show ‘courage’ and provide services through good times and bad

Navigating the hazards of inequalities

Inequality poses a serious challenge for central bank communications, says Mike Hannah

RBNZ eases dividend restrictions

Deputy governor says NZ economy has rebounded more strongly than expected

RBNZ stresses need for clarity on climate disclosures

Taxonomies need to be harmonised and disclosure frameworks reviewed to ensure they are relevant for the public sector

Payments and market infrastructure development – wholesale: Reserve Bank of New Zealand

New Zealand’s central bank has embraced major payments infrastructure changes to reduce risk and future-proof the country’s payments landscape