Coming of age

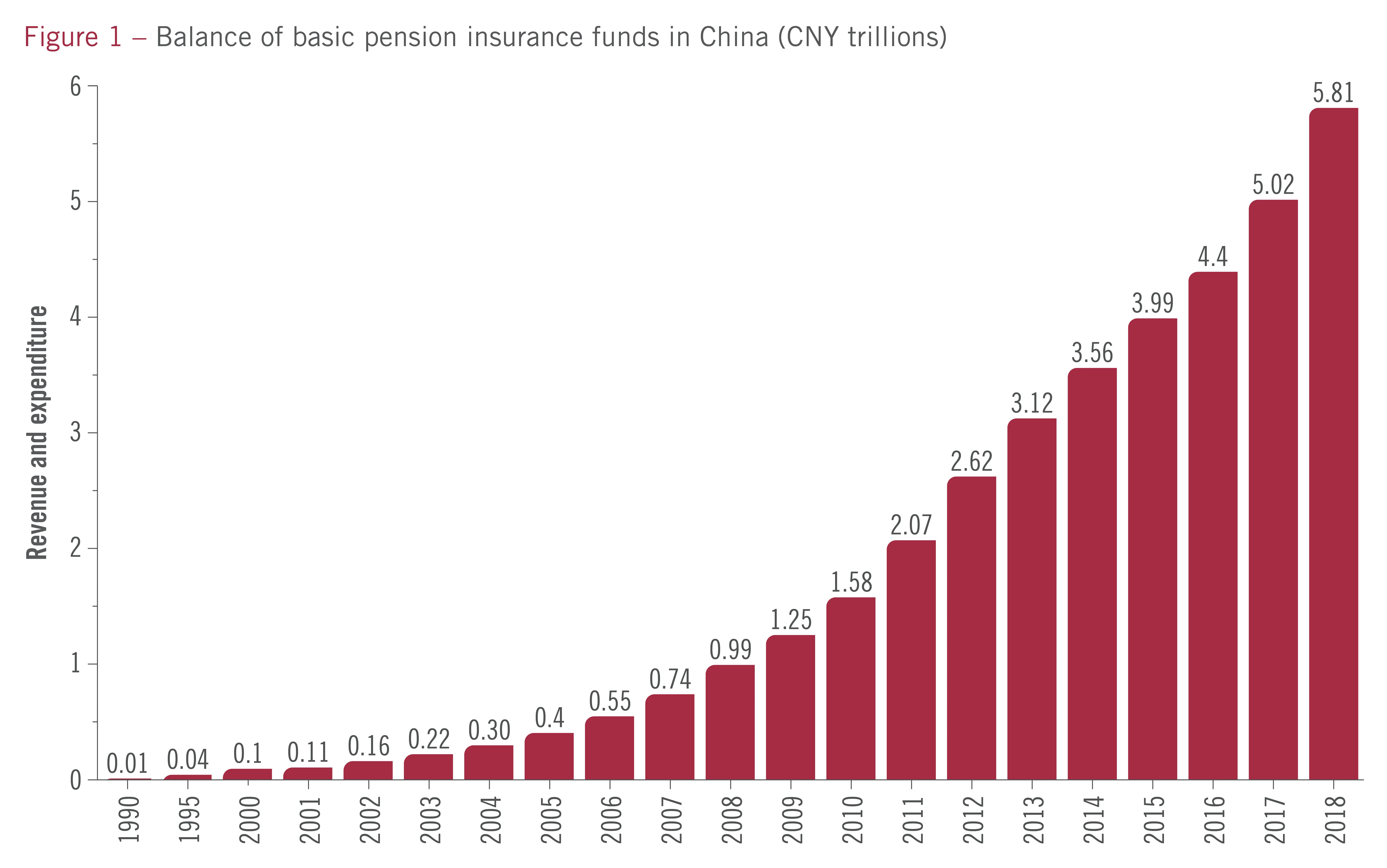

Compared with other countries, China has a large and ageing population. The government closely follows the development of ageing issues, and continues to improve the aged care welfare system. From 1997 to 2011, the primary pension schemes – the basic pension insurance system – covered 950 million people, and the fund balance today is more than CNY5.81 trillion (see figure 1).

In 2000, China established the National Social Security Fund (NSSF), a strategic reserve fund intended to supplement and support the basic old-age insurance system during the peak period of population ageing. Currently, its assets total around CNY2.27 trillion. The establishment of the basic pension insurance system and the reserve fund fulfils the basic needs for public welfare within the limited fiscal expenditure framework, and prevents the surfacing of social risks during China’s structural transformation.

