Eurosystem

Eurosystem lays out retail digital payment strategy

Access to cash and level playing field for electronic payments are key elements – Panetta

Frank Smets on the ECB’s strategy review

The ECB’s DG of economics explains how expectations, communication, fiscal dominance, climate change and the Fed’s actions will be factored into the ECB’s delayed strategy review

Central banking enters a new era

Central banks face a delicate balancing act to preserve their reputations as they evolve into ‘buyers of last resort’ and some of their actions appear functionally equivalent to ‘monetary financing’

ECB publishes framework for assessing prudential spillovers

Detailed paper aims to help regulators assess cross-border effects of macro-prudential policies

ECB mulls wider clearing house access to account facilities

Including CCPs in the Eurosystem may remove the need for them to seek a banking licence

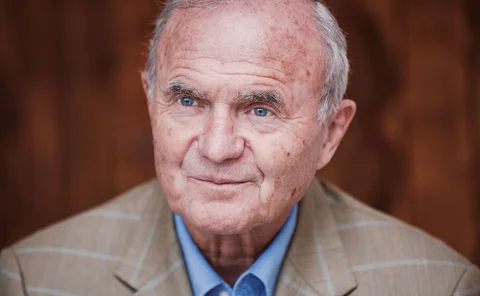

Lifetime achievement award: Otmar Issing

The architect of the euro’s monetary operating framework is still playing an important role in shaping the debate on monetary policy

Treasury systems initiative: Calypso Technology

The tech company secured important breakthroughs including with its Maps treasury operations system

Facing up to the tech challenge

Central banks get a wake-up call from libra

The winners of the 2019 Fintech and Regtech Global Awards

Prizes awarded for outstanding work at the cutting edge of financial technology

ECB’s bond purchases restrict monetary policy – DNB paper

Higher demand for safe assets widens bond yields and cuts policy transmission, says researcher

Italy’s central bank plans could break EU law – ECB

The ECB is challenging the Italian coalition’s plans to take control of gold reserves and central bank shares

Risk management technology: Vermeg

Having successfully delivered the collateral management module of its Megara system to four major central banks, Vermeg has won a high-profile tender to deliver the technology for the Eurosystem Collateral Management System

Transparency: National Bank of Ukraine

The Ukrainian central bank has made strong progress in improving its transparency during a highly challenging operating environment

EU legal officer says Latvian government wrongly barred governor

Authorities provided no evidence to back claims governor acted corruptly, advocate general says

ECB secondary bond purchases are legal, European Court of Justice says

European Union’s highest court rejects German activists’ claim that PSPP breached constitution

Weidmann calls for dropping QE tools in normal conditions

Long-term ultra-loose policy may have shifted natural rate of unemployment – Bundesbank head

Philip Lane on systemic risk, transparency and Brexit

The Central Bank of Ireland governor speaks with Dan Hardie and Chris Jeffery about transparency, shadow banking, ECB succession and tackling systemic banking risk in the eurozone

Eurozone inflation rises in March

Prices rose year on year by 1.4% last month, up from 1.1% in February

Inflation falls in the euro area despite stronger growth

Annual price increases expected to fall to 1.3% in January, Eurostat says

ECB approves major financial infrastructure programmes

ECB plans for Target2 and T2S to merge, plus new collateral management system for Eurosystem

Eurozone must improve management of national cash cycles, paper argues

Researchers find wide variations between cash quality in eurozone countries

Croatia makes it 25 central banks in Target2

The Croatian National Bank will, along with 24 commercial banks in the country, participate in the RTGS system from February 1, making it the fifth central bank outside the eurozone to join

Central banks are on the losing side of government pacts

Quantitative easing by the ECB and the Bank of Japan brought market cheer. But, absent meaningful structural reform, is miring central banks deeper into an ever-more dangerous policy cycle.

Banque de France's Le Lorier says good communication can ‘substitute' for rate decisions

First deputy says comms can complement decisions in non-crisis times by revealing variables that inform monetary policy; argues monetary and macro-pru mandates can be reconciled