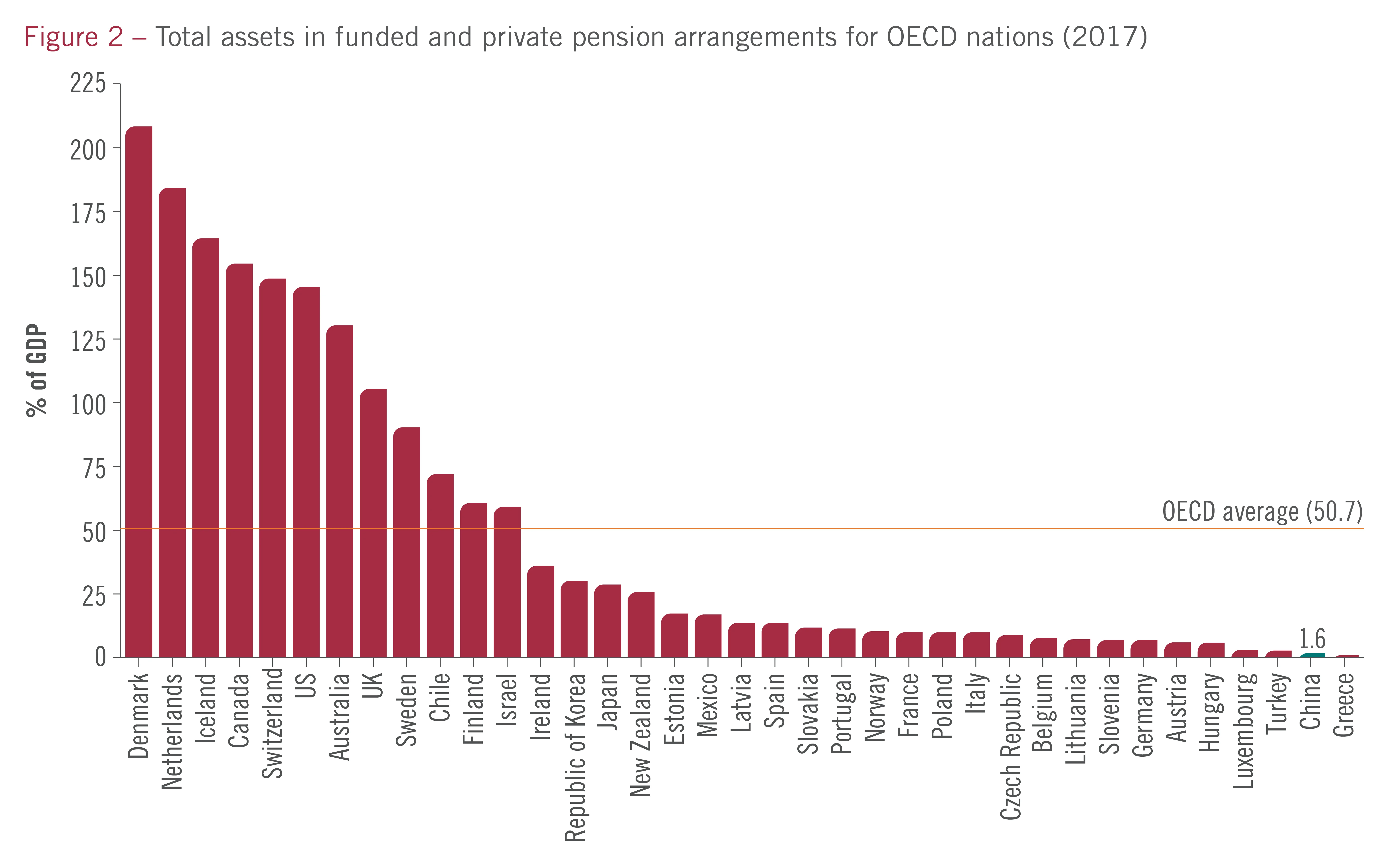

However, China faces the dilemma of people ageing before they attain wealth. This problem has emerged as the economy is insufficiently developed and income levels remain relatively low compared with those of Japan, Europe, the US and other developed nations. The current pension reserve in China is approximately CNY1.1 trillion, accounting for only 1.6% of GDP – far lower than the average of 50.7% in Organisation for Economic Co-operation and Develop-ment (OECD) countries (see figure 2).

The basic pension insurance system accounts for 83% of reserves, while the remaining 17% comprises enterprise and occupational annuities, personal savings and commercial insurances. Thus, the government shoulders the majority of the costs, raising concerns that the growth of the elderly population in China will soon squeeze its fiscal capability. China has therefore been promoting alternative avenues of funding and the pension asset management industry should be able to enjoy new opportunities for rapid growth.

Risk control in pension funds

From the perspective of investment operation, the NSSF was the first market-based investment and, over the past 20 years, has averaged an annual return of 8.05%, achieving its goal of maintaining and increasing pension reserves.

Until August 2015, the basic pension insurance system would invest only in bank deposits and national bonds, so the yield remained relatively low. Since then, the Chinese government has enhanced its investment operations and expanded the investment scope. In addition, pension fund investment and operation was entrusted to the National Council for Social Security Fund (NCSSF). As of October 2019, it has signed investment commission contracts with 18 provinces, districts and municipalities worth CNY966 billion.

The accumulated volume was expected to exceed CNY1 trillion by the end of 2019, and the current average annual return has reached 5.89%. On the other hand, the enterprise annuity, which invests in a broader scope, commissions qualified asset management enterprises, including fund management enterprises, to carry out investment and operations. This path has led to an average annual yield of 6.97% in the recent decade – far higher than the inflation rate.

The pension’s strength lies in its large volume and its long-term outlook, its low risk appetite and its strict supervision. Financial institutions that participate in pension fund business have to fully understand the features of the pension to conduct relative investments. As supervisor, the NCSSF always assigns priority to risk control in the management of social security funds and basic care insurance funds for the aged, and is committed to long-term value investment and responsible investment, achieving good performance and experiences in this regard.

As a result, the asset allocation should be emphasised in the fund’s investment. Effective asset allocation is the decisive factor for obtaining long-term yields. Those in small volumes can take advantage of market opportunities, while the larger ones must take a more strategic asset allocation approach. After years of development, the NCSSF has established a relatively complete set of asset allocations.

The NSSF used to focus on domestic asset allocation. It has now begun to ‘go global’ and expand its asset allocation overseas to maintain a high investment yield in the face of the decline of demographic dividend, the increase in economic aggregate and the moderation of economic growth during restructuring.

First, it is necessary to diversify portfolios. Regional allocation can share the benefits of other countries’ economic development and find more investment opportunities within the global industrial chain and economic cycle. More emphasis should be placed on overseas assets. The correlation between assets of different markets are significantly lower than those in the single market. This is why portfolios with assets from both home and abroad are able to hone their efficiency. Major asset allocation includes investment in domestic and foreign markets, also in the fixed income, primary and secondary markets.

Second, external resources can be useful for improving investment performance. Considering the labour cost, favourable policies and other factors, deposits are the major source of direct investment. Meanwhile, around 50% of large enterprises’ assets are focused on financial investments. Since the establishment of the NCSSF, more than 40 fund management enterprises assigned by the Chinese government and more than 20 Chinese fund management enterprises have become managers of the social security fund. These enterprises conduct open market investments for the NCSSF, contributing significantly to the sound returns of the fund – especially domestically, where the assigned asset managers have achieved remarkably higher yields than the benchmark interest rate.

Third, investment opportunities can be found in new areas as a result of China’s economic transformation and upgrade. China’s rapidly growing innovation-oriented enterprises play a more important role in promoting economic transformation and upgrading. While the long-term nature of the pension fund fits well with science and technology investments, injecting energy into the development of related enterprises will help share the economic benefits of innovation. The NCSSF also invests in hi-tech enterprises such as Alibaba and Ant Financial through direct investment and private equities. It also invests in other areas of technology, including artificial intelligence.

Reform and revival

The state-owned enterprises that dominate China’s economy have strong talent resources and credibility in the tech sector. The government has sought to reform these enterprises further with the introduction of social capital, which it hopes will improve the corporate governance structures of these firms, enhance synergy among shareholders and improve market-oriented operation management and profitability. The reform process brings remarkable capital demands, and the NCSSF – alongside other investors – can support the national strategy and share its benefits. In addition, the mixed-ownership reform agenda also contributes to the growth of productivity through the optimisation and upgrading of corporate system and mechanisms.

In strategic terms, the NCSSF invests in promising projects through private equities. It makes use of its professional strengths in the science and technology sector, and applies its experience in mixed-ownership reform to control risks by diversifying portfolio allocations.

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@centralbanking.com or view our subscription options here: www.centralbanking.com/subscriptions

You are currently unable to print this content. Please contact info@centralbanking.com to find out more.

You are currently unable to copy this content. Please contact info@centralbanking.com to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@centralbanking.com

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@centralbanking.com